Some long-duration energy storage (LDES) technologies are already cost-competitive with lithium-ion (Li-ion) but will struggle to match the incumbent’s cost reduction potential.

That’s according to BloombergNEF (BNEF), which released its first-ever survey of long-duration energy storage costs last week. Based on 278 cost data points, the survey examined seven different LDES technology groups and 20 technology types.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

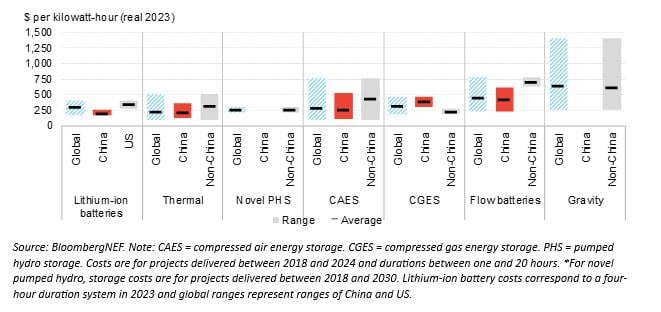

It found that the average capital expenditure (capex) required for a 4-hour duration Li-ion battery energy storage system (BESS) was higher at US$304 per kilowatt-hour than some thermal (US$232/kWh) and compressed air energy storage (US$293/kWh) technologies at 8-hour duration.

However, flow batteries, which were the main electrochemical energy storage technology up for comparison against Li-ion, had an average fully installed cost of US$444/kWh in 2023 according to the survey.

BNEF also noted that most LDES technologies offer the potential to decouple costs related to power and energy. This makes it cheaper to increase energy capacity and, therefore, duration, unlike lithium-ion, where each incremental addition of energy capacity requires additional battery stacks and power conversion equipment.

In other words, to get a bigger duration of compressed air energy storage (CAES), you only need to use a bigger underground salt cavern to store the air in, or to get a bigger duration flow battery, you only need to increase the size of tanks holding liquid electrolyte.

Yet for thermal energy storage and CAES, the energy-related costs are much lower than they are for flow batteries, and BNEF said the latter may be better suited for mid-duration applications (which it defined as up to around 12-hour duration of discharge) than their thermal and mechanical counterparts.

BNEF also said that in general, LDES technologies may struggle to match the economies of scale achieved by lithium-ion battery manufacturers, which mostly entered the energy storage industry—at least to begin with—based on rapidly rising manufacturing capacity due to demand for adjacent sectors like electric vehicles (EVs) and consumer electronics.

China’s different market dynamics

An interesting global industry dynamic BNEF identified was the very different market landscape within China versus the rest of the world.

For example, while China is by far the global leader in lithium-ion battery manufacturing, its government has supported the development and deployment of flow batteries too over the past few years.

As a result, a fully installed flow battery system in China had an average cost of US$423/kWh, and when China was removed from the calculation, the cost of a flow battery elsewhere in the world averaged US$701/kWh in the survey.

China also has a lead in thermal energy storage and compressed air technology costs, although not as pronounced as it is in flow batteries, and indeed, in terms of Li-ion, average installed cost in the country was found to be US$198/kWh versus US$304/kWh globally and US$353/kWh in the US.

Li-ion costs are so low in China, in fact, that although it has cheaper LDES technologies in almost every class except compressed gas storage, BNEF analysts believe LDES may not be able to displace lithium-ion even there.

CATL joins long-duration trade group

An interesting parallel development is that in the past few days, the global Long Duration Energy Storage Council (LDES Council) announced the addition of the world’s biggest lithium battery maker, China’s CATL, to its membership.

CEO LB Tan said as the company became the first Li-ion manufacturer to join the group that “CATL is committed to providing lithium-ion batteries-based LDES solutions, designing cells and systems suitable to various application scenarios.”

Definitions of ‘long-duration’ itself are varied and loose, ranging from six hours in a UK government consultation to multi-day or even seasonal technologies over weeks or months. Recent wins in competitive solicitations for 8-hour LDES by companies proposing lithium-ion projects in California and Australia have pointed to the continuing competitiveness of the incumbent technology.

In a video interview with Energy-Storage.news, published last week, Gabriel Murtagh, LDES Council director of markets and technology, noted that going from shorter to longer durations is “critical for decarbonisation,” and that a diverse portfolio of technologies and durations will be a must for the world’s grids.

“We need to transition from thinking about building short-duration storage resources, getting them on the system, to thinking about building multiple different levels of duration,” Murtagh said.

“So, durations of four hours, like we’ve got a lot of today, durations of 10 hours, to do more of that intraday energy movement, and then durations even beyond that, so thinking eventually about seasonal durations. How do we move energy from a relatively abundant time like the spring and the fall and get that energy to the winter and the summer when we have peak, critical needs on the system?”

‘US, Europe have a chance to invest and develop capabilities’

Although they may not have the same economies of scale on their side, LDES technologies will continue to improve in their feasibility and performance, BNEF said, while noting that it may be essential to implement favourable policies to support those ongoing improvements.

Favourable policies have driven China to its leading position in lowering LDES costs, enabling it to deploy “gigawatt-hour scale projects,” BNEF clean energy specialist and report co-author Yiyi Zhou said.

Zhou described the rate of LDES installations in China as “astounding”.

However, colleague Evelina Stoikou, a BNEF senior associate in energy storage who co-authored the report, said that Europe and the US despite seeing higher costs today, “have a chance to invest in their own industries and drive innovation and deployment.”

“Markets outside of China are developing a wider range of technologies compared to China, including more technology types within flow batteries, compressed air, compressed gas, thermal, gravity and novel pumped hydro.

We’ve seen interest in those regions driven by ambitious clean energy targets, higher lithium-ion battery costs and an effort to develop alternative technologies that do not rely on lithium.”

Watch our interview with LDES Council director of markets and technology Gabriel Murtagh.