US-made battery energy storage system (BESS) DC container solutions will become cost-competitive with those from China in 2025 thanks to incentives under the Inflation Reduction Act (IRA), Clean Energy Associates said.

The solar and storage technical advisory firm revealed the forecast in its new quarterly BESS Price Forecasting Report for Q3 2023.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

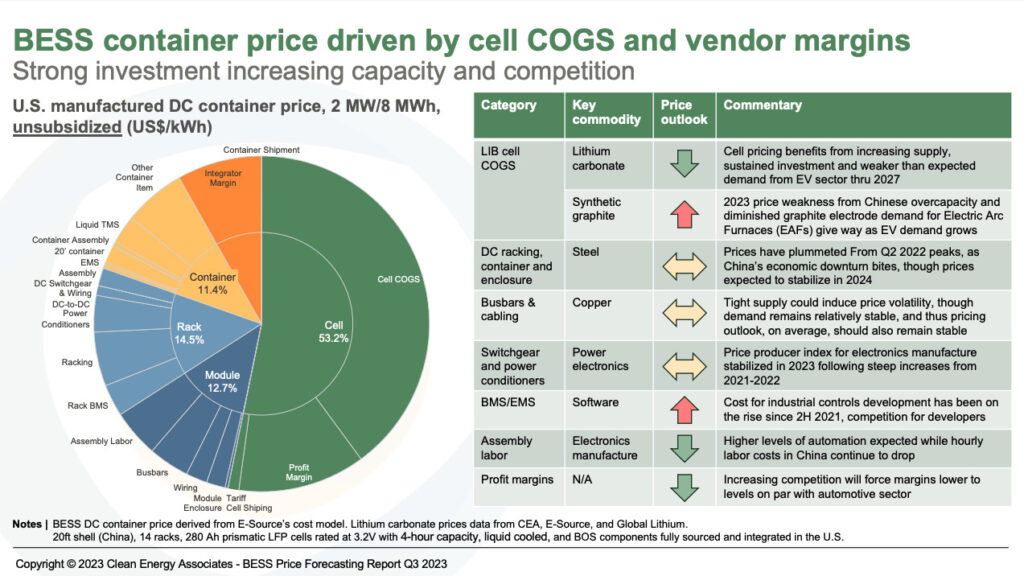

A DC BESS container fully manufactured in the US sits at an average price of US$256/kWh in 2023 for a 2024/25 delivery, while one manufactured in China for US delivery in 2025 sits at US$218/kWh, Clean Energy Associates (CEA) said. The latter includes a 10.89% Section 301 tariff for select Chinese goods.

The firm’s forecasts use the example of 20-foot container comprising 14 tacks of 280 Ah prismatic lithium iron phosphate (LFP) battery cells rated at 3.2V with a 4-hour capacity and a liquid-cooled system.

CEA said that if certain subsidies for US clean energy technology production brought in under the Inflation Reduction Act (IRA) are passed directly onto the customer, the US-made BESS price could fall by 13%.

These are the 45X tax credit for battery cell production, which pays US$35/kWh of production directly to the manufacturer, and the 30D tax credit for consumers buying an electric vehicle (EV) powered by a battery that meets minimum domestic content requirements around the cell and the critical minerals in it.

These will be possible once US manufacturing begins to come online at scale in 2025. As Energy-Storage.news has written previously, the IRA and its upstream incentives have led to a boom in manufacturing investments across clean energy including lithium-ion batteries and energy storage.

Those requirements for 30D are similar but separate from the US-made domestic content requirements for BESS projects to qualify for a 10% adder to the investment tax credit (ITC) for standalone energy storage, which can be monetised by those investing in the project.

The CEA’s report confirmed what Energy-Storage.news has been told anecdotally about BESS costs coming down in 2023 after the spikes of 2022, mainly driven by the soaring cost of lithium carbonate. Going forward, BESS costs will continue to follow the (mostly downward) trajectory of lithium.

Although the CEA didn’t reveal the exact figures in the sample of the report, its charts show that China-made BESS cost for US delivery has fallen by nearly 20% while the US-made BESS cost has fallen by around 9%.

The lithium-ion battery cells are around half of the cost of a containerised BESS solution, CEA added.

Currently, lithium iron phosphate (LFP) cells manufactured in the US cost 30% more than those manufactured in China, US$123.9/kWh versus US$78.7/kWh. However, the Inflation Reduction Act’s incentives could make US lithium-ion batteries the ‘lowest cost option worldwide’, CEA said.

See an infographic from CEA showing the BESS cost breakdown and the long-term price outlook for the different components making up a full solution.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.