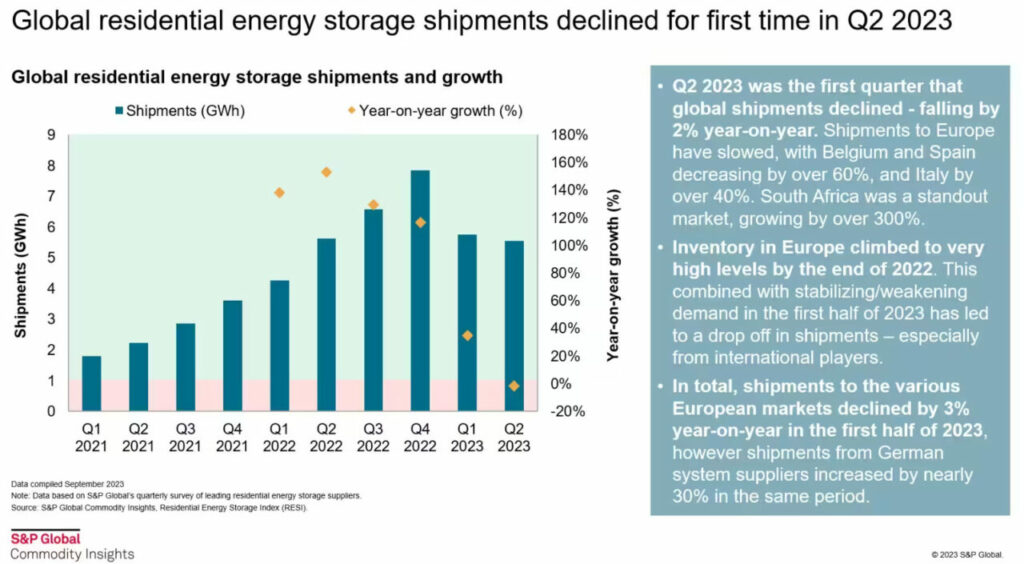

Global residential energy storage shipments fell year-on-year for the first time in the second quarter of 2023, S&P Global said, amidst less energy price volatility, high inventories and rising costs.

Shipments fell 2% year-on-year to around 5.5GWh, with a particularly slowing in Europe, although the German market continued to be strong with 30% growth in the first half of the year (versus a 3% fall continent-wide) according to S&P Global Commodity Insights.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Susan Taylor, senior analyst for S&P Global Commodity Insights, told Energy-Storage.news that the biggest driver behind the fall in demand from Europe has been a normalisation of energy prices combined with high inventory levels on the continent following high demand in 2022, a year of volatile energy prices.

“The biggest factor driving this is that electricity prices have begun to fall after increasing dramatically throughout 2022 off the back of the energy crisis. Subsidies have also been reduced in Italy, which was the largest market in 2022, and high interest rates and economic uncertainty are also reducing consumer spending,” Taylor said.

Residential energy storage systems, typically comprised of batteries, are usually used alongside a home PV system to increase energy self-sufficiency, shielding homes from high or volatile energy prices. They can also be used as part of demand response programmes, which incentivise consumers to reduce how much energy they draw from the grid at peak times.

Global residential energy storage shipments also fell quarter-on-quarter in Q1 but some seasonality may have affected this. Quarterly growth had been seen in the previous eight quarters, however, going back to Q1 2021.

Commenting on how the different factors converged to lead to the recent fall, Taylor added: “A huge surge in residential storage system shipments was seen in 2022 in response to the energy crisis as consumers turned to self-consumption to shield against high electricity bills.”

“Distributors rushed to place orders to meet soaring demand and avoid long anticipated lead times from mainland China, which was still experiencing COVID-19 restrictions in 2022. This led to oversupply, compounded by falling demand in Q1 2023 resulting in high inventory levels at the end of 2022.”

See S&P’s infographic below.

Commenting on the outlook going forward, Taylor said: “Residential storage growth in mature markets like Germany will continue, driven by a strong residential PV market and supportive subsidies. Emerging markets in Southern and Eastern Europe, including Poland, Greece, and Czechia, are also on the rise thanks to attractive subsidies and established PV markets.”

“However, short-term limitations stem from consumer spending, while longer-term growth will be driven by retrofitting existing PV systems coupled with the increasing advancements in sophisticated home energy management systems incorporating EV charging, heat pumps, and VPP (virtual power plant) access.”