Evolving market dynamics in ERCOT and CAISO, the two leading US electricity markets for battery storage, call for smart optimisation strategies, write Ali Karimian and Alden Phinney of GridBeyond.

Battery storage operators in the United States are facing an inflection point. Battery energy storage systems (BESS) in the Electricity Reliability Council of Texas (ERCOT) and California Independent System Operator (CAISO) markets are experiencing a fundamental shift in revenue generation dynamics that demands differentiated strategies for each market.

While ancillary services-focused approaches delivered solid returns in ERCOT during 2023, and basic charge low/ discharge-high strategies worked effectively in CAISO, the rapid deployment of BESS assets has created intense competition, which demands sophisticated optimisation to capture excess returns beyond market benchmarks.

To remain competitive, battery storage operators must transition from basic arbitrage strategies to highly optimised, integrated solutions that capture returns that outperform the benchmark when adjusted for risk (what the financial world calls alpha).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

What is alpha?

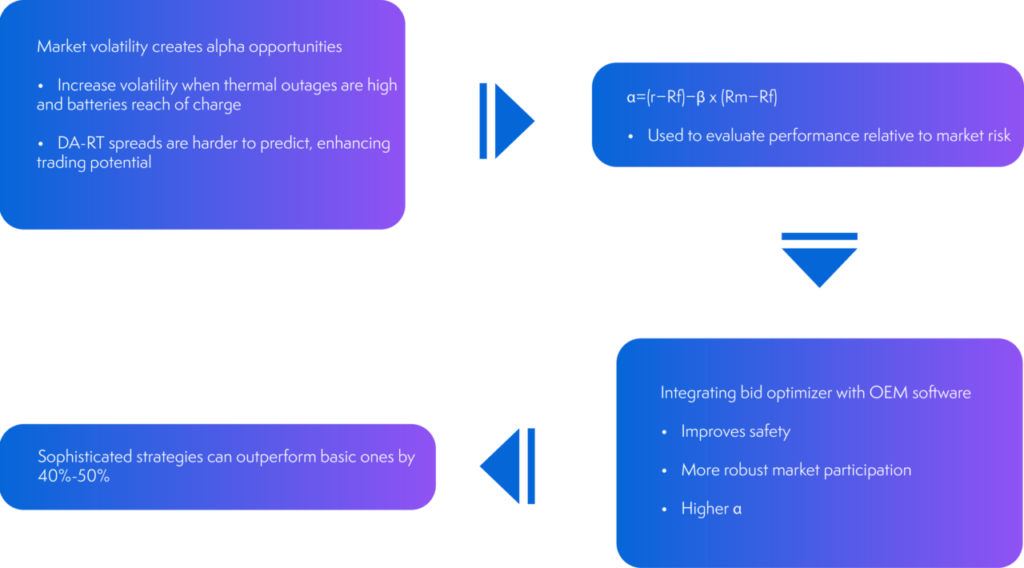

Alpha (), in the context of this paper, represents the excess returns achieved by a particular trading or bidding strategy over a benchmark level of market return. To compare the effectiveness of different strategies in capturing

, it is helpful to borrow from traditional financial metrics.

In the world of equities, the concept of α represents the portion of a portfolio’s return that exceeds the return expected based on its exposure to market risk. This is often measured relative to a benchmark, such as the S&P 500. More precisely, alpha is calculated using the Capital Asset Pricing Model (CAPM) formula:

α=(r−Rf)−β⋅ (Rm−Rf)

Here, r represents the return of the investment strategy being evaluated; R_f is the risk-free rate of return; Rm is the expected return of the market or a benchmark strategy; and β measures how sensitive the strategy is to overall market movements.

This means α captures the excess return after adjusting for systematic risk, i.e., the return that can be attributed to skill, insight, or superior strategy rather than market exposure. Applied to FTM battery strategies, this formula allows stakeholders to assess whether a given approach is truly adding value or merely tracking broader market conditions. A higher α indicates that a strategy is outperforming what would be expected based on its risk profile and the market environment, signalling superior performance and skill in execution.

In the context of battery storage, alpha represents the added value achieved through intelligent asset management, real-time forecasting, multi-market bidding, and seamless operational coordination. Operators must manage project availability and the deployment of ancillary services, which can temporarily remove the battery from energy market participation. As such, alpha in battery storage is derived from accumulated daily P&Ls that exceed the benchmark portfolio:

From simplicity to sophistication

While the concept of α is important in benchmarking revenues, the scale of market volatility batteries face and the strategic options available to them makes them a more complex asset to optimise than a simply financial instrument.

As market structures evolve and complexity deepens, the advantage shifts toward operators that invest in sophisticated software, predictive analytics, and real-time optimisation.

When fewer assets were competing for the same opportunities, charging at off-peak prices and discharging during high-demand periods reliably generated profits.

