We hear from S&P Global Commodity Insights analysts and a former Fluence executive about the major trends shaping the competitive landscape of system integrators in the BESS industry.

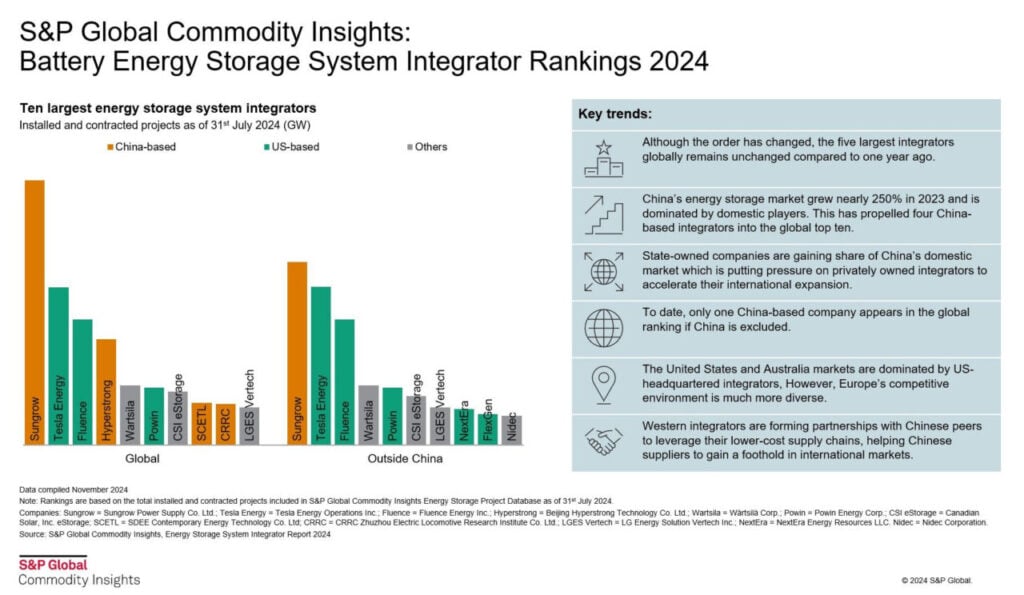

S&P Global has released its latest Battery Energy Storage System (BESS) Integrator Rankings report, using data for installed and contracted projects as of 31 July, 2024, showing the top five globally remains the same as last year’s ranking but with a shift in the order.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

China-based Sungrow tops the list again while Tesla Energy, Fluence, Hyperstrong and Wärtsilä make up the remainder of the top five. Tesla and Fluence have swapped places from last year’s rankings, as have Hyperstrong and Wärtsilä. S&P Global released the infographic below summarising its findings.

The main driver of the ranking is the dynamics within the Chinese domestic energy storage market, said S&P Global’s Anqi Shi, principal analyst, and Rida Rambli, research analyst, both covering batteries and energy storage.

State-owned integrators growing in China

China-based, privately-held system integrators are increasingly expanding their global market share in light of razor thin margins at home, partially driven by an increasing market share in China of state-owned system integrators. That trend of Chinese companies gaining more of a global presence was first noted in last year’s report.

Privately-owned integrators are also increasingly supplying DC block solutions to state-owned integrators, moving away from offering full integration in China. This mirrors their approach abroad too, in the US for example, where cybersecurity concerns limit Chinese companies’ ability to provide more complete hardware and software integration solutions.

Shi and Rambli also noted that four of the five top five system integrators are now offering AC blocks, indicating a growing popularity of the emerging product design. This was a trend covered by Energy-Storage.news in a recent article bringing together the views of ex-Fluence Americas COO Dax Kepshire and other industry sources.

Regional markets: US, Europe and Australia

The top five looks quite different when looking at the US, European and Australian markets, however, with additional data provided to Energy-Storage.news by S&P. Tesla and Fluence are the only companies that are in the top five in each of those three markets, though Sungrow tops the US and Europe.

