Research firm Wood Mackenzie has found that daily price volatility from renewables on Australia’s National Electricity Market (NEM) supports a stronger battery revenue outlook.

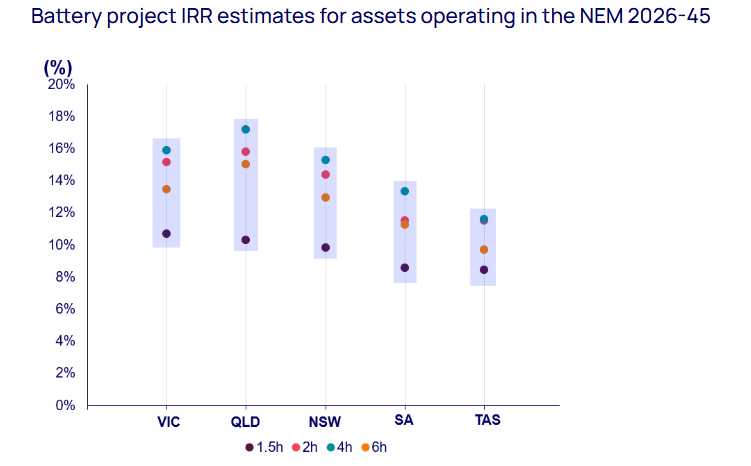

Projected internal rates of return (IRRs) for 4-hour duration battery energy storage systems (BESS) vary between 13% and 15%, demonstrating their viability in a fluctuating energy market.

“Our 30-minute price forecasts show daily price spreads consistently over AU$100/MWh (US$63/MWh), with increasing spikes up to AU$400 or more. By 2030 over 80% of battery project revenues will come from energy arbitrage, as FCAS markets saturate,” Max Whiteman, research associate of Asia Pacific Power & Renewables at Wood Mackenzie said.

The firm also states that 4-hour battery systems will be more profitable going forward than the typical 1.6-hour duration of projects operating currently.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Wood Mackenzie states that investments in BESS have fallen behind. In the past decade, wind and solar capacity in Australia has increased sixfold to an estimated 43GW, now accounting for over one-third of the country’s electricity supply.

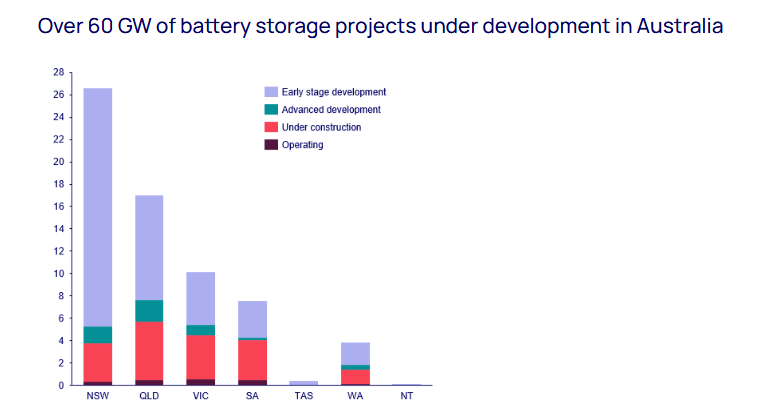

However, with the impending closure of coal-fired power plants across Australia, the BESS market is growing in the NEM, with a pipeline of 60GW of projects under development representing over AU$80 billion of potential investment.

According to Wood Mackenzie data, renewable energy capacity in Australia now represents more than 80% of the peak grid load. However, investments in BESS have lagged significantly, making up less than one-tenth of this capacity.

4-hour BESS in 2026 to earn an average of AU$263,000/MW

It is important to highlight that the capital expenditure (CAPEX) for 4-hour batteries is expected to decrease by 20% by 2030, making investments in this technology even more economically attractive. Wood Mackenzie outlines that a 4-hour battery that starts operations in 2026 is projected to generate an average annual revenue of AU$263,000/MW over its lifetime, with Queensland expected to lead at AU$281,000/MW.

This research follows a report from Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) that found that large-scale BESS capital costs improved the most in 2024-25, falling by 20% year-on-year (YoY).

Detailed within the organisation’s GenCost draft report, which provides an annual assessment of Australia’s future electricity generation costs used in infrastructure planning, variable renewable energy generation technologies such as solar PV and wind continue to lead the country’s energy transition. These are the fastest-growing energy sources in the country, yet large-scale BESS was the most improved technology.