‘Not all providers are equal’ and using different ones for the same project has not proved problematic when it comes to BESS project augmentation, an executive from investment manager Gresham House said.

Gresham House manages Gresham House Energy Storage Fund, listed under the GRID ticker on the London Stock Exchange. It is the UK’s largest battery energy storage system (BESS) owning entity.

The firm’s New Energy assistant fund manager James Bustin was discussing its busy augmentation activities this year, with over 300MWh being added to its UK portfolio – activity which has come at the expense of its first international foray, as he explained.

“Going international has always been the plan, but this year we prioritised our cash focus on delivering duration upgrades in the UK. Augmentation provided the greatest returns right away, so we pulled away from that initial project in California, though we have others on the list,” Bustin said.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

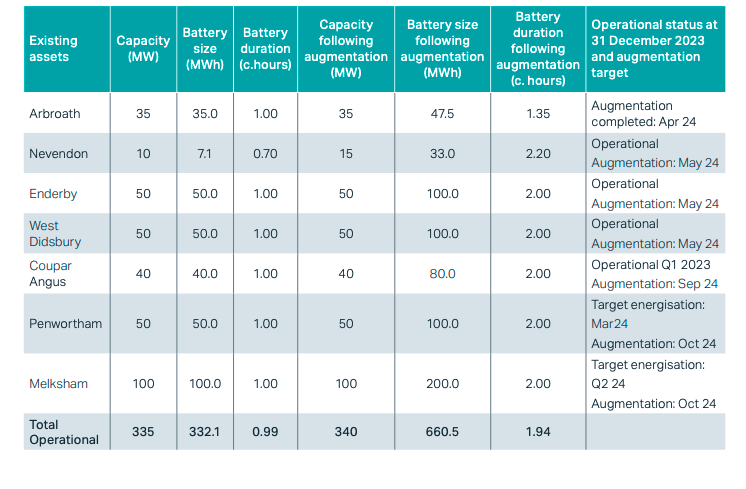

Between April and October this year, GRID is adding 328MWh of BESS capacity to seven existing projects, thereby increasing the average discharge duration of those projects from around one hour to around two hours.

The projects are Arbroath, Nevendon, Enderby, West Didsbury, Coupar Angus, Penwortham and Melksham.This table below, taken from the fund’s annual report, details the additions.

Bustin also discussed the company’s recent tolling deal with utility Octopus Energy, with those comments published in a separate article last week.

‘Using different parties does have challenges for augmentation’

The round of augmentations isn’t GRID’s first, after it turned most of its 30-minute duration sites – sometimes called 0.5C – to 1-hour ones, or 1C (1C meaning a 1:1 ratio between power and capacity) in 2018/2019.

“Each site has been designed with the idea of expanding, but there is never a pre-agreement with the provider. We’ve used two different battery types for the same project when augmenting and this is where our IP (intellectual property) comes in, having already done the augmentation five years ago which means we were familiar with the challenges,” Bustin said.

“The real advantage is around planning in advance, having the foundations laid for it. Having different providers for one project does have some challenges, but if you have experience augmenting it helps.”

“Not all providers are equal on this so we’re very careful about who we pick. Most parties should be able to deliver augmentation to some extent but we spent a lot of time choosing parties appropriately.”

He added that installing new BESS capacity can either involve adding that capacity ‘behind’ the inverter – what some might call DC augmentation – or ‘at’ the inverter – AC augmentation.

The latter potentially involves adding more more power conversion systems (PCS) alongside the additional BESS capacity which adds cost, while the former primarily involves shuffling existing BESS capacity behind inverters to maximise their usage.

The only of the seven projects above to have had its power capacity increased, which presumably required new PCS, was Enderby, going from being a 10MW/7.1MWh system to a 15MW/33MWh one.

System integrator Wärtsilä Energy Storage & Optimisation went into detail on augmentation in a technical paper for an edition of Solar Media’s PV Tech Power journal last year.

Bustin: “You can have different battery containers behind one inverter, if the control system is advanced enough. In our situation we’ve pooled like-for-like containers behind the inverter. In others we’ve done a sort of hybrid of the two types of augmentation.”

He also said that BESS solutions which provide both batteries and PCS integrated into one 20-foot container, increasingly popular so-called ‘AC blocks’, created a challenge for augmentation by limiting flexibility on design and structure. In other (admittedly very different) markets, like Chile, IPPs have said the opposite.