Industrial-scale battery storage systems can significantly lower electricity costs for the facilities they are installed at, but could also help manage the cost of power for consumers, if allowed to.

Speakers at the Electrical Energy Storage Europe (ees Europe) conference in Munich, Germany, said today that commercial and industrial (C&I) battery energy storage systems (BESS) could be a vital source of flexibility for grids across the continent.

A panel discussion held this afternoon (10 May) asked if C&I storage, defined loosely as systems between 30kW to 1,000+kW and installed at different types of commercial and industrial facilities, could be “the next big thing” in Europe’s energy storage market.

Battery systems can lower the amount of electricity a facility needs to draw from the grid. If used strategically, reducing grid consumption at times when demand is at its peak – an application called peak shaving – can also reduce electricity costs dramatically.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In Germany, for example, as demand for electric vehicle (EV) charging infrastructure and renewable energy rises, an increasing portion of costs of managing the network to accommodate them is levied onto C&I electricity users in the form of demand charges.

One company headquartered in Southern Germany, Bayernwerk Natur, installed a 2MW/1MWh lithium-ion BESS at a dairy farm coupled with two 800kW combined heat and power (CHP) generators. Bayernwerk Natur general manager Matthias Jacob said the dairy farm is able to save as much as €600,000 (US$63,240) per year on its electricity costs, such was the intensive nature of its use of power from the grid before installing the new equipment.

The panel discussion’s moderator, Dr Holger Hesse from the University of Applied Sciences Kempten at Technical University Munich (TUM), noted that there has however only been a “little growth” in the C&I market despite “a lot of potential”.

As reported by Energy-Storage.news in March, another team of experts found that during 2021, just 27MW/57MWh of C&I storage was installed in Germany compared to more than a gigawatt-hour of residential energy storage.

Alongside this ability to reduce onsite electricity costs, batteries at industrial plants could be a powerful resource for the entire network, but current market design rules don’t value or incentivise this potential, various speakers on the panel today said.

‘We don’t have tariffs that value flexibility’

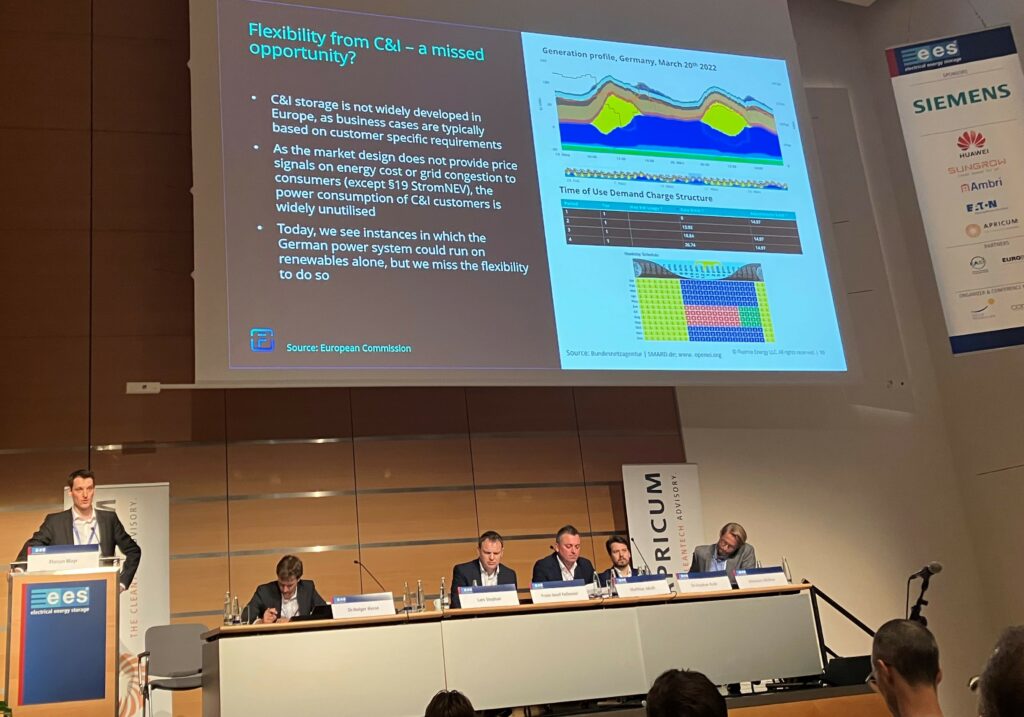

Lars Stephan, policy and markets director for energy storage system integrator Fluence highlighted a day in March this year when there was an abundance of renewable energy, far more than load on the grid to consume. Yet on that day, 20 March, thermal generation plants kept running and the system plunged into negative pricing.

C&I storage could bring flexibility to that situation, he said, “but in Germany we don’t have tariffs that value flexibility”. So for example in California’s CAISO grid service area, time of use electricity pricing has been introduced, which directly correlates the price of power with the demand for it from end users.

Another example Lars Stephan gave was 4 April this year, in France. Settlement prices in day ahead auctions at 7am and 9am went above €2,700 per MWh, and 28GWh was transacted. This came about because interconnectors with other countries were down, and so was much of the country’s nuclear fleet.

Stephan claimed that if just 500MW of two-hour duration (1,000MWh) battery storage was installed on the French grid and could be called upon, the clearing price would have been reduced substantially for the French system, and ultimately for French consumers.

Energy storage systems are noted for their versatility and range of applications they can provide. However, with things being as they currently are, only a narrow band of those applications is incentivised for C&I customers that want to invest in them, these applications generally being peak shaving and the enabling of self-consumption of onsite generated renewable energy.

Energy storage hardware and software development company Fenecon’s CEO, Franz-Joseph Fellmeier, said that as well as recognising and capitalising on the multi-use potential of energy storage, it’s important to derisk investment in the technology and develop an open source ecosystem for hardware and software.

In other words, compatibility across different energy storage systems and adjacent technologies such as EV chargers and heat pumps that BESS can be used to manage and control would help lower costs and increase accessibility. Fellmeier drew the example of the smartphone, where multiple app developers can benefit from a shared operating system platform, be it Android or Apple. Among the ways of derisking investment that can work are rental models for BESS, which lower the capital cost for customers.