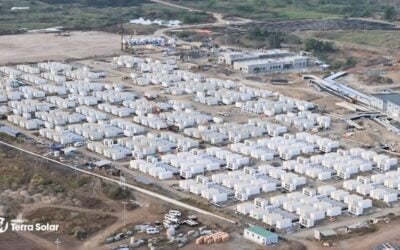

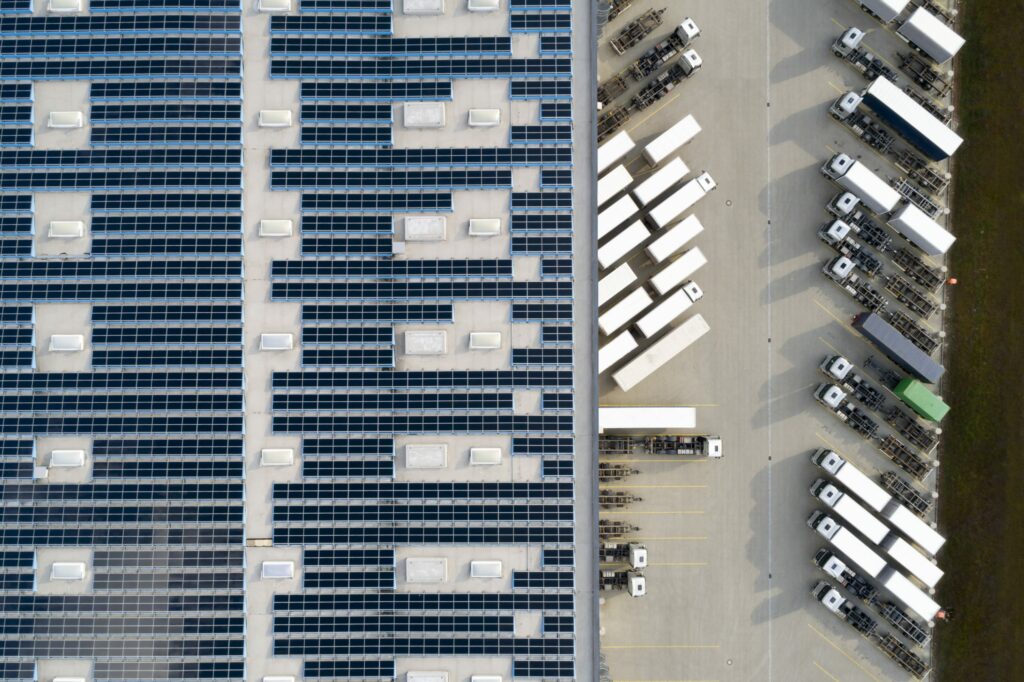

US commercial real estate firm Stream Realty Partners is partnering with independent power producer Catalyze to deploy over 450MW of solar and battery storage projects across its industrial properties portfolio.

Stream, which describes itself as a a national real estate services, development, and investment company announced the Master Framework Agreement with Colorado-based Catalyze on Friday (22 April).

The two will cooperate to deploy 450MW of solar PV, battery storage, and EV charging solutions across Stream’s 40 million square foot portfolio. The rollout will initially be at 42 of Stream’s properties including in California, North Carolina, South Carolina, Tennessee, and Texas.

Catalyze is a national independent power producer that develops, constructs, owns, and operates integrated renewable assets. Two years ago, it launched a new software solution aimed at streamlining the process of deploying commercial and industrial (C&I) sited energy storage and solar solutions. The company is backed by investment groups Yorktown Partners and EnCap Investments.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Adam Jackson, Stream Chief Investment Officer and Chairman of the firm’s ESG Committee, alluded to Catalyze’s capabilities, commenting: “Our partnership with Catalyze makes it effective and profitable to streamline deployment of clean energy solutions across our growing pipeline of industrial facilities while supporting the power grid throughout our industrial portfolio.”

Catalyze said it will de-risk Stream’s costs and supply chains and accelerate construction across the pipeline, allowing for more rapid clean energy development and emissions reductions.

Businesses in the US are increasingly investing in on-site solar and storage projects like Stream is doing to save on energy costs. Some IPPs are starting to make sizeable investments in portfolios specifically comprise of these sorts of C&I-sited projects.

“As the real estate industry moves ESG to the top of its priority list, owners are seeking simple, cost-efficient ways to integrate clean energy solutions and reduce emissions across entire portfolios,” said Steve Luker, Catalyze CEO.