With a handful of leading regions deploying grid-scale storage at a faster rate than ever,

what sort of impact are these additions having so far on the problems they are intended to solve?

This is an extract of an article which appeared in Vol.31 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

A ‘breakout year’ for storage

“Last year was a breakout year for the sector, to prove that on a utility-scale basis, battery storage is a viable, resilient and dependable source of energy,” Thomas Cornell, senior VP Energy Storage Solutions at Mitsubishi Power Americas tells PV Tech Power in a recent interview.

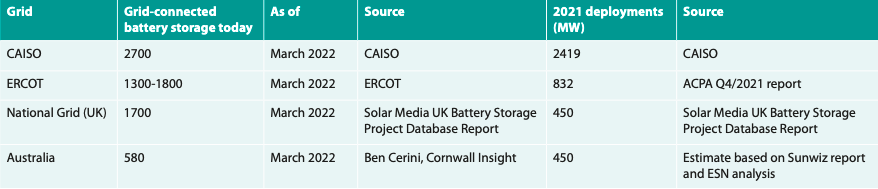

At the time of writing, around 6,500MW of grid-connected battery storage has been deployed in the most advanced markets in the US, UK and Australia, detailed in the table below. Around two-thirds was deployed last year.

But most interviewees agreed that despite these high deployments storage is still mainly being used for its power and not for its energy.

“Right now storage is mainly being a backup system. There’s hope it will start to do more load shifting of renewables but with the amount out there, it’s limited,” says Haresh Kamath, director of distributed energy resources and energy storage at Electric Power Research Institute (EPRI), the R&D and demonstration project organisation.

Shifting renewables-produced energy from periods of higher production to high-demand periods is the big long-term benefit of storage, but the ability to do this profitably is at a relatively early stage. And even where load shifting is happening, as in California, it’s not necessarily shifting renewables.

California ISO (CAISO)

As by far the most mature market on deployment, the California ISO (CAISO) grid is the ideal place to start with over 2,700MW of grid-connected storage on the system. Storage has taken off in response to a number of CPUC directives obliging utilities and other load-serving entities to procure new flexible capacity.

Gabe Murtaugh, storage sector manager for CAISO, tells PV Tech Power that energy storage is now regularly shifting as much as 6,000MWh of energy from low-price periods in the middle parts of the day to high-price periods later in the day. This goes a long way to helping dampen the so-called ‘duck curve’ in demand for power throughout the day in California.

But, Murtaugh adds, this load shifting is mostly shifting low-price but high-polluting gas resources: “There are some periods of overproduction of renewables and storage is certainly absorbing some of that energy but there will be some transition years before storage is charging primarily from renewable resources.”

CAISO recently revealed the role of storage during the Oregon Bootleg wildfire in July 2021, when it dispatched around 1,000MW to help keep the lights on after three transmission lines connecting the regions were disabled.

“We now regularly see five-minute intervals where essentially all storage is dispatched for energy on the grid, nearly 3,000MW, and that will increase over the summer as more storage interconnects to the system,” he adds. With a peak demand on the CAISO grid of 28,971MW in March that means storage is regularly contributing at least 10% of load at various intervals.

CAISO is anticipating about 4,000MW of storage to be online by this summer, which will further help to mitigate the wildfire risk to grid stability. During Bootleg, only around 1,500MW was connected.

ERCOT

Texas is by far the leading US state when it comes to renewable energy deployments with 45,077MW, mostly wind. That is twice the amount deployed in California which is second with 22,929MW (end-2021, figures from the American Clean Power Association).

This creates a huge opportunity to capitalise on a volatile energy market and help smooth out imbalances in the grid, and colocation with wind promises to be a big driver of the storage market in the coming years.

Storage’s main revenue driver historically has been in frequency response, specifically Responsive Reserve Service (RRS) and Firm Frequency Response (FFR), says Jason Abiecunas, SVP Business Development at Texas and California-focused system integrator FlexGen.

However, the proportion between grid balancing and frequency response services and energy trading is now closer to 50:50, says Alex O’Cinneide, CEO of UK-based energy storage investor Gore Street Capital which recently acquired several storage assets in Texas.

Based on figures released by grid operator ERCOT at the end of 2021, there is likely to be somewhere between 1,300-1,800MW of grid-connected storage in Texas at the time of writing.

However, there is no sign that the FFR and RRS markets will saturate any time soon so these will remain the main driver of energy storage in the state, says Abiecunas.

Although over a year has passed since the devastating winter storm of February 2021 which took hundreds of lives, it is still talked about as the critical moment for demonstrating the potential of energy storage on the Texas grid.

Abiecunas: “Everybody saw the enormous value that energy storage was able to deliver during this time of crisis. They saw that it was a resource that provided localised stability, that could be relied upon to provide a variety of services when the grid needed it and could adapt what it was doing to meet the needs of the moment.”

Another extreme winter storm raged across the US in February this year but the system held together well. “The grid held together, the storage assets worked and the headline was ‘all systems normal’,” he adds.

UK/Ireland

Some 446MW of battery energy storage was deployed in the UK in 2021 bringing the total grid-connected power to 1,700MW at the time of writing (figures from Solar Media’s UK Battery Storage Project Database Report).

“Most of the batteries most of the time are being used for their power capacity, rather than their energy capacity. They are on standby in case something happens – so the actual utilisation of the batteries in terms of how much energy they charge and discharge in services like dynamic containment is really very low,” says Robyn Lucas, chief analytics officer at market intelligence firm Modo Energy.

