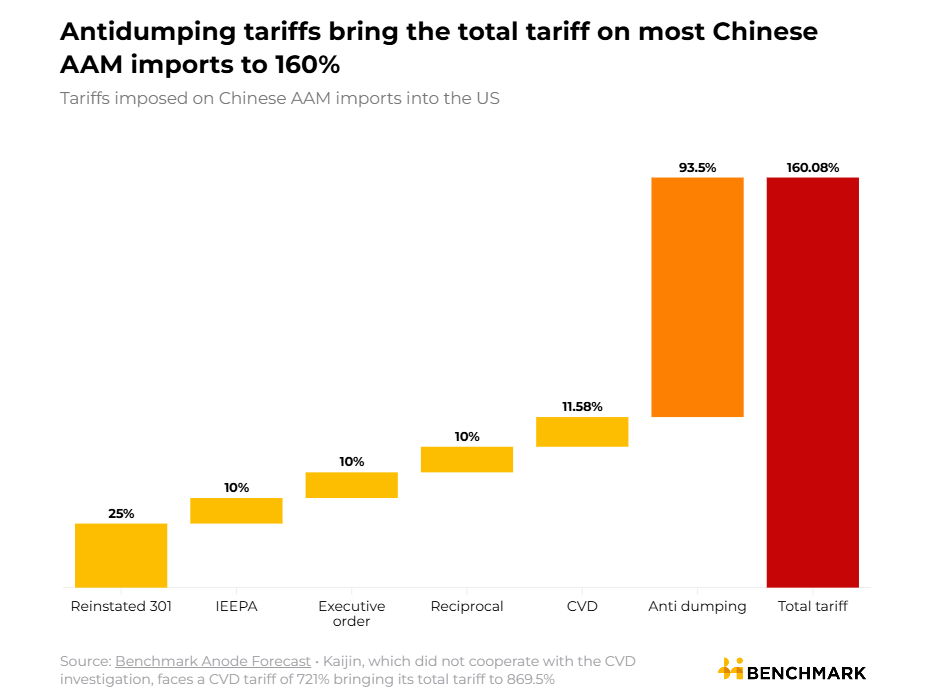

The US Department of Commerce has provisionally decided to impose anti-dumping (AD) tariffs on active anode material (AAM) product imports from China of 93.5%, bringing the total tariff on them to 160%.

The preliminary determination decision made last week (17 July) follows the petition for AD/CVD tariffs of a much higher 828-921% to be placed on AAM imports, brought by the trade body American Active Anode Material Producers (AAAMP) in December 2024.

Michael O’Kronley, CEO of AAAMP member Novonix, said in response to the news: “The decision today underscores the strategic importance of building a domestic supply chain for critical minerals, including synthetic graphite, in North America.”

A final ruling is due on 5 December, 2025, and the rate could change by then.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The tariff includes AAM contained within finished batteries but not finished battery energy storage system (BESS) products. Market intelligence firm Rho Motion pointed out that this means US BESS manufacturers and system integrators will be affected by it if they import batteries from China, but Chinese BESS manufacturers shipping finished products won’t be.

The ruling affects nine main AAM producers, and their key customers in the US are Tesla, Panasonic, SK On and Samsung SDI.

It brings the total tariff on AAM products to 160%, including previously-announced battery-specific and general China tariffs, illustrated in this useful chart from Rho Motion.

Rho Motion also estimated that this increases the effective import cost of Chinese AAM from US$3,700/tonne to US$9,300/tonne. By comparison, US-made AAM costs around US$5,400/t, making domestic material over 40% cheaper, it said.

The move by the US is part of its aim to build up its own battery manufacturing industry, with China today dominating the global market of lithium-ion batteries. Though the Trump regime is clearly anti-clean energy with its recently-passed One Big Beautiful Bill (OBBB) tax reconciliation bill, it appears to have accepted that batteries and BESS are a strategic industry and key to a reliable electricity grid.

Alongside largely keeping tax credit incentives for batteries and BESS, new rules on limiting technologies in projects from foreign entities of concern (FEOC), plus these tariffs, should in theory boost the US’ manufacturing industry.

However, the US’ ability to build up a supply chain completely untangled from China is limited, with a huge portion of the supply chain for upstream components and downstream materials based there. And China has recently responded with its own limitations on exporting this technology and know-how, as covered by our sister site Current, which today (23 July) transitions to the new title EV Infrastructure News.