Some 710MW of battery storage came online in the US in the first three months of the year, of which around 70% was in the ERCOT, Texas market, S&P Global said.

Overall battery storage capacity in the US grew to 10.777GW by the end of Q1 2023, amounting to a 52% year-on-year increase, the research firm said.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The growth should have been even faster, however, with 2.448GW of projects initially proposed to come online during the first quarter, compared to the 710MW in actual commissionings, S&P added.

Major projects that should have come online but were pushed to Q2 include the 260MW Sonoran Solar Energy and 150MW Arroyo Energy Storage, from NextEra Energy Resources and Enel Green Power in Arizona and New Mexico, respectively.

Battery storage project delays have been seen globally, largely driven by grid connection waits and supply chain-related delays.

The Q1 deployment figures contrast with those of trade body American Clean Power Association, which said that Q1 battery storage additions totalled 461 MW/1,075 MWh in Q1, down 32% year-on-year. Energy-Storage.news covered the trade body’s full-year 2022 figures last week here.

Some 498.6MW came online in the ERCOT, Texas market, just over 70% of the 710MW figure. The Western Electricity Coordinating Council grid, which covers the whole western US including California, saw 115MW came online, 17% of the total.

As of the end of the quarter, California (or specifically the grid operated by CAISO) now has 5.2GW online, 48.2% of the US’ total capacity, while ERCOT’s 3.287GW gives it a 30.5% market share. By MWh capacity, CAISO’s share is even larger, with two-thirds of the 29.640GW online.

S&P’s research also listed the largest projects to have come online during the first quarter. They were:

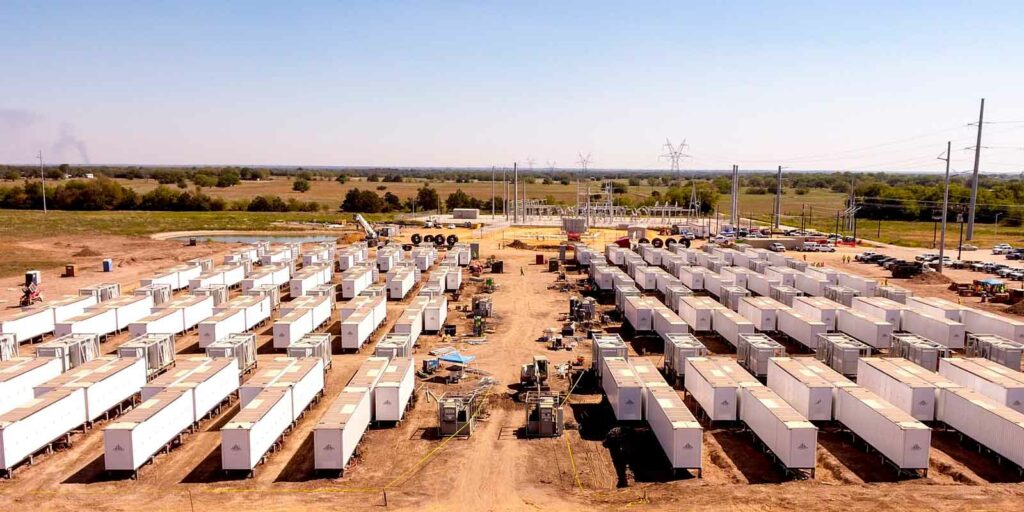

- Acciona Energy North America’s 190-MW BT Cunningham Storage in Texas

- Aypa Power Development’s 155.5-MW Wolf Tank Storage facility in Texas

- Key Capture Energy’s 51.5-MW KCE TX 19 facility in Texas

- Key Capture Energy’s 51.5-MW KCE TX 21 facility in Texas

- NextEra Energy Resources’ 50-MW Buena Vista Energy Center facility in New Mexico

- Arizona Public Service’s 50-MW El Sol BESS facility in Arizona

For Q2, S&P said 3.177GW of projects are expected to come online, of which 51% would be in the CAISO grid and ERCOT accounting for just 6.3%, with 200MW coming online.

When Acciona acquired the Cunningham project in late 2022 it claimed it would be the largest BESS on the Texas grid when commissioned.

That title may now be held by a 200MW project brought online by developer Eolian and system integrator Wärtsilä which Energy-Storage.news was told has an energy storage capacity in MWh of over 500. However, it is actually two co-located BESS units sited together with separate grid connections.

S&P also details the largest project owners by operational capacity. They are NextEra Energy Resources top with 1.421GW online, followed by Axium Infrastructure with 733MW, Vistra Energy with 673MW, LS Power with 615MW and Terra-Gen with 581MW.