However, market saturation has changed the game. With more batteries chasing similar price signals, those simple tactics now result in diminishing returns.

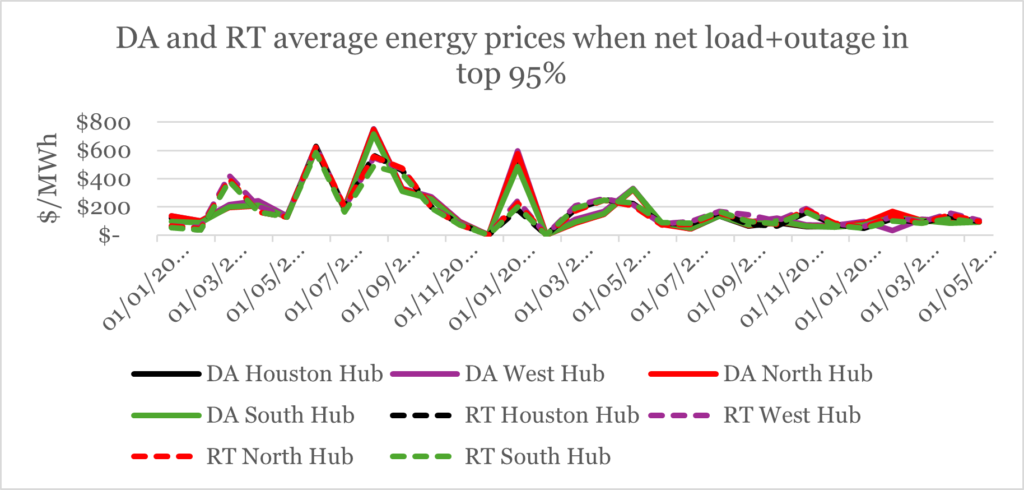

In ERCOT, a notable shift has occurred: price spikes are no longer confined to mid-afternoon peaks. Increasingly sharp surges in real-time pricing occur after sunset, including on weekends. These spikes require agile, responsive strategies. Operators using integrated platforms with real-time optimisation and communication capabilities are now able to capture these high-value windows, while siloed systems often miss them entirely.

In CAISO, the situation is uniquely complex. The high penetration of solar has created a predictable but deceptive energy price pattern. Prices drop during daylight hours due to solar production and then spike during the evening. While this cycle might appear easy to exploit, the true alpha lies not in reacting to predictable curves, but in managing the intricate interplay between energy markets, ancillary services, and must-offer obligations under resource adequacy rules.

With 5.6GW of new battery capacity in ERCOT since 2023, the operators still using basic charge-low/discharge-high strategies are being systematically outcompeted. The question isn’t whether you need sophisticated optimisation – it’s whether your optimisation platform can execute fast enough when price signals emerge.

Finding alpha Q1-Q2 2025

Strategy evaluations show stark differences in alpha generation depending on the approach taken:

In ERCOT (2-hr duration battery):

| Strategy | Alpha | Benchmark | Risk-adjusted Alpha |

| RT Energy | 44% | RRS | 21% |

| AS + RT Energy | 14% | RRS | 10% |

| AS + (DA Physical + RT) Energy | 100% | RRS | 22% |

| AS + (DA Financial + RT) Energy | 125% | RRS | 27% |

In CAISO (4-hr duration battery):

| Strategy | Alpha | Benchmark | Risk-adjusted Alpha |

| AS + (DA + RT) Energy | 6.58% | Co-optimized DA LMP TB4 | 7.9% |

| AS + (DA + RT) Energy | 1184% | Spinning Reserve | 142% |

These figures reinforce the idea that alpha in battery optimisation is not theoretical but quantifiable and can be systematically pursued through strategic market participation.

