Recurrent Energy is seeking a loan from financial institution North American Development Bank (NADBank) to fund the construction of a 100MW/200MWh standalone battery storage facility located in Maverick County, Texas.

Details of the potential loan were disclosed in a certification and financing proposal published by NADBank on 18 July 2024. The proposal not only laid out the scope for Recurrent’s Fort Duncan Energy Storage project but also detailed NADBank’s findings following rigorous financial and risk analysis.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The document is now subject to a 30-day public comment period. Once this closes, Canadian Solar’s development arm Recurrent will submit its final proposal to NADBank’s Board of Directors, which will decide whether to issue the loan or not.

US$60 million construction loan

NADBank has offered Recurrent a market-rate loan of up to US$60 million for the construction of the Fort Duncan project, after the financial institution deemed the project to be financially feasible and presenting “an acceptable level of risk”.

The document states that Recurrent is expected to earn revenue through its Fort Duncan BESS from the sale of electricity and ancillary services in ERCOT’s wholesale market which it will use to pay back the loan.

However, Recurrent may find this to be less lucrative than previous years as the market appears to be reaching a saturation point, as recently reported in Energy-Storage.News.

Construction on the project—which commenced in June 2024—will be funded using equity provided by Recurrent, the NADBank loan, and funding from other lenders.

Acquired from Black Mountain Energy Storage

Initial development of the Fort Duncan BESS facility was carried out by Black Mountain Energy Storage (BMES), before Recurrent Energy acquired the development as part of a two-project portfolio in June 2022, as reported in Energy-Storage.News.

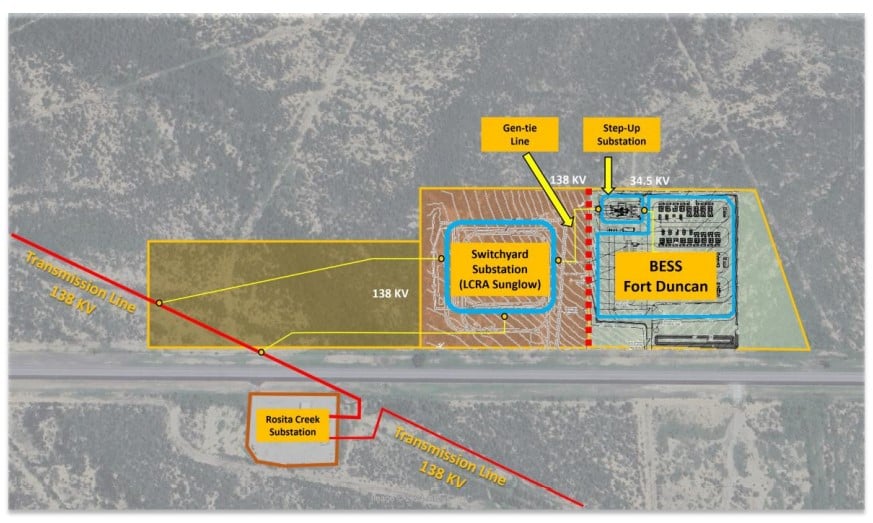

The Fort Duncan facility will comprise 88 individual lithium iron phosphate (LFP) battery units located across 31.8 acres of privately owned land approximately six miles east of Eagle Pass in Maverick County, Texas.

Interconnection to the ERCOT grid will be via Lower County River Authority’s (LCRA’s) new 138kV Sunglow Substation.

Project milestones and vendor contracts

Recurrent has secured a standard generation interconnection agreement with ERCOT and LCRA for the Fort Duncan project (queue no. 23INR0350) that was posted to the Public Utility Commission of Texas site in February 2023.

The developer also recently secured two engineering, procurement, and construction (EPC) agreements for the project—one relating to the BESS portion of the development and the other to the construction of the switchyard. However, the name of the EPC firm was not disclosed in the document posted to the NADBank site.

Start of commercial operation of the Fort Duncan project is scheduled for June 2025.

NADBank elgibility criteria

NADBank was founded in 1994 by the governments of the United States and Mexico to provide funding for infrastructure projects addressing a wide range of human health and environmental issues including developments relating to waste management, water treatment and of course, renewable energy.

To qualify for funding from NADBank, projects in the US must be located within 100km north of the Mexico border in Arizona, California, New Mexico and Texas. To qualify in Mexico, projects must be situated within 300km south of the border in Baja California, Chihuahua, Coahuila, Nuevo Leon, Sonora, and Tamaulipas.

As well as being located within the border region, projects must also satisfy further criteria to qualify for funding from the NADBank, as outlined in the following document.

Fifth NADBank loan for energy storage

If approved by the board of directors, funding for Recurrent’s Fort Duncan facility would be the fifth loan handed out by NADBank to developments incorporating energy storage, according to the financial institution’s most recent quarterly status report.

Cypress Creek Renewables was the beneficiary of one of these funding packages, after the NADBank board of directors approved an up to US$65.7 million loan for the construction of its Zier Solar and Storage facility located in Kinney County, Texas.

The EQT Partners-backed developer held a ribbon cutting ceremony for the Zier development on May 2 2024, as reported in a recent company press release. Managing Director of NADBank, John Beckham, spoke at the event where he described co-located solar and storage projects like the Zier development as “vital for ERCOT’s grid reliability and energy availability”.

Arizona BESS US$513 million financing

Recurrent also recently secured a US$513 million financing package for its 1,200MWh Papago Energy Storage facility located Maricopa County, Arizona.

Construction on the Papago project, which comprises a BESS along with a 300MW solar farm, is scheduled to commence in the third quarter of this year with commercial operations slated for Q2 2025.