India is on the “cusp of a potential energy storage revolution,” thanks to recently launched tenders, according to authors of a new report.

The country’s government has recognised the important role energy storage will play in its power sector. Targeting the deployment of 500GW of non-fossil fuel energy, including 450GW of new wind and solar capacity by 2030, batteries and other storage technologies have been identified as an enabler of the ambitious national goal.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

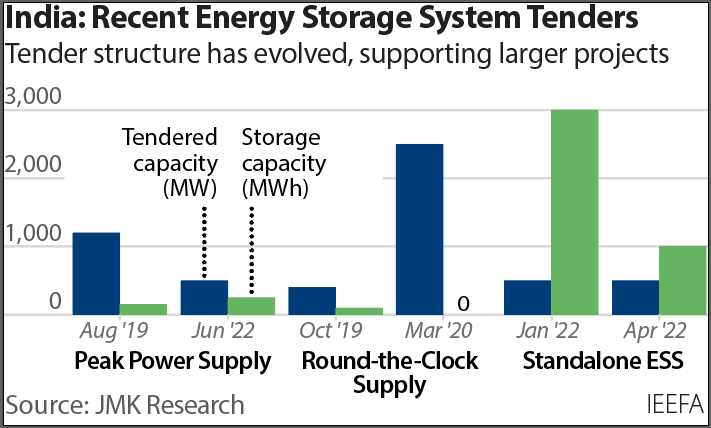

Tenders for energy storage launched by various state-administered agencies are ushering in a new era, the report, co-authored by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Analytics found.

India has already surpassed 150GW renewable energy capacity, as of the time of writing. Yet to arrive at its 2030 target without jeopardising stability of supply or power quality, the nation’s Central Electricity Authority has projected a need for 27GW/108GWh of grid-scale battery storage and about 10.1GW of pumped hydro energy storage (PHES).

Two tenders currently running, one from the Solar Energy Corporation of India (SECI) and another from state-owned power group NTPC, will alone add 1GW/4GWh of storage to the grid. They are also likely to pave the way for a wave of new deployments, with SECI’s tender for standalone battery energy storage systems (BESS) designated as a pilot, for example.

“India is on the cusp of a potential energy storage revolution. Large-scale deployment of storage will be critical to firm increasing amounts of variable wind and solar as India scales up renewable energy capacity to meet its target of 500GW of non-fossil fuel energy by 2030,” IEEFA energy economist and lead for India Vibhuti Garg said.

Garg noted that the recent power crisis highlighted a need to invest in energy storage alongside renewable energy that can help reduce reliance on coal-fired generation, which the economist described as “increasingly uneconomic and unreliable”.

The two tenders are not India’s first: earlier tenders for peak power provision and round-the-clock renewable energy supply had been held in 2019 and 2020, but the NTPC and SECI solicitations are the first for standalone energy storage systems (ESS).

As such, they could catalyse development of the “entire Indian ESS market,” JMK Research founder Jyoti Gulia said.

Along with a government plan to financially support 50GWh of domestic advanced chemistry cell (ACC) battery manufacturing and other developments such as new Ministry of Power battery storage procurement and utilisation guidelines, the sector appears to be advancing rapidly.

There has been huge progress in the last couple of years. Yet it has taken nearly 10 years to reach this point, Dr Rahul Walawalkar, founder and president of the India Energy Storage Alliance (IESA) and director at consultancy Customized Energy Solutions said in a recent Energy-Storage.news webinar.

“The policy framework in India has evolved over the last 10 years. The work started in 2013 with the Ministry of Power and CEA setting up a taskforce for large-scale renewable integration. At that stage, we were looking at 20-30GW of renewable energy by 2030,” Walwalkar said.

The following year, Prime Minister Narendra Modi upped the scale of the targets significantly, setting a 100GW solar PV target for 2020 through a National Solar Mission. From there, the renewables sector grew year-on-year and in 2018 a strategy on energy storage was launched.

India could become one of the top three global markets for energy storage in the coming decade, Dr Walawalkar said, with IESA having recently published its VISION 2030 report on how the country can get there.

There remains a lot of work to be done, but the NTPC and SECI tenders will be among the key developments in the next 12 to 18 months, according to the IESA president.

Challenges ahead

However, while a successful and timely staging of the tenders would likely be transformative in informing how future procurements could be held, there are a few challenges ahead, according to the IEEFA and JMK experts.

Due to the nascent stage of development of ESS technology in India, those challenges include technical, regulatory and procurement issues.

One example is that the NTPC tender requires energy storage with six-hour duration. However, the report said, batteries are not really economically viable beyond the four-hour duration mark, while new PHES resources have lead times too long to be able to compete.

There is also some ambiguity in the regulation of energy storage assets. In India’s Electricity Act law, in place since 2003, storage is not defined as a standalone asset.

“Thus, taxation of such assets might create a few regulatory hurdles, especially until the formulation of a national ESS policy,” JMK Research associate and report co-author Akhil Thayillam said.

Another important point regards the ability of energy storage, particularly batteries, to deliver multiple different services and benefits, from renewable energy integration and supply to applications that support the operation of the grid.

The report took as a case study an existing large-scale battery project in the UK to show how this could work, providing revenues from multiple value streams and offering some degree of certainty to investors.

The report recommended that tender design should be flexible and consider the potential for a variety of business models, while also recognising that different technologies may be suited to different applications. It is also likely that tenders will need to be designed specifically to support local manufacturing, perhaps with domestic content requirements.

In our recent webinar, Dr Rahul Walawalkar highlighted that the ancillary services market is not yet really open for batteries to compete in. This could be a relatively shallow but important market opportunity going forwards, Walawalkar said.

SECI general manager Dr Bharath Reddy also participated in the webinar and gave further details on the corporation’s own tender, as well as learnings from various other deployments and investments the group has made.

Alongside that, market analyst Rachel Loquet from energy storage consultancy Clean Horizon offered some breakdowns of the figures involved in the SECI tender, including modelling on the revenues winning projects would need to be able to earn to offer a return on investment.

Read the IEEFA-JMK Research report ‘Evolution in grid-scale ESS tenders in India’ here.

Watch Energy-Storage.news’ webinar (with Clean Horizon): ‘Learn about India’s current and future business models for energy storage’ here.