Ali Karimian and Alden Phinney of AI-powered energy services provider GridBeyond discuss winning strategies for playing battery storage into wholesale and ancillary markets in ERCOT and CAISO.

Battery energy storage systems (BESS) play an essential role in balancing grids with high renewable energy. BESS owners face a critical challenge: determining how to maximise profits by strategically participating in wholesale and ancillary markets.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Successful bid optimisation has emerged as a cornerstone of revenue maximisation. In a recent white paper, GridBeyond explored market trends in ERCOT, Texas, and CAISO in California impacting power storage and what makes a successful bid optimisation strategy.

It found that in ERCOT, battery storage revenues have dropped significantly in the past year due to factors such as increased battery installations, more renewable generation, and changes in how ERCOT dispatches the ancillary service ECRS.

Despite this, GridBeyond’s optimisation software was able to outperform competitors by up to 40% during peak market conditions of August 2024 in ERCOT, highlighting the importance of having a robust bidding strategy.

The revenue story

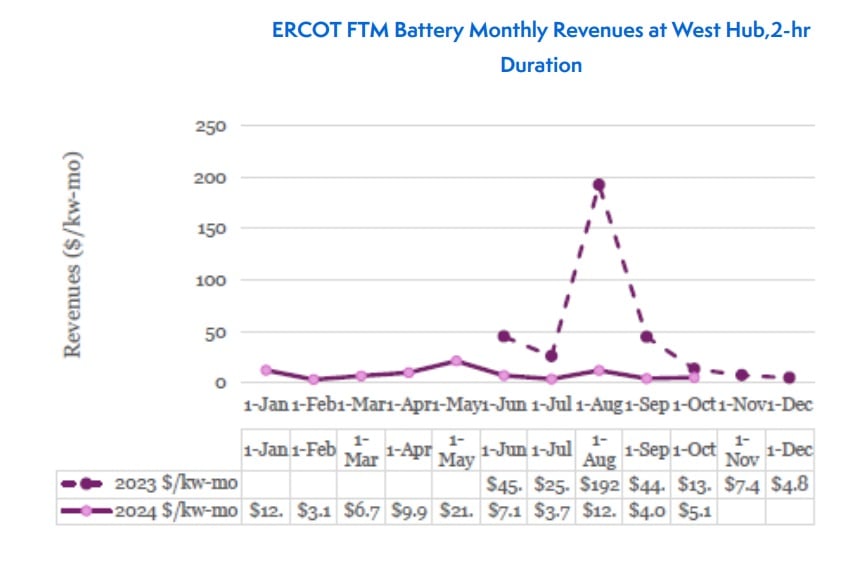

GridBeyond’s analysis centred on a two-hour duration battery as the benchmark, evaluated at key market points: the West Hub in ERCOT and SP15 in Southern California for CAISO. By standardising revenue data on a dollar-per-kilowatt-month basis, it offered a comparison of market dynamics across regions and timeframes.

It found that battery storage revenues in ERCOT have dropped significantly—down to just 5%-10% of the 2023 levels during peak months in 2024. Responsive Reserve Service (RRS) prices plummeted from US$120/MWh in 2023 to US$8/MWh in 2024—a 15-fold decrease.

The revenue drop in ERCOT has often been attributed to mild weather, including just one significant heat event (August 18-22, 2024). However, this explanation only scratches the surface. Both ERCOT and CAISO have seen substantial increases in solar generation capacity.

As renewable providers often bid at zero or negative prices, this expansion has reduced demand for conventional power, lowering net load and suppressing prices. In addition, rapid growth in battery installations has enhanced grid flexibility, reducing reliance on high-cost resources and mitigating price spikes.

The ERCOT Contingency Reserve Service (ECRS) was initially linked to price spikes in 2023. By reserving capacity for reliability, it created operational shortages that pushed prices upward. In 2024, regulatory changes under NPR 1224 adjusted ECRS dispatch strategies, stabilising prices. Enhanced Reliability Unit Commitment (RUC) protocols have ensured surplus generation availability, further suppressing real-time energy prices.

