Italian energy company Enel has agreed terms to buy Element Power’s 12.5MWh battery storage project, which secured one of the most highly remunerated contracts in last year’s Enhanced Frequency Response (EFR) tender by the UK’s transmission system operator National Grid.

The 25MW Tynemouth standalone project, which won an £11.49/MW (US$14.87/MW) contract in September’s competition, has been acquired for around £17 million, including construction costs, and is expected to be completed in February 2018.

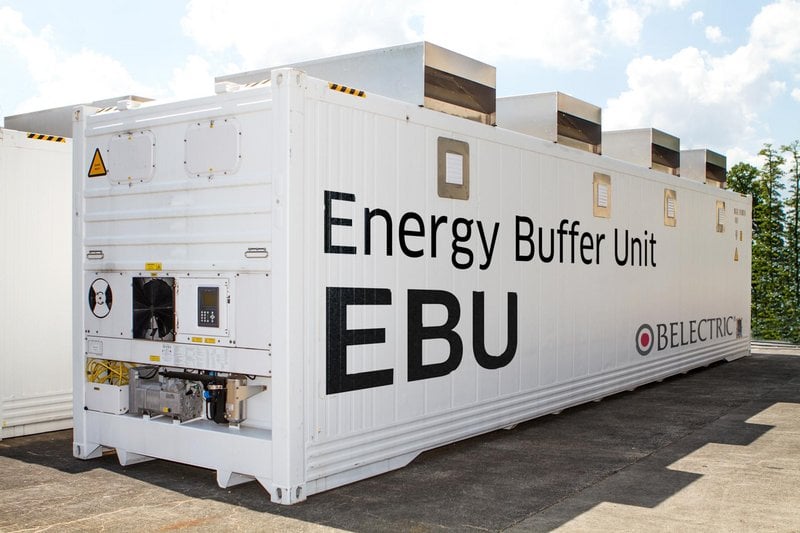

Eight projects totalling 200MW were awarded contracts by National Grid, which received over a gigawatt of applications. Strike prices were agreed for as low as £7/MW by EDF Energy, up to £11.97/MW by Belectric, with Element Power’s being the third most lucrative.

For Enel, the project marks “an important step forward in the growth of our group” according to its head of the global thermal generation division Enrico Viale, who described the battery energy storage system (BESS) sector as “promising and innovative”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Due to the increasing role of renewable energy sources, the growing need of grid balancing services and the fast reduction of technology costs, the BESS market is expected to grow exponentially in all geographies in the next years,” he said.

“For this reason, Tynemouth represents for Enel an opportunity to gain experience and strategic knowledge in building such projects, which can then be applied to other markets.”

Enel added that the project was particularly attractive due to the short time for construction and fast route to market. It also stated that the UK offers one of the most advanced markets in the world for utility-scale battery storage systems, particularly following the EFR tender which was dominated by stand-alone battery storage.

The four-year EFR contract will see the lithium-ion project deliver 100% active power output at 1 second (or less) of registering a frequency deviation from National Grid. Following the end of this period, Enel said the project will provide ancillary services and enter capacity market tenders.

A second EFR tender had been rumoured for later this year, however it has since been suggested this could be modified to incorporate other frequency response services.