Long-duration energy storage (LDES) technologies paired with renewable energy could reduce the emissions from industrial energy use by almost two-thirds, a new report has said.

Around 65% of approximately 12.5 billion tonnes of greenhouse gases (GHGs) emitted through industrial processes globally in 2021 could have been cut, according to ‘Driving to net zero industry through long duration storage’, the new study produced by management consulting firm Roland Berger for the Long Duration Energy Storage Council (LDES Council).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The latest in a series of reports commissioned by the LDES Council global trade association, the paper finds that LDES could enable wider uptake of renewable sources for electricity and industrial heating, arguing that the technologies are “viable, cost-efficient and readily appliable” to those processes.

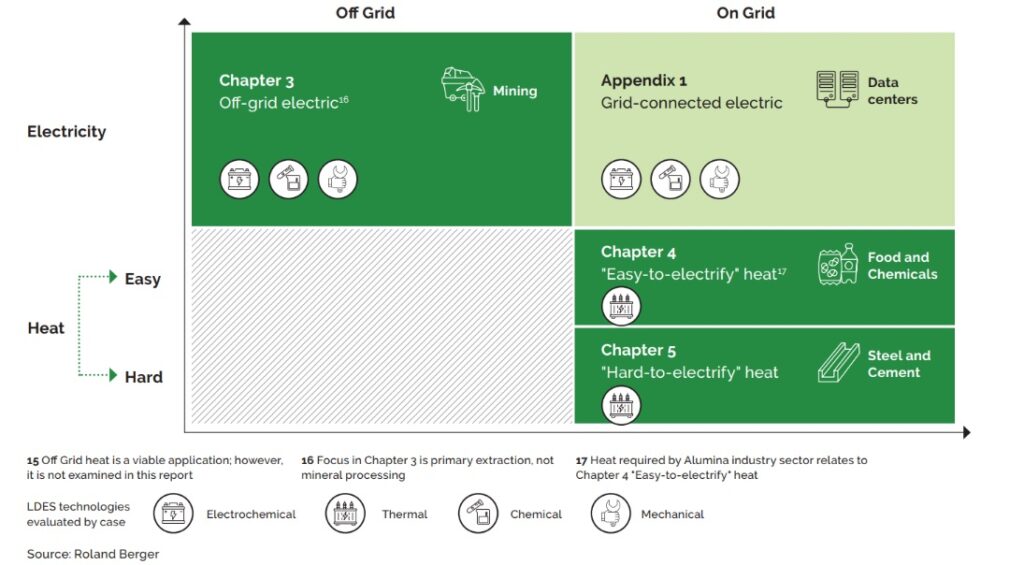

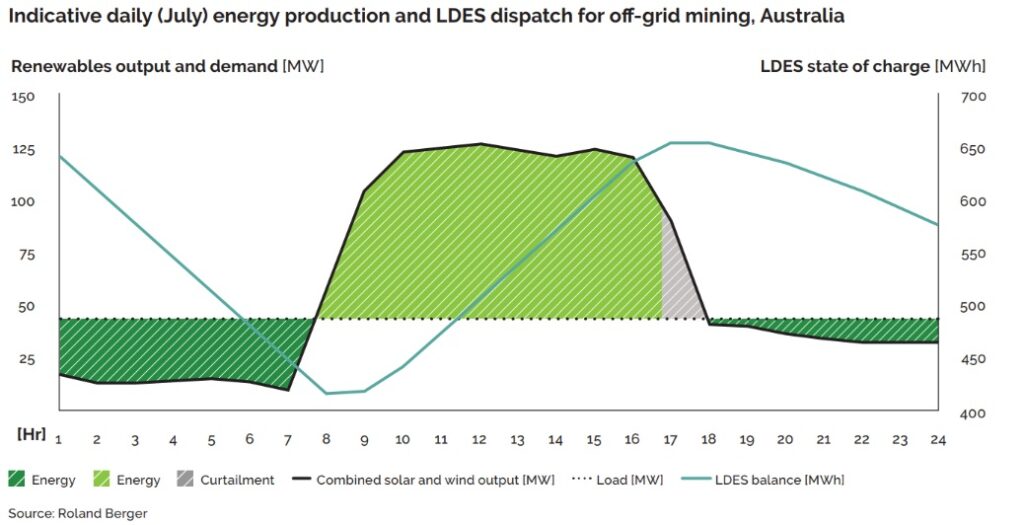

That would require a combination of electrical and thermal energy storage, including long-duration storage paired directly with wind and solar PV for off-grid industrial applications, and in electrifying heating for processes that require temperatures of 500C or below.

For example, around 20% of the cost of abating emissions from low to medium temperature heating for food or chemicals production could be cut by those technologies, even without carbon incentives.

Meanwhile, industries such as cement and steel production, which require much higher temperatures, will be more challenging to find low-carbon alternative processes for. However, even in those instances there are technologies of promise emerging, such as multi-day energy storage through novel battery technologies, while cement or steel producers could still leverage LDES tech to enable round-the-clock renewable energy use and use thermal storage technologies for the lower temperature steps used.

The report notes a number of big names in global industry that are already piloting long-duration technologies, such as Microsoft, metal companies ArcellorMittal and TataSteel, and mining giants BHP and Rio Tinto.

However, for long-duration technologies to find their rightful place in the decarbonisation of industry, “policy and market support” is required, the authors wrote.

That includes the wider adoption by industrial entities and supportive governments. Pilot and demonstration deployments already happening today will likely seed the market for further uptake. Government policies to support the space could include direct subsidies for adoption, taxes or more stringent carbon pricing schemes.

Australia opens industrial decarbonisation funding round