However, sharp transitions between solar generation and conventional thermal resources during morning and evening ramps (the “duck curve”) exacerbate supply constraints, increasing the likelihood of price spikes.

Texas’ burgeoning population as well as growth in data centres, cryptocurrency mines, and AI server farms are driving baseline demand upward, adding pressure to supply margins, while coal plant retirements act to reduce availability of baseload generation and heightens reliance on natural gas and renewables, leading to increased operational costs and higher price volatility.

The interplay between these factors emphasises the need for sophisticated market strategies to navigate competing pressures. Advanced bid optimisation strategies, backed by robust algorithms tailored to market conditions, are pivotal in determining outcomes.

Revenue optimisation strategies

Achieving optimal Profit and Loss (P&L) demands a sophisticated blend of strategic foresight, market expertise, and the application of cutting-edge forecasting tools. Success hinges on the ability to seamlessly integrate diverse strategies while remaining agile in response to dynamic market conditions.

Diversifying offerings between the Day-Ahead (DA) and Real-Time energy markets is an essential approach for exploiting price volatility. By including both physical and financial energy products in their portfolio, operators can respond more effectively to fluctuations across market segments.

This strategy enables participants to capitalise on the spreads between DA and Real-Time prices. The potential benefits are significant; some operators have reported monthly P&L improvements of up to 23% by broadening their market exposure and capturing price differentials.

Equally critical is the alignment of bid optimisation strategies with the capabilities of battery storage assets. In energy markets like ERCOT, characterised by high volatility, the ability to store energy during low-price intervals and discharge during peak price periods can be a game-changer.

This synchronisation between storage technology and bidding tactics allows operators to dynamically adjust their market participation to match prevailing conditions.

Another element is the use of tailored Real-Time offer curves; differentiating bids based on real-time conditions enables operators to maximise revenues by anticipating price peaks and strategically adjusting their offers. This approach requires an understanding of real-time price conditions and market patterns.

By fine-tuning their response to price signals, participants can capitalise on lucrative opportunities during price surges while limiting exposure during low-price intervals, ensuring a more balanced and profitable approach to market participation.

An in-depth understanding of regulatory frameworks is indispensable for maintaining compliance and gaining a strategic edge. Markets like ERCOT and CAISO each have their own unique rules, operational constraints, and policy evolutions, which directly impact market dynamics. Staying informed about these regulatory environments (such as ERCOT’s updates under NPR1224) allows participants to adapt their strategies proactively.

The pursuit of optimal P&L outcomes in competitive energy markets is a complex endeavor requiring a holistic approach. High-quality forecasting forms the foundation of effective participation. Markets are in constant flux, influenced by factors ranging from weather patterns to evolving energy mixes.

Identifying these patterns allows operators to adjust their tactics proactively, transitioning smoothly between different strategies as market conditions change. This adaptability ensures that participants can capture value in favorable scenarios while mitigating risks during challenging periods.

Both ERCOT and CAISO are poised for continued transformation and successful bid optimisation in ERCOT and CAISO hinges on understanding market nuances and leveraging advanced tools to navigate a rapidly evolving energy landscape. By embracing diversified offerings, aligning bids with storage assets, and employing real-time adjustments, operators can optimise their revenues and P&L outcomes.

Watch Energy-Storage.news’ sponsored webinar with GridBeyond on ERCOT and CAISO trading strategies, from November 2024.

About the Authors

Ali Karimian is the director of market optimisation at GridBeyond. He has 10 years of working experience in power and financial markets, including US wholesale electricity markets, retail power market, price forecasting and analytics, and the business landscape. Ali has a PhD in electrical engineering from UC San Diego, and a master’s in financial engineering from UC Berkeley.

Alden Phinney is a regional director at GridBeyond with over 10 years of experience in business development and data analytics for renewable and flexible energy portfolios. At GridBeyond, he partners with renewable energy asset owners and developers to maximise energy market revenues and savings across North American energy markets.