The UK has found itself in a leading position among the world’s markets for battery storage, with last week’s Guest Blog from Solar Media Market Research analyst Mollie McCorkindale offering insights and putting numbers on its progress.

In this article, experts from advisory groups Lane Clark & Peacock (LCP), Apricum – The Cleantech Advisory and law firm CMS offer their take on the development of financing and investment in UK battery storage.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The British Isles are to utility-scale batteries as the Galapagos Islands are to tortoises: the isolated island home to a curious, outsize, marginal, yet instructive population. However, the somewhat faster evolution of UK BESS merits more frequent study.

In reviewing 2021, LCP’s 2022 UK BESS Whitepaper uncovered a single over-arching theme: the start of the battery storage industry’s transition from solving power to solving energy.

The long-held promise of utility-scale batteries was always energy storage, yet that was never their principal application. They sold ancillary power reserves far more than they traded energy. However, that is starting to change. And it will change how batteries are financed.

The change from power (often discussed as ancillary services, and a “MW” focus) to energy (a.k.a. arbitrage and “MWh”) is subtle, but unmistakeable. The shift is observed in two dimensions:

- Revenues

- Duration

Revenues

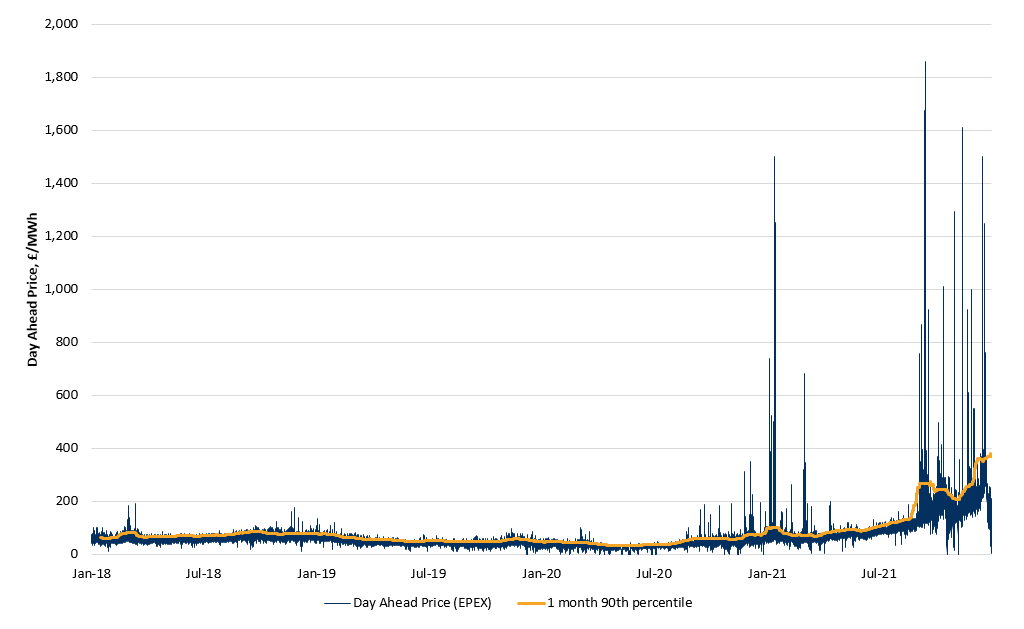

The de facto trading strategy for most of 2021 was to sit in Dynamic Containment (DC) and collect a steady revenue of £17 (US$22.40)/MW/h. An intraday price spread of £408/MWh would have been required to justify exiting DC arbitrage markets (assuming 1 cycle per day).

At the start of 2021, that seemed improbable. Yet it took just 6 days for this to happen, and ultimately 2021 saw 23 days where batteries could have (and did) outperform the DC cap through wholesale arbitrage.

The tailwinds underpinning these trading opportunities are growing stronger.

First, price spreads will increase as the system decarbonises, particularly on days where low prices are set by renewables and high prices set by gas.

Second, arbitrage opportunities become more frequent as wind dominates the shape of residual demand, driving further volatility.

