Global system integrator Fluence has closed a four-year US$400 million asset-backed lending (ABL) credit facility.

The ABL is secured by the firm’s eligible inventory and other assets and replaces its existing US$200 million revolving credit facility, as of yesterday (27 November).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Fluence said the new facility improves its ability to manage working capital, significantly enhances its liquidity position and provides a more flexible solution to enhance control over inventory-related financing.

The company’s CEO Julian Nebreda commented: “We expect the enhanced liquidity to be utilised to finance our growth plan as we continue to scale globally. Our team expects to continue to build upon our market leading position in utility-scale energy storage solutions in the U.S. and worldwide, while establishing a strong foundation for annual recurring revenues from the services and digital business through our hardware solutions.”

Nebreda replaced Manuel Pérez Dubuc in September last year, a move which was said to be aimed to improving the firm’s profitability, which Nebreda appears to be doing based on its most recent released financial results. Its Q4 and full-year results for the year to September 31, 2023, will be released tomorrow (29 November).

Barclays served as Administrative Agent, Joint Lead Arranger, and Joint Bookrunner for the new facility, while J.P. Morgan was Joint Lead Arranger and Joint Lead Bookrunner.

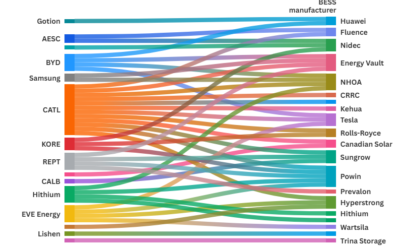

Fluence is the second-largest battery energy storage system (BESS) integrator by past projects, second to Sungrow, according to recent research notes from both Wood Mackenzie and S&P Global, while the latter pegged it as the largest in terms of installed and contracted projects.