Invinity Energy Systems believes partnering with a Chinese materials and manufacturing company will enable significant cost reduction of its vanadium redox flow battery (VRFB) technology.

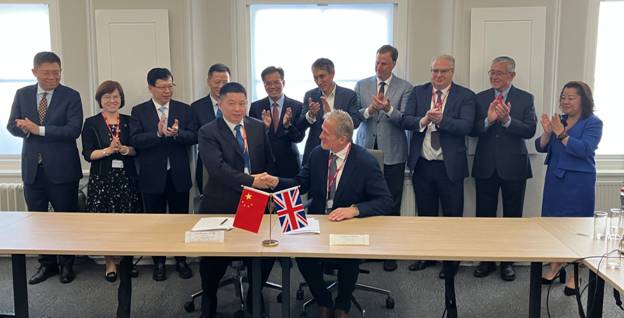

The Anglo-American flow battery company has signed a licensing and royalty agreement with vanadium electrolyte and battery product manufacturer Guangxi United Energy Storage New Materials Technology Limited (UESNT).

In a London Stock Exchange announcement last week (11 July), Invinity said that the agreement would enable it to leverage UESNT’s component manufacturing and materials supply chain advantages for projects in China and overseas.

“What we are excited about with this partnership in general is to bring on board a partner who has end-to-end capabilities to help us reduce the total product cost,” Invinity’s president, Matt Harper, told Energy-Storage.news in an interview.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The agreement runs until 2030 and gives UESNT the right to market, sell, and manufacture Endurium units for the Chinese market, paying Invinity annual royalties based on sales volumes and two one-off conditional royalty payments.

At the same time, Invinity could source sub-components and complete systems manufactured by UESNT for sale outside China, while the Chinese partner could also provide up to 6GWh worth of vanadium electrolyte at a fixed or market discount price.

Harper said Invinity has been sourcing in China for a while and already has a “great manufacturing partner there”.

“What we’re hoping to do with UESNT and the way that the agreement is structured is that we want to go into their supply chain and get the cost of our product down to the point where, first of all, it’s going to be a lot more competitive for us in the rest of the world [outside of China].”

UESNT’s “pedigree” is in materials and minerals processing, which led to the start of discussions between the companies, particularly around the supply of liquid electrolyte, which in VRFBs is typically based on vanadium pentoxide. Harper claimed Invinity’s new partner has implemented a combination of processing techniques and supply chain optimisation that he said “really changes the game” in how mined or recycled vanadium can become electrolyte for VRFBs.

Taking modular form factor to China’s flow battery market

China is the world’s current leader in flow battery deployments, with technology company Rongke Power delivering some projects at a scale exceeding hundreds of megawatt-hours, for example.

Indeed, a 2024 survey of long-duration energy storage (LDES) technologies by BloombergNEF (BNEF) found that a fully installed flow battery system in China cost an average of US$423/kWh, where the rest of the world’s average cost was US$701/kWh.

That said, in a previous interview for ESN Premium when the Endurium VRFB launched at the end of last year, Harper said that while China’s flow battery projects are impressive in scale, they are not based on modular, productised systems.

“If you look at all the flow batteries that are being built in China, they’re all built onsite, highly bespoke, constructed in-situ projects,” Harper said at the time.

“They look like a small chemical plant with huge tanks, pumps and pipes all over the place, which is a great way to build those plants if you can have a hundred or two hundred or so workers walking around putting that thing together over the course of about a year.”

Harper claimed that for higher-cost environments outside of China, and with pressured timelines for execution, a turnkey solution that “comes out of the factory 100% ready to be installed and operated” would be necessary.

Speaking today about the deal with UESNT, the Invinity president said that even within China, a modular factory-built product can be directly competitive with those projects being built onsite. However, it will take some time and is not within reach with Endurium just yet, he said.

“With the UESNT partnerships, we think we can get the cost of the modular products to a point where it directly competes. Obviously, we’d love to see our product competing directly in China, but I think it is the most helpful for us in terms of what it does in the rest of the world.”

This article has been amended from its original form to reflect that Matt Harper is president of Invinity Energy Systems, not CCO as previously published.