Third, absolute price spreads also increase with rising gas prices due to the ranging efficiencies of gas plant in the merit order, and newspapers frequently remind us how susceptible gas prices are to severe spikes (which seem set to continue following Russia’s invasion of Ukraine).

Duration

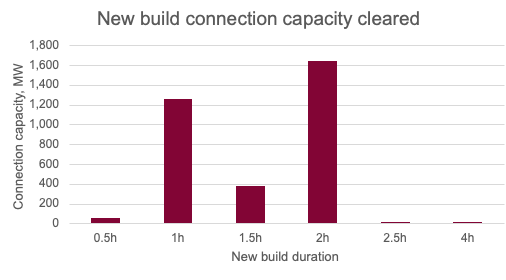

The lifting of the 50 MW planning restrictions, and the growing focus on transmission opportunities, mean planned project MW capacities should have surged. Indeed they have. But planned MWh is outgrowing planned MW. This manifested itself most strongly in the recent T-4 Capacity Market results, with a clear market shift to investing in longer duration batteries: fully 50% of cleared new build battery capacity was two hours or longer.

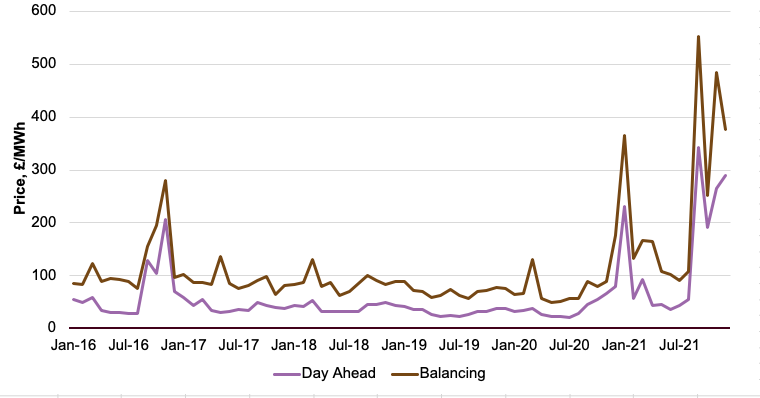

Such additional project cost can only be justified if the revenue opportunity from the sale of energy has increased. That is visible in both LCP’s forecasts for higher future Balancing Mechanism (BM) and intraday volatility, and the historic data for 2021, with extraordinary spikes in January 2021 and September through to December (Fig. 1).

LCP’s back-tested data shows the excess returns that longer duration installations now deliver due to the deeper wholesale opportunity: £60/kW pa for 2 hours eclipses £34/kW pa for 1 hour. There is excitement about the recent re-engagement of storage projects in the BM.

However, one aspect is frequently overlooked. Batteries are competitive with gas peakers in the BM due to peakers’ high feedstock costs: gas prices.

These reflect more cyclical than structural factors, meaning a future reversal is likely to some degree. Little analysis has yet been published on the link between gas prices and BESS revenues, but it cannot be questioned.

However, even if gas prices moderate, batteries should remain more active in arbitrage this year for a second reason: ancillary saturation.

Some already forecast this to be a defining feature of 2022 (e.g. Enhanced Frequency Response expiry, Dynamic Containment Low Frequency reduction, smaller Dynamic Regulation and Dynamic Moderation markets replacing Firm Frequency Response).

As competition grows in these shallow markets, arbitrage opportunities will set the effective price of ancillary provision through its opportunity cost, sealing arbitrage as the key focal area for batteries.

Funding

The funding model for UK BESS is in flux.

BESS 1.0

Even as recently as 2020, BESS investment equity was scarce, forcing under-equitised project developers to seek debt funding at almost any cost.

Efforts to bang a square project finance peg into a round merchant hole, resulted in the bankable ‘floor-price off-take contract’ model, which did little to enhance returns. But it got projects built.

BESS 2.0

As awareness and installations grew, making track record demonstrable (vs hypothetical), the availability of BESS equity and debt has increased. But not equally. UK BESS debt finance is currently dominated by just two lenders, whereas we now have an abundance of potential equity investors.

