Researchers at the US Department of Energy’s (DOE) Pacific Northwest National Laboratory (PNNL) have developed the EZBattery Model, a simulation tool for predicting the performance of redox flow batteries.

The physics-based simulation tool takes less than a second to predict the performance of redox flow batteries.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

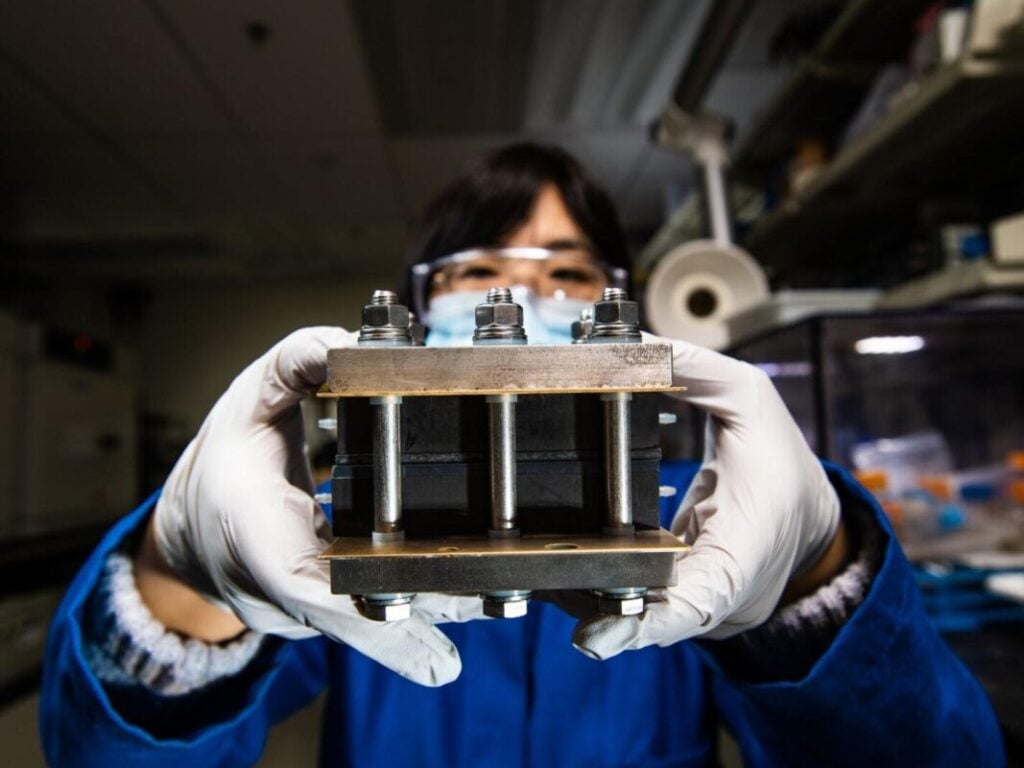

Vanadium redox flow batteries (VRFB) use liquid electrolytes stored in tanks circulated through a membrane to create an electrochemical reaction and generate electricity. Proponents of the technology argue that it has a longer life cycle than lithium-ion (Li-ion) batteries, more scalability, and better fire safety record, among other positives.

While the technology could be more cost-effective for longer durations than Li-ion, it is also more expensive to build. VRFB cell containers must also be larger than Li-ion cell containers to meet the same energy storage capacity.

The EZBattery Model could have far-reaching implications for VRFB. Reducing the time spent experimenting on batteries to seconds means that researchers can quickly adjust VRFB configurations and chemistries within the software before beginning in-person or at-scale testing.

PNNL says that EZBattery can simulate individual battery cells as well as large-scale systems for long-duration energy storage (LDES), and both constant current and varying power operations.

The software also differs from traditional models such as COMSOL because it does not require any training dataset to work. PNNL says its model can generate its own data to train other machine learning models.

Jie Bao, research engineer at PNNL and lead on the project, said of the software: “The physics-based approach lends itself to easily integrate and capture intricate details of battery behavior, like solid deposition during the charging process.”

“For instance, when zinc ions become zinc solid metal, the model can accurately capture this transformation and estimate corresponding battery performance—something a machine learning model cannot do due to lack of associated training data.”

EZBattery Model is publicly available on GitHub.

Stryten Energy and Largo Clean Energy form vanadium flow battery joint venture for US market

In related news, an affiliate of flow battery firm Stryten Energy and a subsidiary of vanadium product manufacturer Largo Inc. have formed Storion Energy to source electrolytes for VRFB in LDES applications in the US.

Stryten Critical E-Storage and Largo Clean Energy Corp. (LCE) announced the formation of Storion on 19 December, 2024, which seeks to combine access to vanadium from the only vanadium mine in the western hemisphere with US electrolyte production to create a vertical supply chain for utility-scale LDES flow batteries.

Storion is calling this strategy its ‘Earth to Energy’ model and claims that it will be able to deliver vanadium electrolyte at less than US$0.02/kWh. Storion says this would accomplish the DOE’s goal of reducing the levelised cost of storage (LCOS) for LDES to US$0.05/kWh immediately.

LCE has a unique vanadium leasing model, ‘Largo Physical Vanadium’ (LPV), which allows investors to invest in vanadium assets while they are stored in VRFBs. Storion will have have exclusive rights to offer LPV to the market in the form of vanadium electrolyte.

Francesco D’Alessio, president of LCE said of the new venture: “Utilizing LPV’s vanadium electrolyte leasing capabilities is expected to create a path for a competitive VRFB pricing model to challenge the dominance of lithium for utility-scale deployments of 10 MWhs and greater.”

“Following the installation of the largest VRFB in Europe by the team at LCE, the establishment of Storion’s cost-effective domestic supply chain for vanadium electrolyte presents a transformational opportunity to rapidly grow adoption of this technology and secure leadership for the US in this critical infrastructure application.”

In 2022, LCE pursued a similar partnership, when the company signed a memorandum of understanding (MOU) with Ansaldo Green Tech to negotiate the formation of a joint venture for manufacturing and deploying VRFBs.

LCE is also known for having provided the 1.1MW/5.5MWh VRFB for Enel Green Power Espana’s 3.34MWp Son Orlandis Solar PV plant in Mallorca, Spain, which was switched on in March 2024. In the same month, the company signed a letter of intent to form the joint venture with Stryten.

In 2023, Stryten launched its pilot VRFB at the company’s Georgia site, a 20kW/120kWh project designed to be tested with utility company Snapping Shoals EMC.

Largo is one of three primary vanadium producers globally, the other two being Bushveld and Glencore. Bushveld also has downstream VRFB activities via an ownership stake in CellCube.