The UK electricity system operator’s T-4 Capacity Market Auction (CMA) for delivery year 2027/28 cleared earlier this week (27 February) after two rounds at an “all-time high” clearing price of £65 (US$82.23)/kW/year.

Fintan Devenney, senior energy analyst at energy data analyst EnAppSys, noted that this “all-time high” is £2/kW/year higher than the 2023 auction clearing price “which was itself a record high at the time.”

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

According to the National Grid ESO’s preliminary results, the auction round secured 42,830MW – less than 2,000MW lower than the auction’s revised target of 44GW – with 98.76% of capacity entering the auction awarded an agreement.

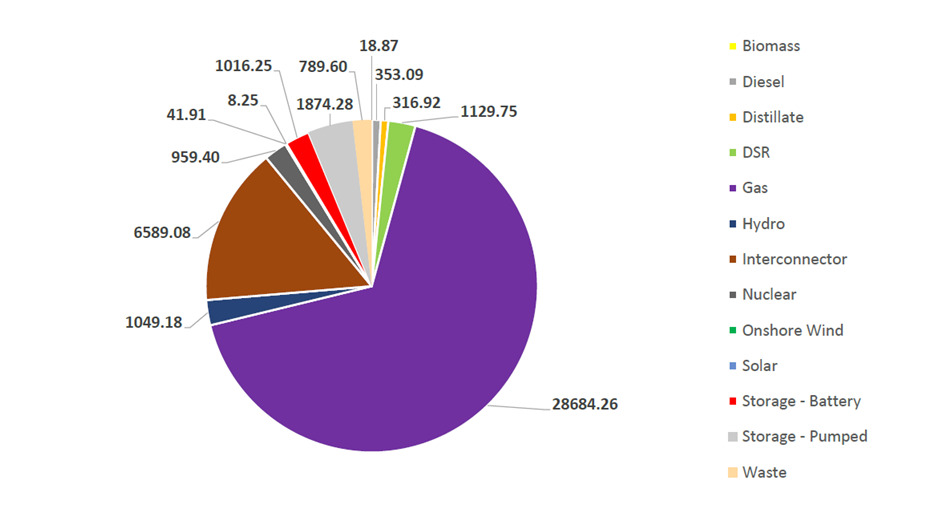

As in the T-1 CMA for delivery year 2024/25, gas was awarded the majority of capacity, securing 28,684MW (66.97%), followed by interconnectors at 6,589MW (15.38%).

Pumped hydro energy storage (PHES) secured the most capacity of the low-carbon technologies entered into this year’s auction, securing 1,874MW (4.38%).

Battery storage received 1,016MW (2.37%), nuclear 959MW (2.24%), onshore wind 41.91MW (0.10%), and solar 8.2MW (0.02%).

A new report commissioned by power plant owner Drax revealed that 2028 would see an energy ‘crunch point’ where demand will exceed secure dispatchable baseload capacity by 7.5GW at peak times. According o the report, this means that the results of the 2024 T-4 CMA, specifically how much capacity is awarded in relation to the target, will decide the “scale of the energy crunch.”

Following the T-1 Capacity Market results last week, despite the large share taken overall by gas, battery storage developers and nuclear plant owner EDF were described by one analyst as that auction’s ‘big winners’. T-4 is however much more lucrative and awards 15-year contracts versus 1-year in T-1, so it will be interesting to see what industry reaction may follow the latest results.

To read the full version of this story, visit Current.