The full report carries calculations of industrial energy demand and decarbonisation opportunities, analysis of the different challenges from technical and market standpoints, as well as explanations of how the different benefits are spread across environmental, social and economic metrics.

It also contains some eye-opening statistics and tables. One surprising table is of announced funding support for LDES in a group of six “indicative countries”: Chile is at the top with US$2 billion of announced commitments, Hungary second with US$1.16 billion – although in both cases those commitments extend to all energy storage technologies, with long-duration energy storage included.

Meanwhile the US has committed around US$500 million, Spain US$350 million and Canada US$220 million, with the UK sixth on US$37 million. In the case of the US, Spain and the UK, those commitments are LDES-specific.

In related news, LDES Council members Malta Inc and Alfa Laval were part of a consortium recently awarded a €9 million (US$9.77 million) German government grant for industrial process decarbonisation projects.

It’s important to note that LDES’ role will be among a suite of technologies for industrial decarbonisation, with the likes of electric heat pumps, electric and green hydrogen boilers, the inevitable lithium-ion batteries and even small modular nuclear reactors (SMNRs) to play their part.

It’s the latest in a series of reports from the LDES Council, with previous reports on topics like an overview of LDES technologies, the role of thermal energy storage in net zero and opportunities for energy storage to back round-the-clock renewable power purchase agreements (PPAs) for corporates.

The report’s publication yesterday (14 November) came a day after the Australian government, through the Australian Renewable Energy Agency (ARENA), announced the opening of a funding round for projects and technologies to reduce emissions at existing industrial sites.

Called the Industrial Transformation Stream (ITS), AU$150 million (US$97.81 million) will be made available for applications that enable decarbonisation of heating for industrial processes and off-road transport. As reported by our colleagues at PV Tech, it’s the first round of a total AU$400 million programme.

ARENA noted that in Australia, industry accounts for about 44% of all emissions, and decarbonising it will be “vital to achieving our emissions reduction goals and will set Australia up as a renewable energy superpower that will maintain jobs and economic activity in our regions and capitalise on the world’s shift to green products,” ARENA CEO Darren Miller said.

Read ‘Net zero’s missing link: Long duration energy storage’, an article by LDES Council executive director Julia Souder in Volume 35 of our quarterly journal, PV Tech Power, or read an extract on the site here.