Battery storage has become the leading provider of frequency control ancillary services (FCAS) in the National Electricity Market (NEM) which covers most of Australia.

That’s according to quarterly figures released by the Australian Energy Market Operator (AEMO). The latest edition of AEMO’s Quarterly Energy Dynamics report covers the period from 1 January to 31 March 2022, highlighting facts, statistics and the trends that are shaping the NEM’s dynamics.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

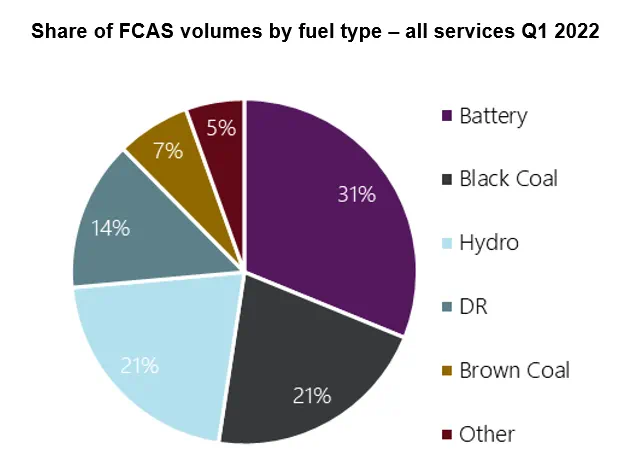

For the first time ever, the largest percentage of frequency regulation provided by technology type came from battery energy storage systems (BESS), with a 31% market share across the eight different FCAS markets. It was a full 10% lead over black coal and hydro which tied for second place with a 21% share each.

Total estimated net revenues for batteries in the NEM were around A$12 million (US$8.3 million) for the first quarter – a rise of A$2 million year-on-year from A$10 million netted in Q1 2021. It was a dip from revenues raised during the rest of last year, but comparisons perhaps tend to be fairer with equivalent quarters due to seasonality of electricity demand patterns.

At the same time, the cost of providing frequency control fell to about A$43 million, which was about a third the cost recorded in Q2, Q3 and Q4 2021 and about the same as was recorded in Q1 2021. This reduction was however largely driven by the impact of transmission system upgrades in Queensland which had led to high contingency FCAS prices for the state as scheduled outages took place in the three preceding quarters.

While batteries took first place in FCAS, other relatively new frequency regulation sources such as demand response and virtual power plants (VPPs) have also started to eat into the share provided by conventional generation, AEMO noted.

Batteries being used for energy as well as power

Perhaps the biggest takeaway for the energy storage industry is that the share of revenues earned through FCAS is in fact at the same time decreasing relative to those earned through energy markets.

In the last couple of years, frequency has been by far the largest revenue-earner for battery storage, with energy applications like arbitrage a way behind. In a recent article for our quarterly technical journal, PV Tech Power, Ben Cerini, managing consultant at energy market expert group Cornwall Insight Australia, said that about 80-90% of battery revenues have been coming from FCAS and about 10-20% from energy trading.

In Q1 2022 however, AEMO found that the proportion gross revenues earned in the energy market by batteries jumped from 24% in Q1 2021 to 49%.

Several new large projects drove this increase in share, like the 300MW/450MWh Victorian Big Battery in Victoria and the Wallgrove 50MW/75MWh battery system in Sydney, New South Wales.

AEMO noted than in Victoria, volume-weighted energy arbitrage value rose from A$18/MWh to A$95/MWh compared to Q1 2021.

Pumped hydro energy storage (PHES) also had a strong quarter: a record quarterly high A$56.5 million of spot market revenue was earned, compared to just A$2.9 million in Q1 2021.

This was largely driven by the performance of Wivenhoe pumped hydro plant in Queensland, which made a lot of money due to high electricity price volatility in the state during the quarter. The plant saw its utilisation increase 551% from Q1 2021 and was able to at times get paid at spot prices higher than A$300/MWh. Just three days of extremely volatile pricing earned the plant 74% of its quarterly revenue.

Fundamental market drivers mean Australia is poised for strong growth in energy storage capacity. The country’s first new pumped storage plant in nearly 40 years is under construction and more are likely to follow. It’s in batteries though that the fastest and largest growth in activity is expected.

Approval granted for ‘coal replacement’ BESS in NSW

AEMO said that while there are now 611MW of BESS operating in the NEM, there are 26,790MW of proposed new battery storage projects.

One of those is the Eraring project in New South Wales, a BESS with up to 700MW output and four hours’ duration (2,800MWh), proposed by major integrated energy retailer and generator Origin Energy.

The project would be built at the site of Origin’s Eraring 2,880MW black coal power plant, which the company is keen to place into retirement by 2025. Its role in the local energy mix would be replaced by the BESS, 2GW of aggregated virtual power plant capacity and other resources including Origin’s existing fleet of thermal generation.

Origin pointed out that coal is being outcompeted by renewables, energy storage and other more modern technologies in the evolving market structures of the NEM.

Origin announced late last week that the NSW government Department of Planning and Environment has given planning approval for the BESS project, making it the largest project of its type in the country to have gotten to that point.