α strategies in ERCOT

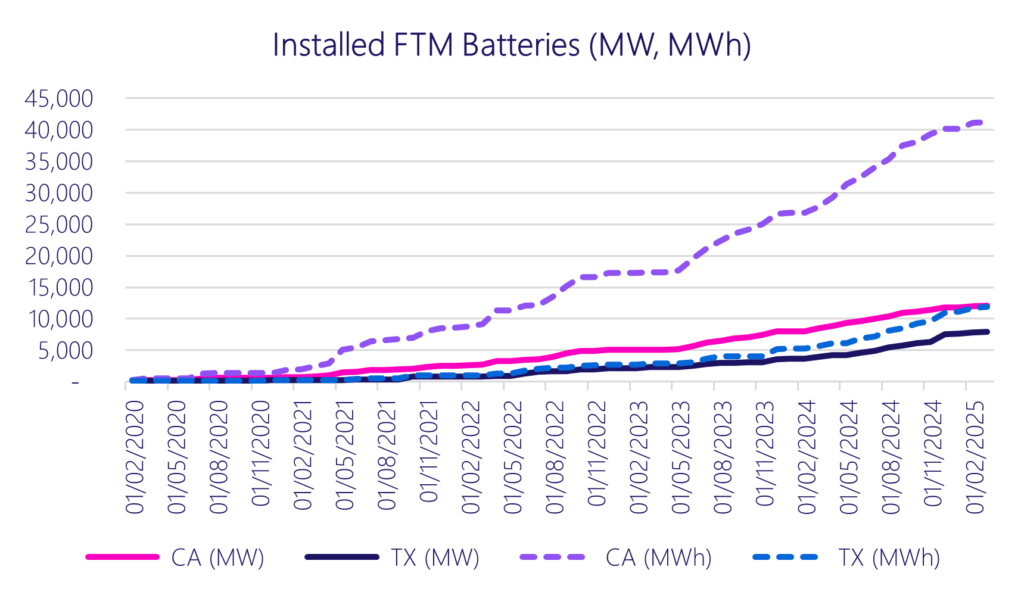

Despite the addition of substantial battery capacity, key underlying market drivers such as net load and non-renewable generation outages have remained relatively flat. Approximately 5.6GW of new battery storage capacity has been installed since 2023 in ERCOT.

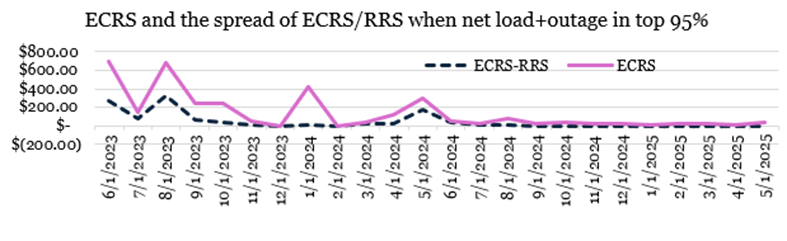

This increase has placed downward pressure on prices. At the same time, price spreads between DA and RT markets, as well as spreads within ancillary services like ECRS and RRS, have become more difficult to forecast.

As of Q2 2025, in ERCOT there is more generation capacity than what is currently needed to meet typical demand. While this may provide reliability benefits for the grid, it also suppresses prices and contributes to saturation in ancillary services markets. With more assets competing to provide the same services, clearing prices fall, and the marginal value of participating in these markets diminishes.

To generate meaningful returns, battery operators and traders must rely on sophisticated algorithms and high-frequency trading strategies. These tools must be capable of analysing real-time market conditions, forecasting prices with high accuracy, adapting to rapid changes in grid conditions, and dynamically allocating battery capacity across energy and ancillary services to maximise returns.

The need for integration

Energy price volatility, far from being a threat, is now the primary driver of profit for advanced BESS strategies.

In both ERCOT and CAISO, the increasing frequency of thermal outages, unpredictable renewable generation, and changing demand patterns have made price spreads harder to forecast, but more lucrative to capitalise on when correctly forecast.

What separates alpha-generating strategies from the rest is integration. Success is no longer determined solely by advanced trading algorithms. Those algorithms must be tightly woven into the operational fabric of battery systems, from scheduling and dispatch to real-time communication with ISOs.

Integrated platforms eliminate delays, minimise human error, and ensure that every market opportunity, no matter how fleeting, can be acted upon.

GridBeyond’s fully integrated optimisation platform exemplifies this shift. By aligning asset control with bid optimisation and direct communication with ERCOT and CAISO, the platform delivers revenue uplift through both operational reliability and strategic foresight. In recent trials, clients leveraging these systems have realised up to 23% monthly revenue improvements, a clear illustration of alpha in action.

For battery storage operators, the pursuit of alpha is a necessity. Success depends on more than just hardware; it demands unified platforms that combine real-time data, forecasting, optimisation, and direct market interaction.

As competition increases and margins narrow, integrated strategies that blend engineering precision with financial insight are proving to be the key differentiator. The question facing the industry is no longer whether to pursue alpha, but how fast you can implement the systems and strategies to capture it.

About the Authors

Ali Karimian is the director of market optimisation at GridBeyond. He has 10 years of working experience in power and financial markets, including US wholesale electricity markets, retail power market, price forecasting and analytics, and the business landscape. Ali has a PhD in electrical engineering from UC San Diego, and a master’s in financial engineering from UC Berkeley.

Alden Phinney is a regional director at GridBeyond with over 10 years of experience in business development and data analytics for renewable and flexible energy portfolios. At GridBeyond, he partners with renewable energy asset owners and developers to maximise energy market revenues and savings across North American energy markets.

Read Ali and Alden’s previous Guest Blog, ‘What goes into successful energy storage bid optimisation in ERCOT and CAISO?’, published on the site in January 2025.