UK electricity market operator National Grid ESO is reassessing how much energy storage gets paid in the Capacity Market, battery storage operators told Energy-Storage.news, with one calling the current system “outdated”.

De-rating factors explained

The UK Capacity Market auctions, which procure reserve energy capacity in annual one year-ahead (T-1) and four years-ahead auctions (T-4), have increasingly been handing out contracts to energy storage.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The Capacity Market pays resources for being available for energy dispatch during grid stress events and tariffs are therefore weighted depending on how ‘reliable’ a resource is seen to be in delivering that stand-by capacity. The percentage of the headline auction tariff that a technology type receives is its ‘de-rating factor’.

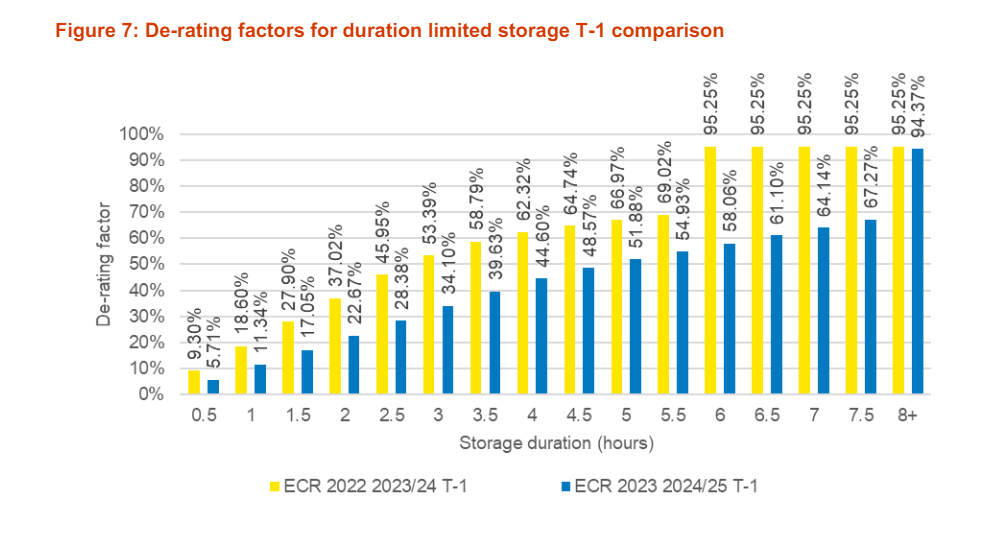

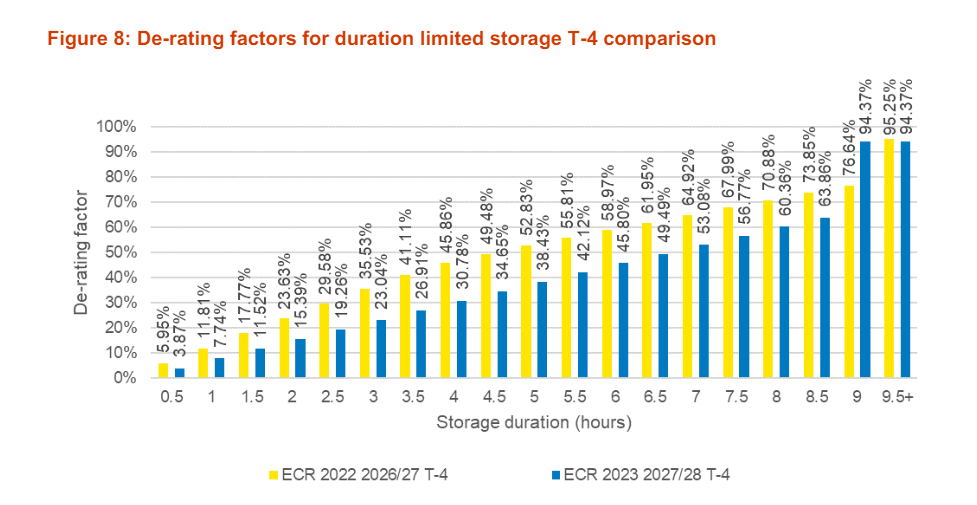

Thermal gas plants and hydro get the highest at 90-95% while solar and wind get the lowest at 5-12%, reflecting their variable nature. Energy storage’s de-rating factor depends on its duration, with 0.5-hour systems getting around 4-5% with a phased increase to around 95% for 8-hour and more systems.

