US national energy laboratory Lawrence Berkeley Laboratory (Berkeley Lab) has released its top 10 findings from a research programme into renewable projects that pair generation with energy storage, so-called hybrid projects.

The research into the growing trend of hybridisation, or colocation, has been carried out in order to better understand where batteries should be located to provide the highest value, according to Will Gorman, Graduate Student Researcher in the Electricity Markets and Policy Department. Gorman wrote about the earlier stages of the study in a piece for Energy-storage.news last year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The first trend Berkeley Lab noted in its report is a growing developer interest in hybrid power plants, which the research defines as a combination of generation and storage, operated either as a single or two separate units and sited at the same location. It excludes non-battery storage technologies and virtual hybridisation.

The report said cumulative operational capacity increased by 133% from 2020 to 2021, by the end of which there were more than 8GW of PV or wind hybrid plants online. It said 42% of PV in interconnection queues is paired with storage while only 5% of wind is.

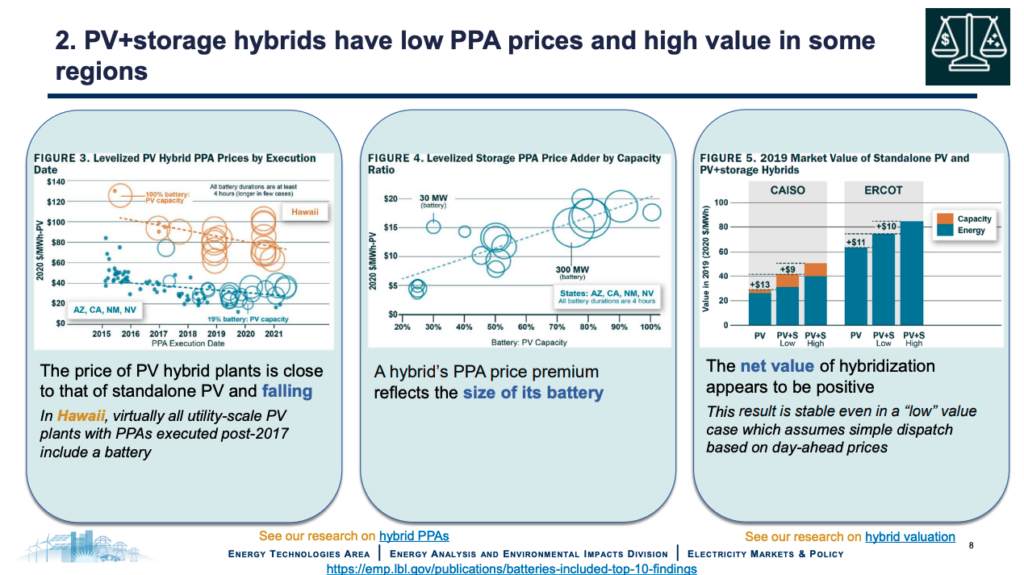

The research also found that a hybrid project power purchase agreement (PPA) price premium reflects the size of its battery, with a positive correlation between the price per MWh and the battery’s PV capacity (i.e. size relative to the PV plant). Overall, the net value of hybridisation appears to be positive, it added.

The hybridisation trends is driven by the availability of the investment tax credit (ITC) for energy storage, but only applies when it is deployed together with storage and the batteries charge directly from the onsite solar PV at least 75% annually. This effectively reduces the overall project cost by 30% if pairing with storage, but it is not the only reason for hybridisation, Berkeley Lab added. Sharing of equipment and interconnection and permitting costs, capturing clipped energy and facilitating intraday energy shifting are other reasons.

Interestingly, market prices have incentivised shorter duration batteries with PV of between one and four hours.

The report’s fifth finding was that the capacity contribution of a hybrid is less than the sum of its parts, as shared infrastructure can limit the contribution of a hybrid project’s constituent components.

This is something that was touched on in a recent interview Energy-storage.news did with Gabe Murtaugh, storage sector manager for the California ISO (Independent System Operator), who challenged the rationale of the tax credit mentioned earlier.

He said: “‘The investment tax credit for storage resources located with on-site storage is challenging for the ISO. It does not incentivise full storage participation in the organised energy markets, but instead incentivises charging only when there is generation from the on-site solar resource. If the ISO needs to charge a battery during the night for grid reliability during the morning ramp, it may not be able to because of these rules.”

“When this is applied to most storage resources on the grid, it threatens reliability. The ISO supports incentives to build storage, but also wants to ensure that these resources can be fully utilised once they are operating in the market.”

Indeed, the research’s eighth finding is that the power system value of hybrids depends on their operation and not all large-scale PV-plus-storage hybrids are integrated into organised markets. It said most operating hybrid projects in 2020 either followed incentive program signals or capacity & transmission demand charges instead of wholesale market price signals.

What’s more, behind-the-meter storage to maximise solar self-consumption through things like net-billing tariffs provides “little market value for the electric system,” it added.

Berkeley Lab’s research also concluded that ancillary services are a valuable yet fleeting option for hybrid projects. Those ancillary service markets are relatively shallow compared to the proposed volumes of battery projects in interconnection queues.

Developer preference for operating the assets separately or as a single asset are also mixed, with the separate strategy currently the most popular in California. The report said that regulators should try to maintain this flexibility in order to spur innovation.

Its penultimate conclusion was that there are big opportunities to pair storage with customer-sited PV. Roughly 30% of US battery storage installed in 2020 was behind-the-meter but only 6% of residential and 2% of non-residential PV systems include storage. The ‘Attachment rates’ is much higher in Hawaii at 80%. The report concluded with the statement that hybridisation’s relative novelty means further research into it is needed.