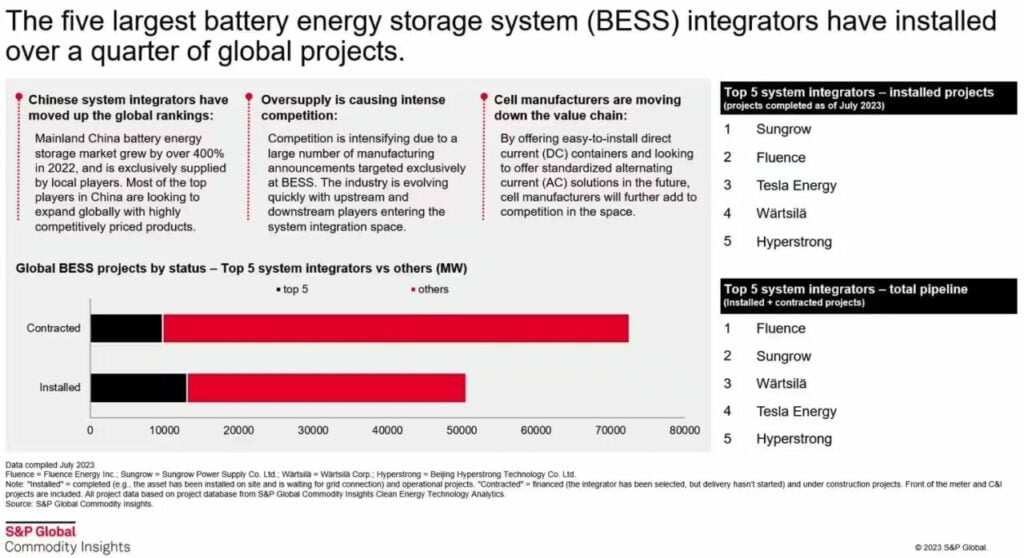

Substantial growth in China’s domestic energy storage market has led to locally-based players Sungrow and Hyperstrong becoming top five system integrators globally, S&P Global Commodity Insights said.

The energy and commodities research firm said that the mainland China battery energy storage market grew by 400% in 2022, which has led to local companies entering the top global rankings as they exclusively supply that market.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

According to S&P, the top five system integrators by installed projects as of July 2023 are:

- Sungrow, a China-headquartered inverter and battery storage provider

- Fluence, a listed pure-play battery storage system integrator

- Tesla Energy, a energy storage division of electric vehicle giant Tesla

- Wärtsilä, a Finland-headquartered power solutions firm

- Hyperstrong, a Beijing-based battery storage system integrator

Meanwhile, the top five by installed and contracted projects are the same companies but in a different order:

- Fluence

- Sungrow

- Wärtsilä

- Tesla Energy

- Hyperstrong

The latter ranking represents a shift from two years ago when IHS Markit, which S&P acquired and integrated into its S&P Global, pegged the top five as Fluence, NextEra Energy Resources, Tesla Energy, Wärtsilä and Oregon-headquartered Powin Energy, in descending order.

The companies making up the latest top five account for around a quarter of global battery storage installations to-date, and around 10% of contracted projects, as shown in S&P’s infographic below.

S&P added that competition in international markets will intensify as Chinese companies look to expand globally by offering highly price-competitive products. It went as far as saying that a ramp-up in battery manufacturing targeting the energy storage system market will “lead to oversupply and highly competitive market conditions”.

A battery developer, speaking anonymously, told Energy-Storage.news that the price difference between Western and China-based battery energy storage system (BESS) integrators has grown this year.

A separate delegate at the Energy Storage Summit Central Eastern Europe (CEE) last week added that a big part of BESS product and capex prices starting to fall in 2023 has been due to an oversupply in China, where a ramp-up in BESS manufacturing capacity has outpaced the domestic market demand for BESS.

Fluence won System Integrator of the Year at last week’s inaugural Energy Storage Awards, organised by our publisher Solar Media.