Energy Storage Award 2024 winner, Semih Oztreves, head of network infrastructure at BESS developer-investor Zenobē Energy, takes part in our annual Q&A series.

UK-headquartered Zenobē Energy is active in the twin energy transition industries of electric transport and network infrastructure. Its network infrastructure division focuses on the large-scale battery energy storage system (BESS) projects; from design and financing to building and operation.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In addition to around 735MW of contracted energy storage assets as of the time of writing, and over 2 billion raised in debt and equity funding, the company has also delivered some of the Great Britain (GB) grid’s most innovative—as well as largest—projects to date.

This includes the Blackhillock project currently under construction in Scotland in the northern UK: a 300MW/600MWh battery storage system supplied and integrated by Wärtsilä is paired with advanced inverters from SMA which will enable Blackhillock to be the first in the country to provide System Stability services to the grid, such as reactive power and inertia, from a transmission-connected battery system.

Zenobē is also developing projects internationally, with offices in Australia, New Zealand, North America and the Benelux region of Europe as it expands from its UK base.

Global director of network infrastructure Semih Oztreves joined Zenobē from Wärtsilä’s Energy Storage and Optimisation (ES&O) division and works to shape markets and optimise revenues for the developer, all while growing its business worldwide.

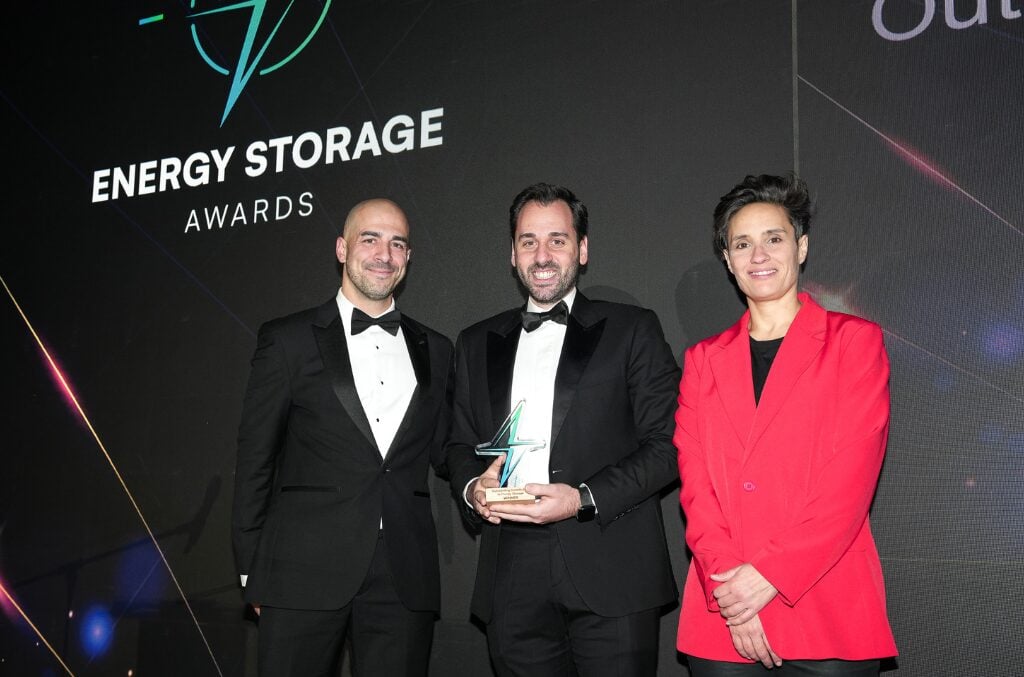

Part of the industry for well over a decade, Semih Oztreves was the deserving winner of the Outstanding Contribution Award at the 2024 Energy Storage Awards, hosted by our publisher Solar Media in November last year.

Stay tuned as our Year in Review Q&A series with industry leaders and experts continues.

“With gigawatts of capacity coming online and the asset class maturing, we see 2024 as setting the foundation for growth of the sector in 2025 and beyond.”

Semih Oztreves, Zenobē Energy

What did 2024 mean for the energy storage industry from your company’s perspective and the bigger picture?

It was a transformative year. At the beginning of 2024, the industry faced a challenging environment—revenues were at historic lows, and policy headwinds globally created uncertainty around energy storage.

However, the momentum shifted significantly as the year progressed. In the UK, Labour [which won the 2024 General Election] introduced ambitious targets and we observed key trends such as negative pricing with increased renewable energy penetration and a notable reduction in capital expenditure requirements. These factors collectively boosted the market environment.

For Zenobē, this translated into remarkable growth. We began 2024 following several exciting business developments, including an £870million (US$1061.4 million) investment from KKR and Infracapital in September, followed by our 50MW battery in Wishaw going live in November.

By year-end, the revenue of our GB BESS portfolio had doubled, which was a clear sign of the shifting dynamics in the industry and our high-performing team.

