A product launch at this year’s EESA Energy Storage Exhibition in China drew attention, discussion of price war and even disbelief, reports Carrie Xiao.

On 13 August, at the 2025 EESA Energy Storage Exhibition held at the Shanghai National Convention and Exhibition Center, a company’s quotation sent shockwaves through the industry and drew widespread attention.

Zhejiang Wocheng New Energy Co., Ltd. (Wocheng New Energy) released its new energy storage product, Starry Stone, debuting at the exhibition with an ultra-low AC-side quotation of RMB0.38 (US$0.053)/Wh.

The company also stated that the same price applies to residential storage, commercial & industrial (C&I) storage, and utility-scale storage. This price is far below the market average, instantly making it the exhibition’s focal point and sparking energy storage industry discussion about marketing tactics and the ethics of mounting price competition.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to China Energy Storage Alliance (CNESA) Datalink data, in H1 2025, the average winning bid price for 2-hour energy storage systems was RMB0.558/Wh, and RMB0.448 yuan/Wh for 4-hour duration systems. The lowest quote reached RMB0.398/Wh, almost 5% higher than Wocheng New Energy’s quoted price point.

As for the C&I storage sector, statistics from XunShang Research show that the average winning bid price for 2-hour C&I cabinet systems was RMB0.769/Wh, with prices ranging from RMB0.55 to 1.08/Wh. Wocheng’s quoted price is directly half of the industry average.

This is not the first instance of Wocheng New Energy offering storage at ultra-low prices. At the 2024 EESA Energy Storage Exhibition, Clou Electronics launched its Aqua-E series of C&I storage products, with the Grade A cells version priced at RMB0.598/Wh and the CATL cells version priced at RMB0.68/Wh.

Wocheng New Energy, however, directly quoted a price of RMB0.58/Wh and offered preferential terms of ‘Zero-yuan trial, six-month payment term,’ setting a new low for C&I storage cabinet prices at that time.

This time, the claim was even more staggering. Wocheng New Energy rolled out a marketing slogan – “Zero Downtime, Lifetime Warranty (where lifetime means 15 years).”

Staff from several energy storage companies, speaking at the 2025 exhibition, stated: “Unbelievable, our cell cost alone is about two mao (RMB0.2), it’s simply impossible to do it for three mao (RMB0.3) or so.”

‘Technological innovation, not price war’

Faced with doubts from various parties, Xu Yichen, Chairman of Wocheng New Energy, responded on-site: “Technological innovation leads to cost reduction; RMB0.38/Wh is not price war, it’s a technological revolution.”

Faced with doubts from various parties, Xu Yichen, Chairman of Wocheng New Energy, responded on-site: “Technological innovation leads to cost reduction; RMB0.38/Wh is not price war, it’s a technological revolution.”

According to Xu Yichen, the company pioneered an “underground” energy storage system that does not occupy ground space. The Starry Stone energy storage system is not placed on the ground but is applied under parking lots, underground, or underwater (using IP68 waterproof standard).

Because it is buried deep over 2 meters underground, the energy storage system has a low operating temperature and is less likely to catch fire, the company claimed. Consequently, this energy storage system does not require a fire protection system, thereby saving costs.

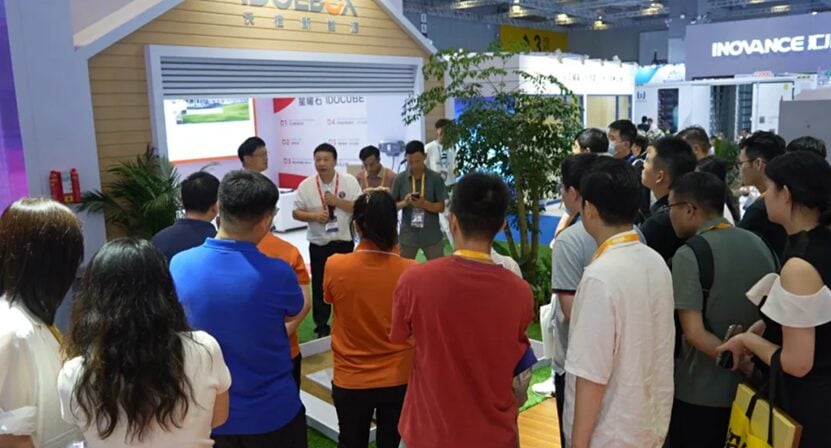

Wocheng New Energy chairman Xu Yichen responded to discussions onsite at the expo. Image: Wocheng New Energy.

Beyond low prices, Wocheng New Energy has also set “ambitious” goals.

Xu Yichen pledged: “By 2030, Wocheng will lead the formulation of national energy storage safety standards and international safety standards; build 20 smart production lines with capacity reaching 100GWh; incubate 100 small and medium-sized energy service providers, driving employment for 100,000 people in the industrial chain; implement 1,000 zero-carbon park projects globally, achieving cumulative carbon reduction exceeding 100 million tonnes.”

Wocheng New Energy is a very young company. Its official website shows that the company was founded in August 2022, with its headquarters located in Jiashan County, Jiaxing City, Zhejiang Province. Currently, it has a digital-intelligent factory in Jiashan County with an annual production capacity of 5GWh.

Energy Storage Leaders Alliance urges healthy competition

Facing the chaotic competition within the industry, the Energy Storage Leaders Alliance issued an initiative for the healthy development of the energy storage industry on the same day.

The alliance pointed out that the healthy industry development requires reasonable competitive order, and enterprises should focus on technological innovation, product quality improvement, and service optimisation, rather than engaging solely in price wars.

Excessive price competition will not only compress corporate profit margins, leading to insufficient funds for R&D investment and hindering technological progress, but may also trigger product quality issues, thereby posing potential risks to the safe operation of energy storage systems, according to the group.