In the US, there is a growing trend for battery storage systems to be directly paired with onsite wind and solar generation, creating hybrid resources. Will Gorman from Lawrence Berkeley National Laboratory looks at when and where this configuration makes sense — and why sometimes it doesn’t.

This is an extract of an article which appeared in Vol.28 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Meeting the demands of the electricity system with growing wind and solar requires greater balancing due to their inherent variability. While this is typically done at the network level, using dispatchable power plants, demand response, and other techniques, developers are seeing some advantages to integrating batteries on-site, potentially allowing the wind or solar plant to look more like a conventional power plant.

Solar projects can use batteries to shift generation from the day to the evening, to capture higher power prices as the sun goes down. Wind projects can use batteries to smooth power output and avoid congestion. As battery prices continue to fall and the penetration of variable wind and solar generation rises, power plant developers are increasingly turning to these “hybrid” power plants.

By the end of 2020, roughly 70 solar-plus-storage power plants were in operation in the United States, representing almost 1GW of solar and 250MW of battery capacity. This compares to 14 wind-plus-storage projects with 1.4GW of wind and 200MW of battery capacity installed.

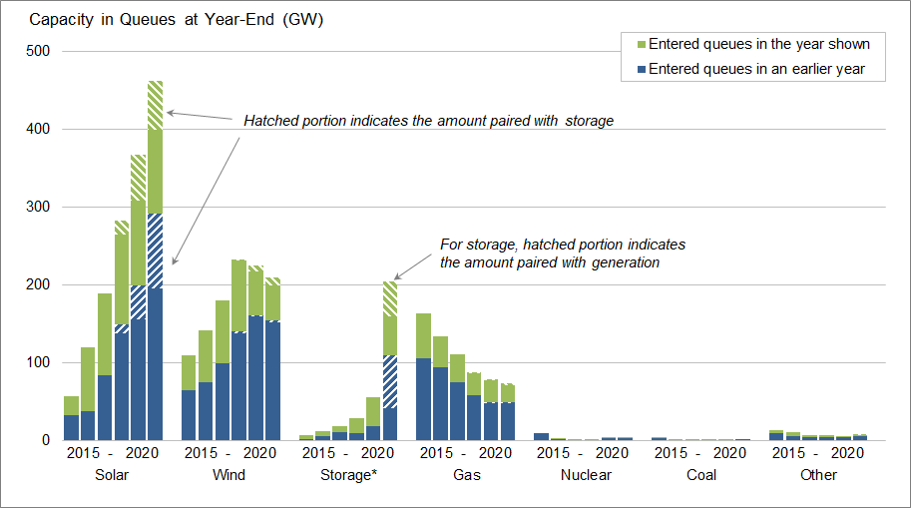

But developers are proposing a massive increase in the number of hybrid plants. Looking at the major power plant interconnection queues in the United States, we found 160GW of solar and 13GW of wind being developed with co-located batteries, amounting to almost 34% of solar and 6% of wind currently in the queues. (Figure 1 below).

In the western US the percentages are even higher, with 70%–90% of proposed solar paired with storage, including almost all grid-scale solar projects in California. Almost two-thirds of all grid-connected batteries in California are part of hybrid solar-plus-storage systems. In other regions, the share is typically less than 40%.

While wind and solar plants are located to take advantage of strong winds and sunshine, with plentiful land and good grid connections, batteries can be put practically anywhere. In high-value locations they can provide multiple values to the local grid, such as voltage support, congestion relief and resilience. With the right controls they can also provide system-wide benefits, such as capacity and load following.

If developers are co-locating batteries with wind and solar plants, it raises some questions:

- What are the benefits of co-location,compared to optimal siting for gridservices?

- What are the relative cost savings?

- And how valuable are the opportunities developers might be missing?

Our research team at Lawrence Berkeley National Laboratory (Berkeley Lab) has been studying this hybridisation trend in order to better understand where batteries should be located to provide the highest value. We aimed to understand whether renewable-plus-battery power plants provide more value than independently sited installations.

In the process, we uncovered explanations for why commercial activity of hybrids is higher in the western US as well as for solar rather than wind technologies.

Our answers point to strategies that can be used to understand the renewable transition and therefore have important implications for an electricity system aiming for higher levels of renewable energy.

To hybridise, or not to hybridise?

The growth of hybrids is, in part, being driven by significant declines in project costs. Power purchase agreement (PPA) prices for hybrid power plants have plummeted in recent years, with declining costs for wind, solar and for batteries. Based on contract price information for 50 solar-battery hybrid projects, we found that prices have fallen for mainland US projects from US$40-70 per MWh in 2017 to US$20-30 per MWh in 2020. In Hawaii, per MWh prices have dropped from US$120 in 2015 to US$80 by the end of 2020.

These PPAs also shed light on how hybrid developers are choosing batteries to pair with their generators. Simply put, the larger the battery, the larger the cost. We found that the cost of adding a four-hour duration battery at a utility-scale solar project ranges from US$5 to US$20 per MWh, depending on the battery to PV capacity ratio. Lower ratios (25%-50%) have smaller storage adders (US$5-10/ MWh) and higher ratios (75-100%) have higher storage adders (US$15-20/MWh).

However, by co-locating the generators and batteries at a single site, project developers see cost savings by sharing equipment, cutting interconnection and permitting costs, capturing otherwise clipped energy, and taking advantage of federal tax credits that encourage coupling solar and batteries. Furthermore, batteries have greater dispatch flexibility, making them more attractive for grid operations.

