According to the Q3 2025 US Energy Storage Monitor from Wood Mackenzie Power & Renewables and the American Clean Power Association (ACP), annual installations will not reach 2025 levels again until 2029.

From Wood Mackenzie, “2025 is set to be another record-breaking year for utility-scale storage, but annual installations will not reach 2025 levels again until 2029.”

Utility-scale installations

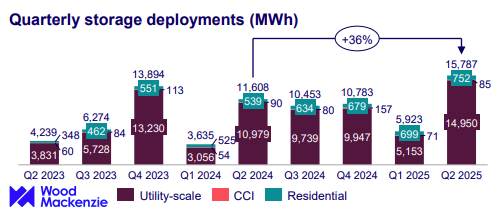

The key takeaway from the Q2 2025 US Energy Storage Monitor was that the industry installed 2GW of energy storage across all segments in Q1, with utility-scale or grid-scale additions totalling 1,558mw/4,078mwh. This reflected a 57% increase compared to the same period in 2024.

Last year was the first time total installations surpassed 10GW, reaching 12,314MW in output and 37,143MWh in storage capacity. This marked roughly a one-third increase from 2023 figures, according to Wood Mackenzie.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Q3 2025 report states that utility-scale storage installations then reached an all-time high in Q2 2025.

As stated in the report, “Q2 2025 marked a new high for US utility-scale energy storage with 4.9GW/15GWh installed, a 63% year-on-year increase. Texas, California and Arizona accounted for 75% of installed capacity.”

Notably, Oklahoma had an unusually large presence, re-entering the market with 170MW across three projects.

While the growth reported in this and the organisation’s previous market reports is encouraging, the Q3 2025 US Energy Storage Monitor notes that, due to the impacts of the ‘One Big Beautiful Bill’ Act (OBBBA) and global trade uncertainty, deployment is expected to slow.

As noted in the report, “US utility-scale storage installations will drop 10% y-o-y in 2027 but reach 72GW/259 GWh cumulative installations through 2029.”

The leading markets for utility-scale storage are expected to remain California, Texas, and other states that have supportive storage policies and anticipated high load growth.

The US energy storage market is projected to remain resilient despite federal policy challenges, with total installations reaching 87.8GW/281.2GWh over the next five years.

Residential, community-scale and commercial and industrial storage

The national residential storage market expanded for the fifth straight quarter in Q2 2025.

California, Arizona, and Illinois were at the forefront of quarterly installation growth in the residential sector, primarily due to California’s Net Billing Tariff (NBT), decreasing solar export rates, and state incentives.

The report predicts that residential storage will increase by 96% in MWs and 41% in the number of installations by 2025.

According to the report, the community-scale and commercial and industrial (CCI) segment achieved its highest Q2 storage installations since 2023.

The deployment of commercial solar-plus-storage projects in California has spurred growth in this sector, driven by the implementation of Net Energy Metering (NEM) 3.0.

Wood Mackenzie says storage incentive programmes encourage storage growth in New York, Illinois, and Massachusetts.

The CCI storage market is anticipated to steadily increase as demand for more solar-plus-storage projects grows.

From the report, “High development costs and slow transition to programs with lower solar project support, such as NEM 3.0 in California, cap CCI storage deployment pace until 2027. By the end of the five-year outlook, storage is expected to rise.”

Five-year forecast

Wood Mackenzie states that federal policy headwinds could reduce the five-year buildout by 16.5GW.

The forecasted low case predicts a 19% reduction in installations from 2025 to 2029.

The low case assumes a significant foreign entity of concern (FEOC)-compliant supply shortage, persistent trade barriers between the US and China that restrict procurement, and limited issuance of permits for renewables and transmission on federal lands.

This scenario leads to a 19% cumulative decrease in the utility-scale outlook compared to the base case. Projects not secured by 2025 may be at risk if additional FEOC-compliant supply does not emerge in the near term.

Beyond the five-year horizon, there is further downside risk if gas supply chain bottlenecks are resolved and if additional permitting restrictions threaten solar and storage projects.

The residential low case forecast considers the uncertainty regarding further guidance on FEOC, which could restrict FEOC-compliant supply and affect third-party ownership investment tax credit (ITC) qualification.

In the CCI segment, the low case indicates slow deployment of SMART 3.0 and limited BESS adoption because of higher costs, leading to fewer installations over the five-year period.

In Q2 2025, the low case assumed the US reconciliation bill was passed as written in the House version. The House version established a 60-day start of construction period and a deadline of 2028 for in-service status to obtain the ITC.

The final version of the OBBBA was less strict on storage, leading Wood Mackenzie and ACP to boost the low case scenario forecast by 23% quarter-over-quarter.