Corporate investments in storage. Image: GTM Research.

US energy storage had a fairly quiet period in the third quarter of this year deploying just 16.4MW / 31.4MWh but enjoyed a record quarterly sum of US$660 million of corporate investment.

According to GTM Research’s latest US Energy Storage Monitor report, produced in conjunction with the national Energy Storage Association, venture funding and project financing, where disclosed, totalled the record sum and brought the annual total up to US$812 million.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This included US$300 million raised by inverter maker Tabuchi America for residential projects from the Electric Gas & Industries Association and US$200 million for Advanced Microgrid Solutions, closing its deal with Macquarie.

GTM analyst Ravi Manghani said that while this jump to US$660 million of project financing for the quarter does not constitute a trend in itself, it does appear to be “a harbinger for further strengthening of deployment business models”.

In late October, rival research firm Mercom Capital also reported the rise of storage project financing in the US, including those two big deals for Tabuchi and AMS, even as appetite from VCs appeared to have cooled by comparison.

“Financing activities in this most recent quarter are noteworthy not just because of the scale, but also because project financing made up a significant portion of the total,” GTM’s Ravi Manghani said.

Deployment drops but strong fourth quarter expected

For the quarter, deployment figures dropped 75% to 16.4MW compared to the equivalent period last year when 65MW was deployed, 14MW behind the meter and 51.4MW in front. This time around, just 2.3MW was deployed in front of the meter while behind the meter installations rose just slightly to 14.1MW. This was also down on the second quarter of this year, when 41.2MW was installed.

In megawatt-hour terms, 31.4MWh deployed in the quarter also meant a 43% drop from Q3 2015, when 55.1MWh was deployed. In the quarter just gone, this was split between 3.7MWh in front of the meter and 27.7MWh behind whereas in the same quarter of last year the US saw 26.3MWh installed in front of the meter and 28.8MWh behind it.

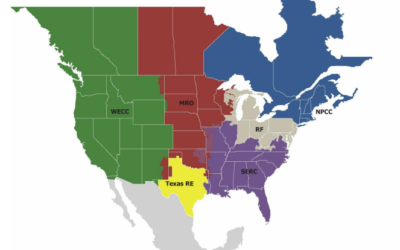

As stated in previous reports from GTM, the country’s two leading regional markets, in mandate-driven California and the grid-balancing frequency response market in the service area of transmission operator PJM still make up more than 80% of the total national market for energy storage. While PJM holds the top spot for utility procurement, this is expected to tip in California’s favour as several projects speedily awarded to counter the effects of the state’s Aliso Canyon gas leak come on line.

California's Aliso Canyon gas leak led to the expedited award of storage contracts. Image: GTM Research / ESA US Energy Storage Monitor Q4 2016. Image: GTM (map from California elections website.

State-by-state differences

GTM highlighted that those Aliso Canyon-related projects will total 84.5MW, variously coming on line in Q4 of this year and in the first quarter of next year. Samsung SDI and Tesla are the big battery-supplier winners of these project awards. Utilities Southern California Edison (SCE) and San Diego Gas & Electric (SDG&E) share these projects, all of which have four hours storage duration.

In terms of state-by-state policy developments, the biggest news was perhaps in New York, with New York City having implemented a 100MWh energy storage target by 2020, while at state level the New York Independent System Operator (NYISO), which oversees the reliability of electricity delivery and ongoing New York Reforming the Energy Vision (NY REV) programmes continued to overhaul wholesale markets and distribution structures.

Meanwhile Massachusetts and Oregon could also implement storage mandates. California, once again appeared to continue moving quickly, passing several bills that could encourage the uptake of energy storage. This included AB33, which directs the California Public Utilities Commission (CPUC) to examine the use of energy storage in renewable energy integration and AB2628, which further to the state’s existing mandate AB2514, which calls on investor-owned utilities to deploy 1.35GW of storage by 2022, added 500MW to the procurement.

At a federal level, GTM mentioned recent moves by the regulator, FERC (Federal Energy Regulatory Commission) to begin reforming wholesale markets to begin incorporating energy storage.

Other findings

In other findings from the report, over 90% of energy storage deployed was lithium-ion battery based (96.2%), with the second-placed technology, lead acid, holding just a 2.7% share in the market.

GTM also reiterated its previously made prediction that by the year 2021 annual deployments in the US will exceed 2GW, an eightfold leap from the expected 2016 total market size of 260MW. The share of that storage behind the meter will steadily grow from around a quarter this year to about half of the annual market in 2021.