There can also be a corresponding value boost from pairing a storage unit with a renewable energy generator. Using wholesale power market prices at utility-scale wind and solar locations from 2012–2019 across the seven main US independent system operators (ISOs), we found that co-locating a 4-hour battery with a 50% battery-to-renewable capacity ratio can add value ranging from US$3 to US$22 per MWh, depending on the year and market region being studied, with an average value boost of US$10 per MWh.

The greatest value came from the California market (US$22/MWh) where, thanks to a high penetration of solar (20% of energy in 2019), California is seeing low net load in the day, with a large ramp in the evening hours, as the sun goes down – a phenomenon known as the ‘duck curve’. Prices have begun to correlate with this trend, so using hybrid technologies to mitigate the duck curve can bring in more revenues. The US$20/MWh value boost resulting from adding storage in California is double the US$10/MWh storage cost adder we found in PPA prices.

On the other hand, the power market in the Midwest (MISO) has a significantly lower value boost from storage (US$4-US$5 per MWh), which does not offset the US$10/MWh storage cost adder. So far, we have seen less hybrid development activity in these low value regions.

There are additional complications to hybrid development, including policy and market designs. In the US, only batteries that charge from renewable resources can take advantage of a 30% tax credit.

If this tax credit expires or is expanded to standalone batteries, hybrid projects would lose this special advantage. Though by charging only from their co-located generators, batteries may be unable to offer their full flexibility to power markets.

Constraints on hybrid market value

To understand the significance of these hybrid constraints, we compared the market value of hybrid projects to the value of the same generators and batteries deployed separately.

To do this we expanded our wholesale market value analysis to cover market prices across all nodal prices points in the seven main US independent system operators (ISOs) rather than just market prices at utility-scale wind and solar locations.

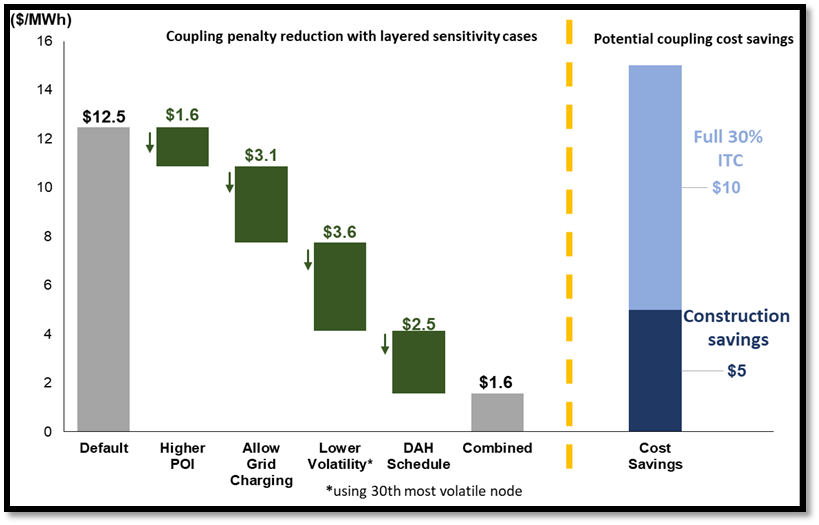

We found that installing a battery separately in a nearby high-value location results in higher market values than from siting the same batteries together with wind and solar. This holds true in nearly all markets and years, with a higher value of US$2–US$50/MWh, averaging US$12.50/ MWh.

We call this opportunity cost that results from co-location the ‘coupling penalty’. The highest coupling penalties are found in particularly grid-constrained regions, like New York’s Long Island, while lower coupling penalties occur in Texas in certain years of the study period.

Through a variety of strategies, the coupling penalty of co-located projects can be reduced, such as by recharging batteries from the grid during low-price hours, or sizing the interconnection capacity so both the generator and the battery can deliver power to the grid at the same time. Though independent batteries have the flexibility to be placed anywhere on the grid, it is not always straightforward to identify high value locations in the market. When accounting for these issues, we found that the coupling penalty could be reduced from the US$12.5/MWh cited earlier to US$1.6/MWh (Figure 2 below).

Though separating generation from storage usually delivers higher value, it may also deliver higher costs, as a project developer will need multiple sites and grid interconnections, and may lose the benefit of sharing equipment with generators. While it is difficult to precisely estimate the cost difference between combined and separated resources, a rough estimate found about US$15/MWh in cost savings from using a single location (Figure 2).

The biggest part of the savings is when the federal tax credit for renewable energy production is applied to batteries, provided the batteries are directly charged by the renewable generator. The tax credit, worth as much as US$10/MWh, can tip the scale toward co-location, making coupled projects more attractive to the developer than separate locations.

As developers and policymakers continue to search for the best way to deploy renewables and storage, this consideration of cost and value will be important. We found that the relative benefits and costs can vary by market, by time, and by other factors. Depending on conditions, both separate and hybrid projects can pencil out from a system optimisation perspective.

This is an extract of an article from Volume 28 of PV Tech Power, our quarterly journal. You can buy individual issues digitally or in print, as well as subscribe to get every volume as soon as it comes out. PV Tech Power subscriptions are also included in some packages for our new PV Tech Premium service.

About the Author

Will Gorman is a researcher in the Electricity Markets and Policy Department at Lawrence Berkeley National Lab. This article was largely based on two research publications: (1) ‘Motivations and options for deploying hybrid generator-plus-battery projects within the bulk power system’ and (2) ‘Are coupled renewable-battery power plants more valuable than independently sited installations?’ For links to these publications and more research see emp.lbl.gov and follow the Department on Twitter at @BerkeleyLabEMP.

This work was supported by the U.S. Department of Energy (DOE) under Lawrence Berkeley National Laboratory Contract No. DE-AC02-05CH11231.