Microvast is receiving more purchase orders from the US energy storage market than it can produce, the battery cell, pack and energy storage system manufacturer has said.

The company makes lithium-ion (Li-ion) battery solutions, and while targeting the electric vehicle (EV) sector for most of its business, it set up a US-based stationary energy storage division late last year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Microvast has just reported its financial results for the second quarter of 2023, reporting a year-over-year growth in revenues of 16.4% to US$75 million and a backlog of orders worth US$675.9 million, an increase of 541.9% from Q2 2022.

The growth in backlog was driven by “both the rapidly expanding energy storage business in the US and strong commercial vehicle demand in Europe,” according to chief revenue officer Sascha Kelterborn, speaking on a conference call to explain results.

The launch of a new product, a 53.5Ah nickel manganese cobalt (NMC) Li-ion cell, has also been well received by both the e-mobility and stationary battery energy storage system (BESS) sectors, the company claimed. Around 80% of the orders in its backlog are for the new cell, which has a claimed energy density of 230Wh/kg.

The US currently represents the smallest portion of Microvast’s revenues by geography. In Q2 2023, Asia-Pacific accounted for 86% of revenues, 62% of that in China, Europe 13% and the US just 1%.

However, Microvast is expanding its reach in Europe and US, and lessening its focus on the Asia-Pacific region. As explained in the company’s filings with the US Securities and Exchange Commission (SEC), Microvast wants to capitalise on those new regions’ growing EV and BESS demand.

Meanwhile average selling price (ASP) for its products tend to be higher in Europe and US, while customers in those regions are more likely to choose products based on quality or technology, rather than in China where Microvast said it faces tough competition from local manufacturers that produce at low cost, often backed by state entities.

Colorado ESS factory to capture domestic content incentives

CFO Craig Webster said in the call that while US revenues rose just 1% year-over-year for Q2, Microvast expected to report a rise in US revenues later in 2023 as it begins delivering equipment to a 1.2GWh BESS project in the US for an undisclosed customer.

The company has also been slower to recognise US revenues than it had expected due to a pivot in strategy, executives said.

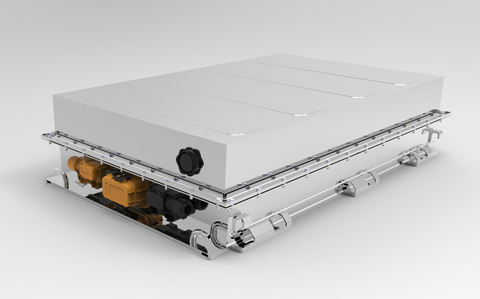

That’s partly because of a recent decision to build an energy storage system (ESS) assembly plant in Colorado, which was announced in July, as reported by Energy-Storage.news. Microvast’s 20-foot, 4.3MWh battery container product, ME-4300 ESS, will be assembled at the site.

Microvast opted for the Colorado plant due to the US Inflation Reduction Act (IRA) and the incentives for producing clean energy technologies domestically within the US that came with it, CEO Yang Wu said in the call.

“Due to the rule change related to how domestic content is valued as a part of [the] Inflation Reduction Act, we have decided to locate all ESS container assembly operations in the United States,” Wu said, with Microvast no longer carrying out the work from Mexicali, Mexico, as it had been originally planning.

The site in Windsor, Colorado will have an annual production capacity for 1,000 BESS containers. The site is currently being prepared to being assembly operations and deliveries to customers are expected to begin shipping in Q4 this year, CEO Wu said.

That target is a quarter behind the originally planned Q3 start date from Mexicali. The CEO said that although this means a pushback in Microvast’s ability to recognise revenues from its ESS business, the “short-term impact on booking revenues this year is far outweighed by ensuring our assembly facility put our customers and partners in the best position to claim the domestic content bonus credit”.

Those 1,000 containerised units per year represent roughly US$1 billion in revenues, CFO Webster said in response to an analyst’s question on the earnings call.

The analyst asking that question, Sean Miligan of financial advisory Janney Montgomery Scott, went on to also ask if Microvast was waiting on “some of the domestic content revision clarity” and whether customers were waiting to see what the advice from the government would be before committing to volumes of orders.

Wu said that not only was Microvast not waiting, the company was “working so hard to increase the capacity as much as possible,” and that at present, order numbers were greater than it could fulfil with its existing 2GWh battery cell and pack factory in China. Another 2GWh Microvast cell and pack factory is on its way in Clarksville, Tennessee, US and expected to also open its doors in Q4 2023.

“It’s a good problem to have,” Wu said, while CFO Webster said the company anticipated “further upticks in our backlog through the rest of the year supported by new energy storage and commercial vehicle projects, which would lead to very high utilisation rates on our new capacity expansions”.

Microvast was recently denied application for a US Department of Energy (DOE) loan worth an expected US$200 million to build a separator plant in the country. This was due to claimed links between the company and the Chinese Communist Party, which Microvast has denied.

Conference call transcript by Seeking Alpha.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.