Developer Solvent Energy is talking to investment bankers with a view to selling some of a 2.5GW portfolio of battery energy storage system (BESS) projects in ERCOT, Texas.

The 2.5GW portfolio comprises 13 standalone 2-hour BESS projects mainly in the ERCOT West, North and South regions with West seeing the greatest price volatility due to a high renewable generation portfolio.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Solvent, which counts Switzerland-based family investment firm JC Mont-Fort Holding as a shareholder, will keep some of the projects through to construction and operation but plans to sell others in tranches of 300-500MW, and is in early stage discussions with banks to do so.

A spokesperson told Energy-Storage.news that all 13 qualify for the 10% ‘energy community’ adder to the investment tax credit (ITC), with counties qualifying based on historic reliance on coal or fossil fuel sectors for employment.

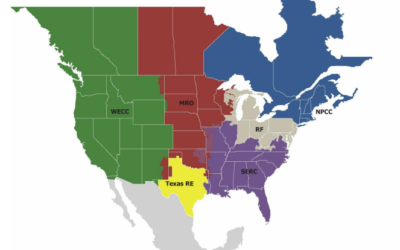

The US Department of Energy (DOE) has released an interactive map showing all of them here, which shows the majority of Texas qualifies.

The projects are expected to have signed interconnection agreements with grid operator ERCOT in July or August next year, which likely means a commercial operation date (COD) in the first half of 2026 based on the necessary time to make and complete transmission infrastructure investments, they added.

The ERCOT BESS market is taking off as investors look to capitalise on significant opportunities in the ancillary service market and wholesale energy trading with the ERCOT market among the most price volatile in the world.

Early-stage developers have been busy marketing portfolios to sell to long-term owners or later-stage developers, including Hexagon and Granite Source Power, the latter of which discussed its projects with Energy-Storage.news in July.

The prices that buyers of projects are willing to pay has come down in the past year, however. Renewable energy project M&A platform LevelTen Energy said that buyers are now exhibiting a more balanced and disciplined approach with longer-date projects more highly scrutinised with interconnection delays and long lead times particularly affecting acquisition interest, as well as interest rate headwinds.

Solvent Energy is expecting a conservative valuation for project deals in ERCOT, of 7-9% of Capex for a 100MW ready-to-build project equating to 5.95-7.65 US$ cents per Watt or US$59,500 to US$76,500 per MW.

Solvent also has solar-plus-storage projects in addition to the portfolio, two of which are close to the ready-to-build (RTB) stage, the spokesperson added. JC Mont-Fort lists two in Texas on its website, one combining 200MW PV and a 200MWh BESS and another pairing 300MW PV and a 300MWh BESS.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.