Pittsburgh, Pennsylvania-based International Electric Power (IEP) is proposing to construct a long-duration energy storage (LDES) project on the Marine Corps Base (MCB) Camp Pendleton in San Diego County, California utilising Eos Energy Enterprises’s zinc cathode battery technology.

IEP, which describes itself as a technology-neutral power producer, is currently seeking funding for its 50MW/486MWh Haybarn Energy Reliability Center through the California Energy Commission’s (CEC’s) Long-Duration Energy Storage programme.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

A handful of LDES specialists have already benefited from this grant programme, including iron-air battery technology firm Form Energy which received US$30 million at the end of last year as reported by Energy-Storage.news. The 5MW/500MWh standalone BESS, located at a substation owned by investor-owned utility (IOU) Pacific Gas & Electric (PG&E), is expected online next year.

‘Less-than-significant environmental impact’

In its position of lead agency and pursuant to the California Environmental Quality Act (CEQA) review process, the California Energy Commission (CEC) carried out an independent review and published an Initial Study (IS) at the end of last month outlining the potential environmental impacts of IEP’s Haybarn project.

The CEC also published a Mitigated Negative Declaration (MND) alongside the IS, after it found that through “feasible mitigation measures,” all project-related environmental impacts could be reduced to a “less-than-significant level”.

A review period for the public to submit comments on the two documents is now open and closes on 25 November 2024. The CEC will use the IS and MND and any comments received to issue its final decision on whether to issue a grant to IEP.

Front-of-meter asset with behind-the-meter backup power configuration

The Haybarn Energy Reliability Center is expected to encompass 19.35 acres of land owned by MCB Camp Pendleton in San Diego County, although the project will be constructed, owned, and operated by IEP.

Interconnection to the California Independent System Operator (CAISO)-controlled grid is expected via San Diego Gas & Electric’s (SDG&E’s) Pendleton substation, located adjacent and southwest of the proposed project site (see image on right).

IEP expects the facility to be operational for 20 years where it will participate in the wholesale energy, frequency regulation, spinning reserves, and flexible ramping CAISO markets.

The project will also be connected ‘behind-the-meter’ to provide the MCB with power during emergency situations such as regional grid outages.

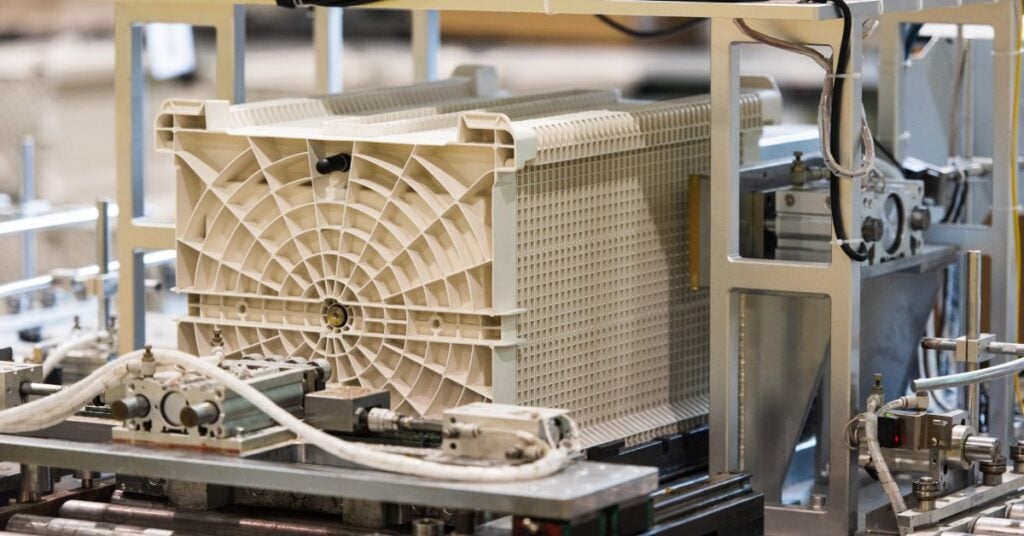

608 Eos Z3.4 Cubes

The project is expected to be made up of 608 Z3.4 Cube energy storage units manufactured by Eos Energy, utilising its zinc hybrid cathode aqueous electrolyte battery technology.

This is the same battery technology selected by Richmond, Virginia-based Dominion Energy for a smaller 16MWh battery project located at the utility’s existing Darbytown Power Station in Henrico County, Virginia, as reported by Energy-Storage.news last year.

Unlike lithium-based batteries, Eos claims that its batteries aren’t at risk of thermal runaway due to the non-flammable electrolyte used in its proprietary zinc hybrid technology.

IEP anticipates commencing construction on the zinc battery project next year which it expects to complete in two phases. The first would involve substation upgrades along with the installation of 6MW/48MWh worth of battery storage capacity, followed by a second phase to bring the capacity up to 50MW/486MWh.

The first phase is scheduled to come online by June 2026, and the full BESS capacity is expected to be operational a year later.

NASDAQ-listed Eos announced its Q3 2024 financial results last week (5 November). The company reported just US$0.9 million in revenue for the quarter, which it said was lower than expected and attributed to an “acute supply chain delivery delay” in enclosures for its new Z3 units.

The company saw its Cost of Goods Sold rise 21% year-on-year to US$28.4 million, and other operating expenses go up 65% to US$28.4 million. However, the company is making investments in automation technology for its production lines and claims Cost of Goods Sold will reduce in future as the level of manual labour required falls, while the higher sum spent on other operating expenses related in part to those investments, which again should ultimately reduce the cost of production further.

Eos also had to spend significant sums in the quarter on measures to enable it to meet the conditions of two sources of loan funding: firstly for a tranche of a total US$315 million loan package from Cerberus Capital Management, a private equity firm, and secondly for a conditional loan of up to US$398.6 million from the US Department of Energy’s Loan Programs Office.

The zinc battery company had said a few days prior to the results announcement that it had satisfied performance milestone conditions of the Cerberus loan to draw an additional US$65 million from it.

Company executives then said during an earnings call to explain results that it expected to be able to close the LPO loan before the end of this year. There has been some speculation around the future of the Loan Programs Office following the election of Donald Trump as US president, given than during his previous tenure in 2016-2020 the office lay dormant and was revived during the Biden-Harris Administration.

US$330 million California Energy Commission funding for LDES technology

Launched in 2023, the CEC’s LDES programme has allocated US$330 million to promote the development of 8-hour+ non-lithium battery storage projects and speed up the deployment of these facilities to address future capacity shortfalls in California.

One other example is community-owned electric utility Sacramento Municipal Utility District (SMUD), which received funding from the CEC LDES fund to develop a 3.8MW/28.8MWh iron and saltwater electrolyte flow battery storage facility in partnership with manufacturer and IP holder ESS Tech Inc.

The two parties hope the pilot project will enable them to gain a greater understanding of the technology as they look to scale-up deployment of iron electrolyte BESS facilities to 2WGh across SMUD’s service territory.

Importance of LDES technology

As grid operators across the US strive to reach net-zero targets across the next couple of decades and dispatchable fossil fuel plants are shut down for good, LDES facilities will play a crucial role in keeping electricity grids operating properly.

In light of this, there has been an emergence of developers proposing utility-scale 8-hour+ battery storage facilities, including one recently from Canada’s Capstone Infrastructure and Denmark’s Eurowind Energy.

The pair’s 400MW/3,200MWh Potentia-Viridi battery energy storage system planned for Alameda County, California is something which wouldn’t have been thought possible until very recently.

Additional reporting by Andy Colthorpe.