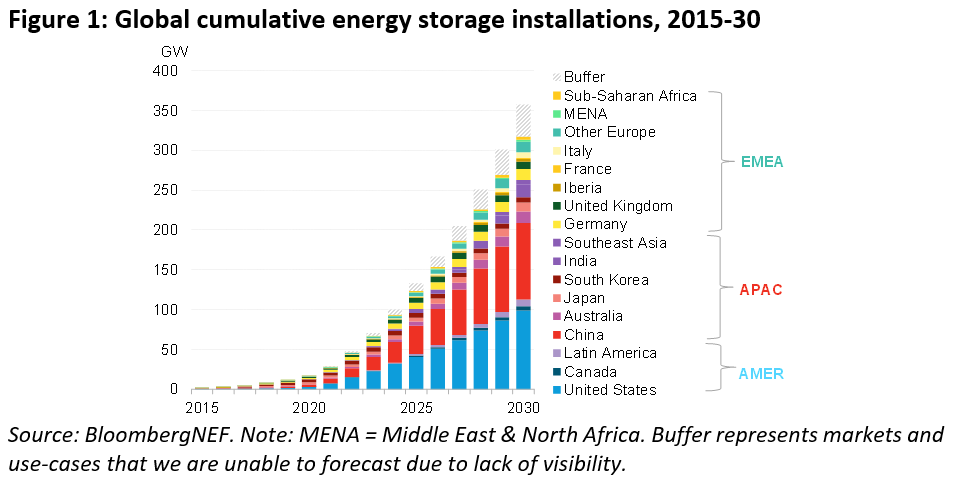

The 2020s are “the energy storage decade,” and the world will surpass a terawatt-hour of installations by the time they are over, according to predictions made by analysts at BloombergNEF.

From 17GW / 34GWh online as of the end of 2020, there will be investment worth US$262 billion in making 345GW / 999GWh of new energy storage deployments, with cumulative installations reaching 358GW / 1,028GWh by 2030, the firm forecasts in the latest edition of its Global Energy Storage Outlook report.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“This is the energy storage decade. We’ve been anticipating significant scale-up for many years and the industry is now more than ready to deliver,” BloombergNEF head of decentralised energy Yayoi Sekine said.

Just over half of that new capacity will be built to provide energy shifting, storing surplus solar and wind generation for dispatch to the grid and to be used when it’s most needed at a later time. This is already being seen in the growing popularity of renewable energy-plus-storage projects, particularly solar-plus-storage.

While large-scale, front-of-the-meter energy storage is likely to dominate those capacity additions, about a quarter will be deployed at residential and commercial & industrial (C&I) scale, with consumers seeking both higher shares of renewable energy integration and the back up power capability that energy storage can provide.

BloombergNEF believes that as things stand, energy storage as a means to defer investment in more expensive grid infrastructure may remain marginal as an application in most markets through to 2030. However, the removal of regulatory barriers and the introduction of incentives for networks owners to consider energy storage as an alternative to traditional infrastructure investment could change that dynamic.

It’s the rapid evolution of battery tech which drives the energy storage market, according to BloombergNEF. Multiple lithium-ion battery chemistries are being adopted by the industry, with lithium iron phosphate (LFP) set to overtake nickel manganese cobalt (NMC) for stationary storage applications for the first time in 2021.

LFP will continue that upward trajectory and be the main chemistry of choice for the decade, but BloombergNEF said it’s worth keeping an eye on new developments like sodium-ion — which Chinese manufacturer CATL is currently working to commercialise. Sodium-ion could play a “meaningful role” as a contender to lithium, the firm said.

Batteries will dominate over non-electrochemical storage technologies that could theoretically offer practical solutions to the question of storing energy for longer durations, BloombergNEF said, at least until the 2030s. Competitive advantages such as price, established supply chain and track record will be among the factors keeping that the case. No mention was made of the many non-lithium battery technologies besides sodium-ion, in a press release sent to Energy-Storage.news.

US and China will be biggest markets

Another market research group, Wood Mackenzie Power & Renewables, made a similar installation forecast in October when it published its own Global Energy Storage Outlook report, saying that a “surge” in installations would take total demand for energy storage to close to 1TWh worldwide this decade.

Both Wood Mackenzie and BloombergNEF also predicted the US and China will dominate the global market, installing more than half of all new storage by 2030. In the US, utilities and state governments are showing a growing appetite to drive energy storage deployment forwards, while in China, a 30GW by 2025 deployment target is a major driver, as are stricter rules on renewable energy integration on the grid.

“The global storage market is growing at an unprecedented pace,” the BloombergNEF report’s lead author Yiyi Zhou said.

“Falling battery costs and surging renewables penetration make energy storage a compelling flexible resource in many power systems. Energy storage projects are growing in scale, increasing in dispatch duration, and are increasingly paired with renewables.”

Other regional markets to watch out for include India, Australia, Germany, the UK and Japan, BloombergNEF said, with common drivers like supportive policies, commitments on climate and the growing need for flexible energy resources likely to drive deployments in each.

The Europe, Middle East and Africa (EMEA) region lags behind Asia-Pacific and the Americas, which the analysis group highlighted as being perhaps surprising due to the strong climate targets set in Europe in particular. However if the energy transition picks up pace in EMEA with the growth of renewables and retirement of fossil fuels, as well as localisation of battery supply chains, there could be acceleration in the energy storage market there, too.

The Asia-Pacific region is going to deploy more megawatts of storage, but the Americas more megawatt-hours: projects in the Americas tend to be longer in duration of storage, BloombergNEF said and this dynamic will continue throughout the decade.