Frequency response services total a little over 1,000MW and are largely designed for and thus dominated by energy storage. They are Dynamic Containment (DC), firm frequency response (FFR) and enhanced frequency response (EFR) which accounted for well over 90% of battery storage’s revenues in 2021 according to Modo. But a shift started towards the end of the year.

“Wholesale and merchant revenues have really started to kick off for storage. Back in Q1 and Q2 you’d have been looking at less than 5% of your revenues coming from those sources but then into Q3 and Q4 that’s going up to 10%, even 20%,” says Alex Done, head of research at Modo.

“There’s now a hell of a lot of opportunities in the wholesale market because of how volatile prices have been.”

O’Cinneide says the optimal revenue mix in the UK is still 80-85% grid balancing, 10% capacity and 5-10% energy trading.

Utilisation of storage measured in MWh discharge may be low but frequency response services are essential to the smooth operation of the grid. Lucas says that the most recent big event where their power was needed was on March 22, 2022.

At 15:27, a trip on the system caused the grid frequency to crash to 49.67Hz. Assuming the 1,100MW of contracted batteries responded as per their contracts, a max response of 650MW of power was produced by storage to help restore frequency to 50Hz, which took 10 minutes, she says.

Another notable example of storage responding quickly was when the new IFA2 interconnector with France tripped on January 29 2021, one month after going live, which was covered by our sister site Current±.

Energy storage is also becoming a notable player in Capacity Market auctions launched by National Grid. In the most recent auction for 2025/26, 1,094MW of batteries won out in a tender totalling 27,632MW, or 2.5% of that amount.

Although storage’s role in the Balancing Mechanism is small for now, it’s a hugely important area for National Grid to balance its network in a short-term way. Trading in the wholesale markets helps dampen price volatility so it’s good from a system point of view.

Ireland has seen much lower levels of deployment but there are still notable examples of battery storage. Two battery storage systems totalling 37MW stepped in when the frequency of Ireland’s electricity grid dropped below normal operating range in May 2021. It was the longest under-frequency event seen in the country in years as the grid went out of bounds of 49.9Hz – 50.1Hz for more than 14 minutes, but the batteries stepped in within 180 milliseconds.

Western Europe

Western Europe is a bit behind the UK, California, Texas and Australia when it comes to storage deployment. France has around 300MW of grid-connected storage, Germany around 600MW and Netherlands and Belgium are below 100MW each, says Jean-Paul Harreman, director of market intelligence firm EnAppSys. Though, he adds, there are big pipelines in each including 500MW in France alone.

Most of this is providing Frequency Containment Reserve, a frequency response service requiring activation within 30 seconds of a drop. The auction has seen higher availability payments in the last year due to shorter delivery periods and an increase in gas and carbon prices. Shorter delivery periods for frequency response services are also pushing more conventional assets out of the market in favour of storage.

But, due to the small scale of storage in West Europe there are no examples to-date of it playing a key role in maintaining grid stability. “It will take three to five years for storage to start having an impact,” he says.

Harreman: “In the longer term, storage has the potential to reduce market volatility, starting with the tail-ends of the distribution. As a certain price spread between charging and discharging is required to break even, storage will try to capture the most extreme prices at both ends of the distribution.”

He says the FCR market may be the first to get saturated but that storage can qualify for a variety of markets and asset operators will be able to pick their market, be it FCR, aFRR or energy-only markets.

Australia

Australia’s grid operator AEMO wants more storage to be connected and participating in the ancillary services market. But it’s a thin market, totalling around 800-820MW including 600MW of frequency control ancillary services (FCAS), and so the more storage is deployed the more prices are cannibalised.

That is according to Ben Cerini, Managing Consultant at Cornwall Insight Australia who says there is around 580MW of grid-scale storage connected today and around 15GW expected by 2030 (another 30GW will be distributed energy resources including rooftop solar). Storage today has a market share of around 25% in the FCAS services.

Today, 80-90% of grid-scale energy storage’s revenues in Australia come from FCAS services with only the remaining 10-20% coming from energy trading, he says. The economic viability of a purely merchant model is not proven yet, but the opportunity is growing so this could change in future.

“The spreads between the middle of the day and the evening peak will continue to increase in future, especially as lots more rooftop solar comes onto the system,” he says.

Cerini says that one of the biggest events in which storage played a key role in maintaining grid stability was the South Australia islanding event two years ago.

“So there have been a few trips but one of the better examples is when South Australia was forced into an islanded state two years ago, isolated from the rest of the grid. Most of the storage in the country at that point had been deployed in South Australia, and that was all called upon to provide those services over the 17-day period to keep the grid stable.”

Challenges and conclusion

Alongside all the various challenges for energy storage developers and owners around maximising revenues, grid and distribution network operators face their own problems with growing amounts of energy storage. Availability of real-time data on storage assets and long-term resource planning were highlighted as key technical challenges because the unique nature of batteries.

It’s clear that despite the massive amounts of deployments we saw in 2021, energy storage is still some way away from doing the renewable load shifting that everyone hopes it one day will.

But as the examples covered show, its role as a backup power source through frequency response is still hugely important to the functioning of grids. The instant responses we’ve seen to frequency drops, be it technical faults or extreme weather events, provide wonderful, tangible examples of what storage can do.

And there is a clear move to more wholesale trading over time which should start to encompass renewable load shifting, even if it is currently at a relatively early stage. Paired with more renewables coming online, we will increasingly see how storage can make a dent in our electricity system’s carbon emissions in the coming years.