The IRS has released an amended cost breakdown of BESS to be used for calculating if a product qualifies for domestic content tax credit incentives, with an increase in US suppliers in the coming quarters.

In its ‘Notice 2025-08‘, the Internal Revenue Service (IRS) provided the updated cost proportion reference table for solar PV and battery energy system system (BESS) products.

The cost proportions can be used to work out if a product qualifies for an additional 10% added to the investment tax credit (ITC), which is 40% US-made for projects already in construction with a phased increase to 55% from 2027 onwards.

The cost reference system was introduced to give companies an alternative to providing their own cost figures, the possibility of which saw significant backlash when the cost-basis for calculating domestic content was first introduced in 2023.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

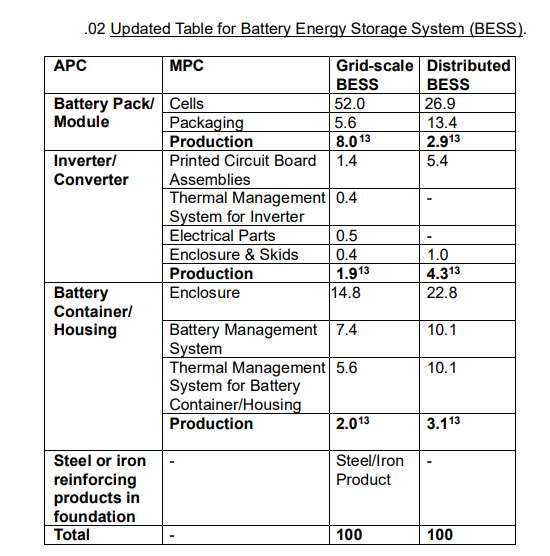

The new table, on the right, is organised slightly differently to the previous one from May 2024 but still has the same four primary Applicable Project Component (APC) categories.

Those are Battery Pack/Module, Inverter/Converter, Battery Container/Housing and Steel or Iron products in the foundation and, as with May’s, there are different figures for grid-scale BESS and distributed BESS.

Grid-scale BESS means projects over 1MWh in size in nameplate capacity, distributed is anything under that.

For grid-scale BESS the proportion for the Battery Pack/Module has been decreased from 72.4% to 65.6% while the Battery Container/Housing now accounts for 29.8% of the cost, versus 22.3% before (increases or decreases for the second categories within these, MPCs, would be misleading since they have changed since May).

The proportion of the two APC categories combined—i.e. the batteries and all enclosures and housing—has changed nominally, from 94.7% previously to 95.4% now.

The IRS didn’t explain why it had reduced the cost applicable to the Battery Pack/Module. Global battery prices fell over 2024, so it’s possible it was adjusted to account for this.

Our colleagues at PV Tech published an article looking at what changed in 2025-08 with regards to solar PV technology.

More suppliers with US-manufactured products

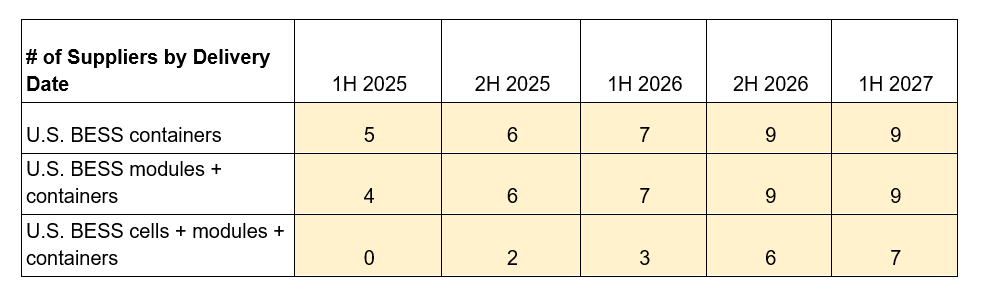

Meanwhile, procurement platform Anza Renewables has released data showing the number of US suppliers of battery cells, modules and BESS containers there are, now and in the coming few years.

According to the firm’s research, there are currently five BESS container manufacturers and by the first half of 2027 that will grow to nine. For full cell-module-BESS solutions, two will emerge in the second half of 2025, growing to seven by H1 2027.

Anza didn’t say that the move to onshore production to the US is being driven by the domestic content ITC, however. The drivers it cited are the desire to avoid 25% Section 301 tariffs on batteries from China, coming into force for BESS from 2026, alongside 45x tax credits for cell manufacturing, both of which have bigger financial impacts than the domestic content ITC.

Anza didn’t name the first suppliers with full US-made solutions coming online this year, but one is likely to be Fluence. The firm’s table on suppliers is below.