In the US, the top five ranking is (in descending order) Sungrow, Tesla, Fluence, Powin and NextEra Energy Resources. Powin is another pure-play system integrator while NextEra Energy Resources is an independent power producer (IPP) which has its own system integration capabilities.

In Europe, the top five are Sungrow, Fluence, Nidec ASI, Tesla, SMA Altenso. Nidec ASI is a system integrator based in Italy and is part of the Japanese conglomerate Nidec Corporation, while SMA is an inverter company which has moved into BESS solutions too.

Australia, meanwhile, is the only market where the top five are all US or European companies: Tesla Energy, Fluence, Powin, Wärtsilä, and GE Vernova, a spinout of General Electric (GE), make up the list.

Vertical integration: PV-BESS players into cells, IPPs into system integration

S&P’s analysts also noted the increasing BESS activity of major solar PV manufacturers like Canadian Solar, which is in the top ten for the US, UK and Australia, while Trina Storage is in the top 10 in UK, China and Australia. Canadian Solar, via its BESS subsidiary e-Storage, is also sixth in the global ranking.

They also said that such companies are also planning their own battery cell production, mirroring their vertical integration strategy in the PV module supply chain. Canadian Solar alluded to this possibility in an earlier interview with Energy-Storage.news, and the move was confirmed last week with the launch of a BESS and cell plant in Kentucky.

The possibility of Western system integrators like Fluence, Powin or Wärtsilä doing the same and moving into cell manufacturing has been speculated, but in a recent interview Kepshire said this was unlikely.

“System integrators will partner with cell manufacturers but I don’t see them going into cell production as it’s too complex, capital-intensive and risks component obsolescence. You do see the cell manufacturers move upstream into BESS however in a big way,” Kepshire said.

Indeed, virtually all major lithium-ion cell manufacturers have moved into BESS at scale, including CATL, LG Energy Solution, BYD, EVE Energy, Envision, Gotion, REPT and more.

Interestingly, another sort of vertical integration affecting the market of system integrators is IPPs in energy storage opting to build system integration capabilities in-house. That allows them to bypass system integrators entirely and buy directly from DC block manufacturers, notably those Chinese players listed above.

By doing this, IPPs like NextEra in the US and Eco Stor in Germany (two examples) can save on the cost of hiring system integrators, and this approach accounts for a ‘significant share’ in some local markets, Shi and Rambli said.

“This will narrow the market share for dedicated system integrators but increase the opportunities for battery manufacturers offering DC blocks,” their note added.

Localisation and insourcing of manufacturing?

Another major question for system integrators vis-a-vis their own supply chain is the decision of bringing manufacturing into the US to leverage various domestic content incentives under the outgoing Biden-Harris administration’s Inflation Reduction Act (IRA).

Canadian Solar’s Kentucky announcement and a similar move from Fluence and smaller player Saft this year are examples, while Tesla already has a factory in California where it assembles its grid-scale Megapack systems.

However, the extent to which the full componentry of a BESS unit will shift production to the US anytime soon is not clear. Kepshire said that, even with the IRA’s generous incentives, you will not see the entirety built in the US.

“It’s significantly more expensive to manufacture things in the US. I think you’ll see module assembly done in the US with enclosures coming from overseas to put them together in the US. Tesla are in a good position as they own their manufacturing.”

The move to onshore BESS assembly and cell production to the US should also be prompting considerations for system integrators that have their own proprietary BESS configurations – not all do – about whether to own their own manufacturing. The norm to-date for system integrators has been to outsource manufacturing to someone else.

Kepshire agreed with Energy-Storage.news suggestion that manufacturing in-house was most likely better for quality control, but did not think that the industry was necessarily heading that way.

“I agree that owning your own manufacturing makes a lot of sense,” he said. “By outsourcing, you are basically giving away the margin expansion that you might otherwise get from scaling up your own production. It’s about capital allocation, and they often take the view that it makes sense to partner with someone rather than invest to do it themselves, as they are often more short-term focused.”