Research firm Wood Mackenzie has released its latest BESS supply rankings list for 2024, which it said shows “intensifying regional competition and shifting market dynamics” as Tesla retained its top spot.

The research finds Tesla as the largest battery energy storage system (BESS) supplier by shipments for the second year in a row, with a global market share of 15%.

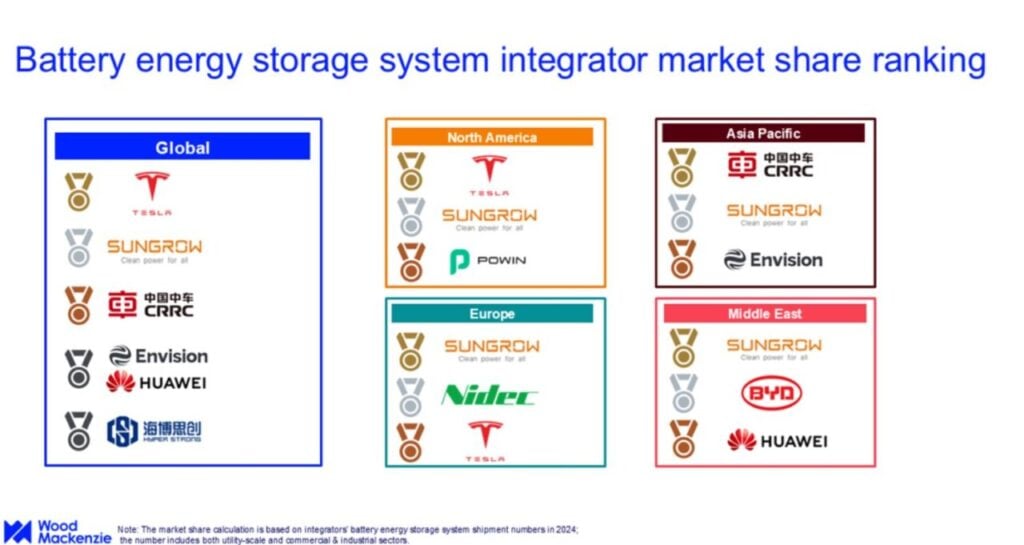

As with the 2023 figures, which Energy-Storage.news covered at the time, China-based inverter and BESS firm Sungrow was the second-largest. But it closed the gap on Tesla, going from a market share of 11% in 2023 to 14% in 2024. Third place CRRC, a Chinese state-owned firm specialising in train infrastructure, had a market share of 8%. Envision and Huawei are joint-fourth, followed by Hyperstrong.

Principal research analyst at Wood Mackenzie Kevin Shang, author of the report, told Energy-Storage.news that the report shows “incredibly tense” competition among BESS integrators but significant differences across regions, and an overall increase in market share of Chinese companies. They now make up seven out of the top ten globally.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Overall, the market remained at about the same level of consolidation as last year, with the top three providers increasing their share by 1% but the top five’s remaining the same.

“Seven of the top ten vendors last year struggled to expand their market share, remaining either unchanged or declining,” Shang said.

“The global BESS integrator landscape is becoming increasingly complex, with regional trade policies and geopolitical tensions reshaping competitive dynamics,” Shang said.

“While Tesla maintains its global leadership, the rapid rise of Chinese integrators in Europe and their dominance in emerging markets like the Middle East signals a fundamental shift in the industry. Success will increasingly depend on companies’ ability to navigate diverse regulatory environments, adapt to local market requirements, and maintain competitive cost structures across multiple regions.”

Tesla and CATL remain the only BESS suppliers with a AAA bankability rating in Solar Media Market Research’s Battery StorageTech Bankability Ratings report. Sungrow and CRRC score well, but their lack of cell manufacturing gives them a lower manufacturing score, analyst Charlotte Gisbourne said. Sungrow did temporarily join them as AAA-rated, but has since gone down in score in response to market conditions.

Regional differences: Sungrow soars to Europe’s largest

The growth in China-headquartered companies was particularly seen in Europe, where they increased their market share by 67% year-on-year and now make up four out of the ten largest suppliers.

Sungrow led this charge, doubling its market share from 10% in 2023 to 21% in 2024 to become the largest supplier, followed by Nidec and Tesla.

Market consolidation fell in Europe, going from 86% held by the top five to 70%.

US-China tensions appear to have had an early impact, Tesla remains largest

Chinese firms saw opposite fortunes in North America, where their market share fell from 23% to 16%, mainly due to escalating US-China geopolitical tensions and trade barriers.

Tesla remained the largest player with a 39% market share. Sungrow was second, but its share fell from 17% to 10% while Powin, which has just been acquired out of bankruptcy by peer FlexGen, was the third-largest. Overall market consolidation fell in North America too, going from 90% for the top five to 73%.

In mid-2024, the US tripled tariffs on Chinese battery products, effectively immediately for EVs and from 2026 for BESS. Since taking office at the start of 2025, president Trump has gone much further. The current effective rate on Chinese batteries is around 41%, and further increases have been prevented by today’s announcement of another 90-day tariff truce while negotiations continue.

While the tariffs won’t have immediate or direct effects on shipments in 2024, the direction of travel towards increase trade barriers and anti-China legislation had been clear for some time.

“In the US, there has been a clear trend towards procuring more locally manufactured BESS, primarily due to escalating US-China geopolitical tensions and increased US trade protectionism,” Shang told us.

Shang also said that there is also an increasing trend to non-price factors in BESS procurement, possibly also related to domestic manufacturing.

“Price remains an important factor in BESS procurement process. However, in the US, now also in Europe, an increasing number of companies have gradually given more weight to non-price factors,” he said.

Asia and the Middle East

In Asia, Chinese companies cemented their dominance of the region with a 90% market share, and the top three were CRRC, Sungrow and Envision.

One big story to have emerged in the last 12-18 months is the Middle East’s position as a huge market for BESS, going from virtually nothing to having some of the largest projects anywhere in the world and a forecast 31GW/115GWh online by 2034. Sungrow, BYD and Huawei have dominated the nascent market, Shang said.

Chinese companies’ aggressive expansion into overseas markets, particularly Europe and the Middle East, has partly been driven by intense competition in the domestic market. This trend was first noted in late 2023, in reports put out by Wood Mackenzie and another research firm S&P Global.

“Established BESS integrators keep fighting for the market share severely. Almost all the leading BESS integrators said to me they would deliver more in 2025 and climb higher in our ranking next year,” Shang concluded.