However, most battery energy storage system (BESS) projects being developed in the UK today are 2-hour and 4-hour systems which, if they bid in to the Capacity Market auction reflecting that, would only get 19-22% and 30-40% of the tariff respectively (the figures are different for the T-1 and T-4, and shown in full in charts at the bottom of this article).

Most systems online today are 1-hour and 2-hour systems, but operators can bid in projects at a higher duration than the whole systems’ true duration, explained further down.

ESO looking at de-rating factors for energy storage

The Electricity System Operator (ESO) recently discussed the topic in a ‘Storage de-rating factors methodology review’ webinar, which developer-operator Field’s technical director Chris Wickins characterised as an admission that the figures weren’t fairly reflecting the value of energy storage.

“National Grid is looking at de-rating factors for energy storage in the capacity market and has proposed increasing them in future auctions. This is because, having looked more closely at the energy storage that has been procured so far, they have realised that the assets as a whole are more useful than current de-rating factors would imply,” Wickins told Energy-Storage.news.

EV infrastructure and BESS developer-operator Zenobe’s global director of network infrastructure Semih Oztreves similarly said, via written comments: “We’re calling for DESNZ (Department for Energy Security and Net Zero) and ESO to introduce a battery storage-specific methodology for calculating technical availability.”

“The current de-rating methodology is outdated having been introduced in 2014, long before battery storage was an established technology in the UK electricity system. The UK now has around 3GW of large-scale electricity storage, so it’s important the methodology is updated to reflect storage’s important role of ensuring national security of supply.”

In response to a request for comment, National Grid ESO pointed out that the current method was introduced in 2018 and that the organisation periodically reviews its modelling assumptions and methods in light of market development.

The ESO spokesperson added that it is DESNZ that sets policy direction for the Capacity Market and is responsible for changes to its rules and regulations, and commissions a panel to scrutinise the modelling with a report published annually.

Oztreves said that energy storage operators are not being paid adequately for their contributions in the Capacity Market and that unfair de-ratings push up the overall clearing price of the auction, increasing prices for consumers.

Suggested improvements

As mentioned earlier, operators can bid in at a higher duration than what their project is in reality, by bidding in a lower MW power capacity than their nameplate output. Nick Provost, commercial manager for developer Balance Power, suggested a way to get around this as well as make investment in long-duration energy storage more attractive.

“A good compromise that addresses both challenges would be to make bidders in the Capacity Market auction provide both the maximum amount of energy a project can store (MWh) and how quickly it can release it (MW),” Provost said.

“This would allow the Capacity Market to reward projects that genuinely store energy for longer periods and offer up the incentives needed to stimulate the procurement of these systems that provide important stability to the energy system.”

Field’s Wickins said that moving from a self-dispatch system, where operators are responsible for and control their dispatch in response to stress event notifications, to one of central dispatch where ESO or an equivalent delivery body controls the entire fleet of energy storage resources, would improve storage’s utility.

“At Field we think the key thing for energy storage to be utilised to its full potential to provide support in a system stress event, is giving the system operator more control over when electricity is dispatched in that system stress event. Rather than self-dispatching at the start of a system stress event, energy storage assets could instead be utilised for the duration or at the peak of the system stress event,” Wickins said.

“If the Capacity Market was operated using central dispatch, de-rating factors for limited-duration storage would, therefore, be higher because the ESO would have complete control to deploy batteries during peak system stress events when electricity margins are tightest. This would maximise energy storage’s value to the system and ensure as little fossil fuel generation as possible was needed at the critical moment.”

See the latest publicly available de-rating factors for energy storage in the T-1 and T-4 below, taken from the ‘ESO Electricity Capacity Report’ (May 2023).

Energy-Storage.news’ publisher Solar Media will host the Renewable Energy Revenues Summit on 21-23 May 2024 in London. The event will explore PPA structuring, revenue risk management strategies, renewable energy certificates, and much more. For more information, go to the website.