From a broader perspective, the fundamentals are now firmly in the industry’s favour. Investor confidence is on the rise, due in part and thanks to galvanised pressure to resolve constraint skips, and system operators are becoming more adept at managing dispatch for energy storage assets.

With gigawatts of capacity coming online and the asset class maturing, we see 2024 as setting the foundation for growth of the sector in 2025 and beyond.

What do you think 2025 will hold, firstly in terms of things to look forward to, but also in terms of challenges ahead?

2025 is shaping up to be a flagship year for the energy storage sector – we’re going to see several large-scale energy storage projects going live, significant transactions being signed and the sector continuing to solidify its role as critical national infrastructure for the energy transition.

As the sector continues to mature, I’d anticipate a wave of project consolidations, company acquisitions and unprecedented collaborations between supply chains and investors.

I’m particularly excited about the emergence of innovative offtake structures as the utilities and renewable majors who hold solar and wind on their balance sheet have come to recognise the hedging benefits of energy storage systems.

We’re expecting strong years in the UK, Europe, and Australia where numerous projects will reach Final Investment Decisions (FID). These regions are benefiting from increased political momentum which is positioning the industry for substantial growth.

In the US, there remains uncertainty, given the expected political shift under Trump which could introduce challenging for policy and regulatory frameworks, although the US will still remain a dominant market for BESS.

While the year marks a transition from headwinds to tailwinds, challenges still remain and the sector must navigate this transitional period carefully to ensure long-term success. Looking ahead, 2025 will largely be about players solidifying their positions in the core markets.

“Whilst supply chain competition is increasing, contractor availability is becoming less abundant due to competing priorities with significant transmission infrastructure projects.”

Semih Oztreves, Zenobē Energy

The last year has seen incredible growth in energy storage deployments in key markets worldwide, but what are some things that people may not be aware of when considering the development of mature and emerging markets?

While the energy storage sector has made remarkable strides, there are key challenges less frequently considered when assessing the market.

One is the complexity of delivering large-scale energy storage infrastructure. Many underestimate the complexity and the impact of construction delays, which remain a significant hurdle. Despite the growing demand there is a limited pool of qualified contractors to execute these projects.

Whilst supply chain competition is increasing, contractor availability is becoming less abundant due to competing priorities with significant transmission infrastructure projects. As a result, project margins being squeezed and delivery timescales are being extended, with many projects inevitably pushed to 2025.

It’s also easy to be disappointed by the scale of rollouts when compared to ambitious projections. However, it’s important to consider this context: the sheer complexity of delivery and the resource challenges the industry faces.

Another area that’s often overlooked is asset management. There’s a prevailing assumption that batteries are ‘build and forget’ assets, but this couldn’t be further from the truth.

Effective management of inverters, State of Charge (SoC) systems, controls, and software systems is critical for long-term performance. Unfortunately, these considerations are not always built into investors’ business cases during early project development stages, which can lead to sub-optimal outcomes over the asset’s lifecycle.

Addressing these hidden challenges—whether through better planning or embedding robust asset management practices—will be crucial as the sector continues to scale and mature.

Are there any major market trends that our readers should watch, perhaps related to technology, financing, or other aspects of the industry?

Several key trends are shaping the energy storage industry. On the technology front, advancements like pre-lithiation are generating significant buzz. This emerging innovation reduces degradation and cycling costs compared to legacy systems, though it remains in the early stages of adoption.

Another technology to watch this year is grid-forming invertors. Zenobē Energy has integrated them into the design of our Blackhillock site, which once live, will demonstrate this technology at scale.

A major trend is the shift toward larger projects. Five years ago, 50MW systems were notable but today investments are being made in 500MW to 1 GW+ projects.

Large-scale standalone storage is dominating [the market], offering advantages of strategic locational placement and market stacking. In contrast, co-location [of storage] with renewables has underperformed expectations due to limitations in project size, locational flexibility and added complexities.

Additionally, it will be interesting to see the impact of increasing demand from data centres. Growth in this sector could potentially create scarcity during peak demand hours, as seen in Texas. While the full impact is not yet known, this development will be important to watch.

What should the industry’s priorities be in 2025 and beyond?

In 2025 and beyond, the energy storage industry must prioritise achieving policy stability and clarity. While costs, technology, offtakes and financing are maturing, inconsistent policy frameworks continue to delay investment decisions and project timelines. Clear, reliable policies are essential to enable large-scale growth and secure confidence from investors.

For example, in the UK, the rise of subsidised long-duration energy storage (LDES) poses a potential challenge, as it risks sidelining conventional storage solutions.

The industry should work with policymakers to ensure fair competition and balanced support for all storage technologies – and in this specific case [national regulator] Ofgem should complete an impact assessment to ensure unintended consequences are avoided. Proper preparation and industry collaboration will pave the way for sustainable and equitable growth across the energy sector.