Huawei and BYD were among the five largest battery energy storage system (BESS) integrators globally last year, with the Chinese market going through a ‘price war’ of competition, according to research from Wood Mackenzie.

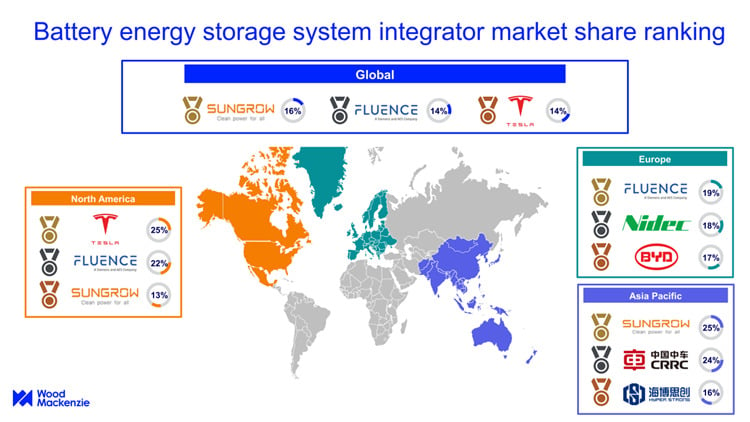

Sungrow topped the list of 2022 deployments with a market share of 16% last year, Wood Mackenzie said, followed by Fluence and Tesla, each with 14% of the market, and Huawei and BYD, each with a 9% share. The top five collectively held a 62% market share.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Fluence is a pure-play BESS solution provider controlled by utility AES and technology firm Siemens, while Sungrow is primarily an inverter manufacturer. Huawei is a technology firm, while BYD and Tesla entered the BESS market from their position as leading EV manufacturers.

The top five system integrators differs slightly to that put out by S&P Global recently as it only considers 2022 deployments, while S&P’s top five of, in order, Sungrow, Fluence, Tesla, Wärtsilä and Hyperstrong was based on cumulative installations to-date as of July 2023. Wärtsilä is a power solutions firm, which, it emerged today, may divest its energy storage business, while Hyperstrong is a China-based system integrator.

The US market meanwhile was more concentrated than the global one last year, with Tesla (25%), Fluence (22%) and Sungrow (13%) making up the top three holding a collective 60% market share, and the top five holding 81%.

An increasingly competitive market

Wood Mackenzie’s note corroborates S&P’s observation that Chinese companies are gaining market share in the global BESS space, which Wood Mackenzie called “increasingly competitive”.

This competition is particularly pronounced in China, Kevin Shang, senior research analyst at Wood Mackenzie said, where the market has effectively commoditised.

“China’s integrator market is becoming increasingly competitive, squeezed heavily by both upstream and downstream supply chain participants. Possessing manufacturing capacity on key components, like cell, PCS, BMS and EMS, tends to be a necessity rather than a plus as bid requirements for energy storage projects become more detailed and stringent,” Shang explained.

“The price war among system integrators has started in China. We’ve observed an increasing number of players willing to sacrifice profits in exchange for market share, dragging down the profitability of the whole industry. However, we forecast that aggressive bid strategies with little margin will not be sustained. Intensifying market competition will make it difficult for companies with low profitability and no clear competitiveness to survive over the coming years.”

S&P attributed strong growth in the Chinese domestic energy storage market to companies based there gaining a foothold in the global market. In comments provided to Energy-Storage.news after we covered their rankings release, S&P Global Commodity Insights’ senior analyst Anqi Shi suggested this could impact the global storage industry.

“The oversupply and fiercely competitive market that we foresee is actually a global issue,” said Shi. “Annual energy storage installations in China grew by 400% in 2022, and will more than double again in 2023 to reach 18 GW. This is supporting the growth of many local system integrators.”

“In fact, we found eight Chinese system integrators each with total pipelines (installed plus contracted) of over 1GWh. Many of these system integrators are using this as a platform to expand internationally, heating up competition in the market.”

“In addition, throughout 2023 we have seen aggressive energy storage system manufacturing capacity announcements, partly to a bid to localise production and also to drive scale. As a result, system manufacturing capacity will far outstrip demand in the coming years.”

Energy-Storage.news has been told anecdotally that BESS price drops in 2023, confirmed by Clean Energy Associates (CEA) in a recent report, can be attributed to oversupply from China-based providers.

CEA said in its report, covered by us yesterday, that the incentives under Inflation Reduction Act will make US-made BESS, within specific parameters, cost-competitive with those from China.