The UK’s battery energy storage market will grow to 24GW by the end of the decade and account for almost 9% of all global capacity installations, energy research firm Rystad Energy said.

Utility-scale battery systems could also present an opportunity investment in the battery storage space with Rystad having said it could “attract investment of up to £16.15 billion ($20 billion) by 2030.”

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In terms of capacity by 2030, the UK is forecast to sit fourth in the table only behind China, the US and Germany.

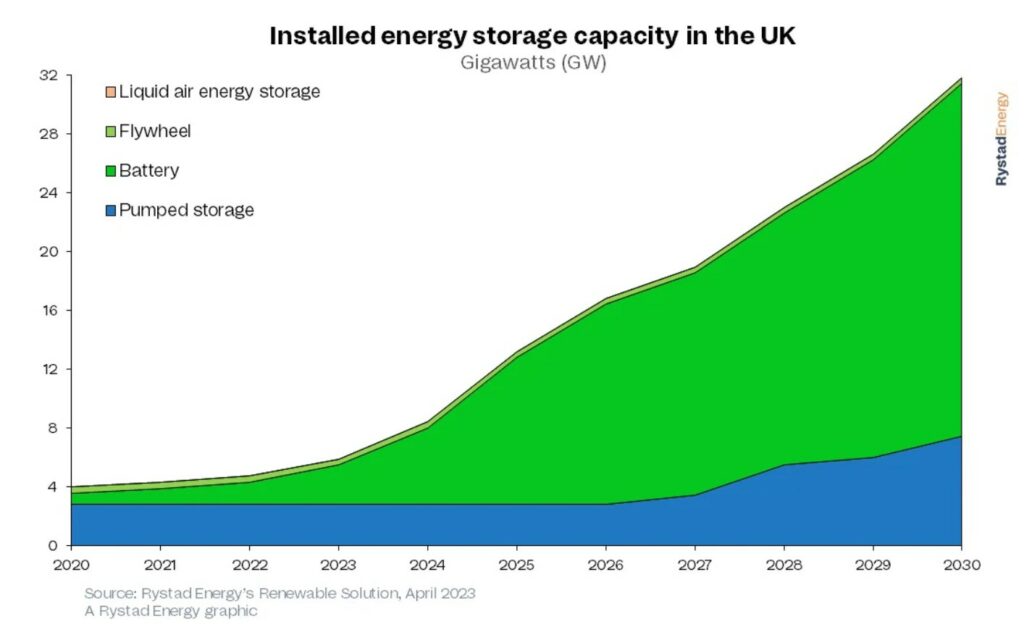

One of the major reasons for this leading position in the global battery storage race is the ever-growing pipeline of intermittent renewable energy in the UK such as solar and wind. Consequently, the government has set ambitious energy storage requirement targets, eyeing 30GW of capacity by 2030, including batteries, flywheel, pumped hydro and liquid air energy storage.

Rystad believes the UK will both meet and even surpass this target but only if the government is able to address expected roadblocks such as grid connections, mitigating supply chain issues and developing a policy framework for pumped hydro projects.

The UK currently has 4.7GW of energy storage installed. Pumped hydro storage makes up the majority of this capacity with 2.8GW installed whereas battery energy storage systems (BESS) account for around 2.1GW.

Despite pumped hydro’s potential, the financial and regulatory hurdles required to develop new capacity means the UK is unlikely to add new projects in the short term. This is set to be rectified in the near future with the government aiming to establish a strategy for long-duration energy storage (LDES) developments, such as pumped hydro, by the end of 2024.

Battery developments are also estimated to grow in number and size as we approach the end of the decade due to the government’s decision to lift size restrictions on project planning. Because of this, single projects could grow to 1GW in size.

UK company Alcemi is the market leader in the UK with 3.3GW of capacity in the pipeline, with Zenobe taking second place with over 1GW of projects at different stages of development.

“Large-scale battery developments will soon be the norm in the UK, solving the problem of balancing short-term power demand with the intermittency of wind and solar generation. And this could just be the start. Further growth could soon be on the way if the government introduces additional incentives to spur investments,” said Pratheeksha R, renewable energy analyst at Rystad Energy.