The result is that developers are no longer reliant on debt, and can eschew offtake contracts that impede project returns, provided their investors believe in the fundamental business case of merchant batteries.

Simultaneously, the offtake market improved noticeably in 2021, offering higher floors and better ceiling terms as confidence and competition among offtakers grew. This helped debt LTVs shift rapidly from below 30% to over 50% without ramping borrower spreads (albeit supported by falling equipment capital costs, which will not recur in 2022).

And crucially for developers, the nexus between lenders and offtakers improved as warranties adapted to stacked revenue models. As a result, debt is increasingly competitive as a source of funding, despite bountiful equity.

BESS 3.0?

There are several, often unclear and conflicting, implications in the shift from power to energy, which will reshape the financing of BESS projects.

- The shift to arbitrage represents a shift to a more fundamentally merchant (but no less bankable) model.

- Longer durations open up longer term bankable revenues (such as the Capacity Market and NGESO pathfinders).

- Longer durations support greater asset finance capability, so may support yet higher LTVs

- The fundamental link between BM spreads and gas prices could even create hedging opportunities that reduce funding risk.

Debt

Industry lenders have worked to create innovative and effective funding structures that are now increasingly attractive. A few future trends are likely.

First, more lenders will enter the market. Not just at the portfolio level (Gresham House 20 Sept 2021), but at the asset level too. This is as much a necessity as a probability.

As project numbers, capacity and duration increase, and lending exposure accelerates, UK BESS is over-reliant on the pioneering work of the market leading lenders, whose appetite cannot be infinite. Other participants are already eyeing entry.

Second, the blended project/asset finance model may continue to grow in sophistication. The banking industry developed sophisticated products to accommodate the merchant risk inherent in project finance of volatile commodity industries and large-scale CCGTs.

So, the expertise to enhance BESS lending products already exists, albeit elsewhere, and has not yet been integrated in BESS financing structures to enhance them.

Third, as the industry achieves critical mass, mezzanine lenders should emerge to supplement senior lending, as we have observed in the USA.

Equity

Historically, we principally saw project equity seeking seniority in distributions, but equity provision is becoming more competitive, with growing appetite for corporate equity attracted by the exponential potential of a globally scalable industry.

To date, this has principally come from overseas investors, and while that appetite has not abated, there is finally greater interest from domestic equity capital too.

A countervailing thought

The system tightness, manifest in the high price spikes observed in the balancing market and intraday pricing, has another influence, often overlooked in the current exuberance.

They are symptoms of system strain: market signals of the need for more flexible capacity in the market – including storage.

Until that need is met, and the system is less strained, batteries are a welcome solution for system operators: regulators are unlikely to impede their deployment. It is currently a cottage industry serving an acute system need. It would be a brave regulator who intervened at this stage, but that will not always be the case.

As the storage industry swells and system strain abates, re-regulation of the storage industry becomes more likely, which the BESS industry will ultimately need to navigate, and perhaps welcome.

Conclusions

Some of our expectations for the evolution of UK BESS will prove incorrect, but we have tried to highlight some key trends emerging in business model, revenues, configuration, and funding; there is also sufficient dynamism for the industry to adapt.

2021 witnessed transformational progress, but the UK BESS industry is still highly immature: its capital providers, data sources, processes and advisors are emerging. Increased maturity will reduce its friction costs, execution times and potentially the cost of capital.

We are confident of further evolution in 2022.

About the Authors

Charles Lesser is partner and head of UK at Apricum – The Cleantech Advisory. Apricum has significant expertise in equity funding and project finance advisory, as well as its strategy teams’ expertise in the industry’s evolution and opportunities.

Rajiv Gogna is partner, energy technology & analytics, LCP. LCP provides the market with data-driven, fundamentals-first, grounded forecasts that are trusted by government, NGESO and key industry players.

Louise Dalton is partner, energy & climate change at CMS, which has been advising developers and investors in relation to the deployment of energy storage in the UK (including equity and debt funding and the full suite of revenue arrangements, construction and O&M documentation) since 2016.