The US Department of Energy (DOE) Loan Programs Office (LPO) has committed US$504 million to a 300GWh hydrogen storage project in Utah and another US$107 million to a battery graphite production facility in Louisiana.

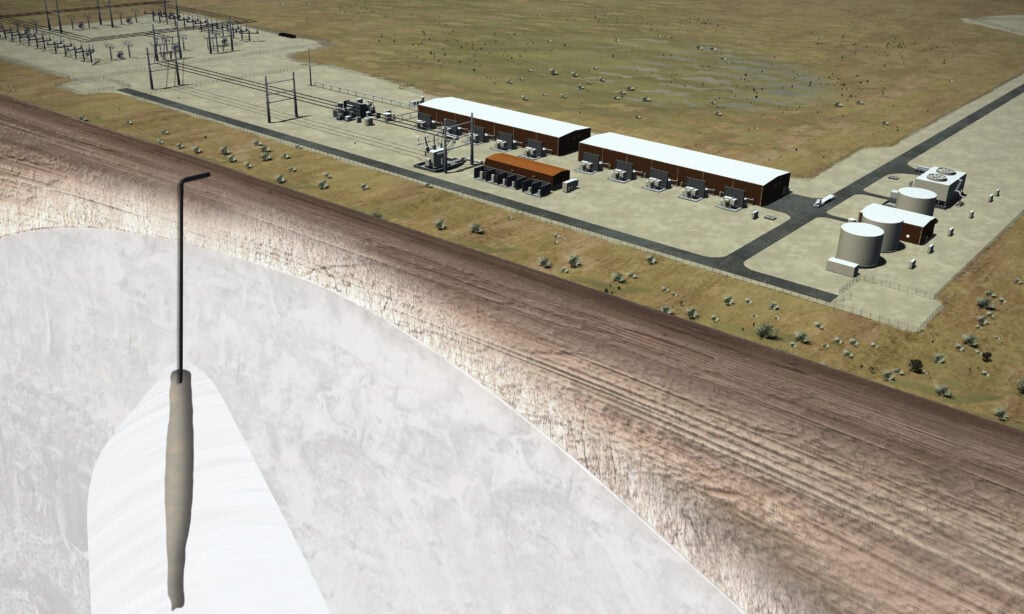

The DOE has offered a conditional commitment for a US$504.4 million loan guarantee to the Advanced Clean Energy Storage Project in Delta, Utah, which broke ground this Spring and has several backers and developers including Mitsubishi Power Americas.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It was invited to apply for a loan last year shortly after the LPO was re-opened, having lain dormant during the Trump years.

Renewable energy will be converted through 220MW of electrolysers into up to 100 metric tonnes of green hydrogen a day when the project is completed in 2025. This will be stored in two huge salt caverns with a combined storage capacity of 300GWh.

The facility will supply the stored hydrogen to Intermountain Power Agency’s IPP Renewed Project, an 840MW combined cycle power plant also in Delta, powering 30% of the plant at its concurrent 2025 launch with plans to increase to 100% by 2045. However, in a recent interview with Energy-storage.news, Mitsubishi Power America’s Thomas Cornell said that could happen as early as 2030 or 2035.

“The Los Angeles Department of Water and Power (LADWP) is one of the anchor tenants of the IPP Renewed facility, which will be on a DC line. The plan is, with all the curtailed renewables on that DC line, to move power into Utah to make the hydrogen and then during times that they need the excess power, to then take that power from Utah and ship it back to to Southern California,” Cornell said.

The green hydrogen hub is the largest planned globally and its proximity and connection to California, with its huge solar pipeline, is unsurprising considering large-scale green hydrogen needs substantial renewable power sources. The technology is at an early stage of commercialisation which makes commercial bank debt financing hard to come by. Premium subscription users of Energy-storage.news’ sister site PV-tech can read an analysis paper on the topic here.

The hydrogen hub has secured offtake agreements and all major contracts with engineering, procurement and construction (EPC) contractors, major equipment suppliers and operations and maintenance (O&M) providers, Mitsubishi Power said. Haddington Ventures is raising US$650 million from investors to help fund the project.

Black & Veatch is providing EPC services for the energy conversion facility while Mitsubishi Power is providing the hydrogen equipment integration including electrolysers, gas separators, rectifiers, medium voltage transformers, and distributed control system. NAES Corporation will provide O&M services while WSP handle EPC management services for the development of two salt cavern storage facilities.

The DOE LPO has also offered a conditional commitment of US$107 million to Syrah Technologies to expand its Syrah Vidalia Facility in Louisiana. The facility produces graphite-based active anode material (AAM) for EV batteries and has secured an offtake agreement with Tesla for the majority of its output.

It expects the expansion to enable the facility to produce enough AAM for 2.4 million EVs by 2040.

The commitment is the first from the LPO’s Advanced Technology Vehicles Manufacturing (ATVM) program in more than a decade. The DOE said it builds on Biden’s recent enactment of the Defense Production Act to secure critical materials for batteries including graphite.