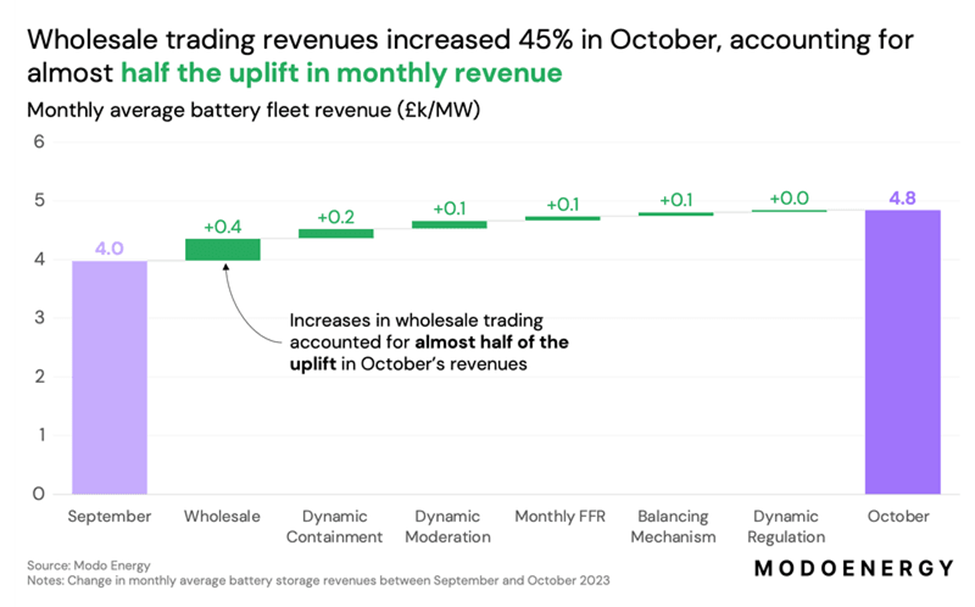

Wholesale trading revenues for UK battery storage systems grew 45% month-on-month in October, accounting for half of revenue growth according to Modo Energy.

Wholesale trading revenues rose by 45% from September to October, reaching their highest level since December 2022, the market analytics platform said.

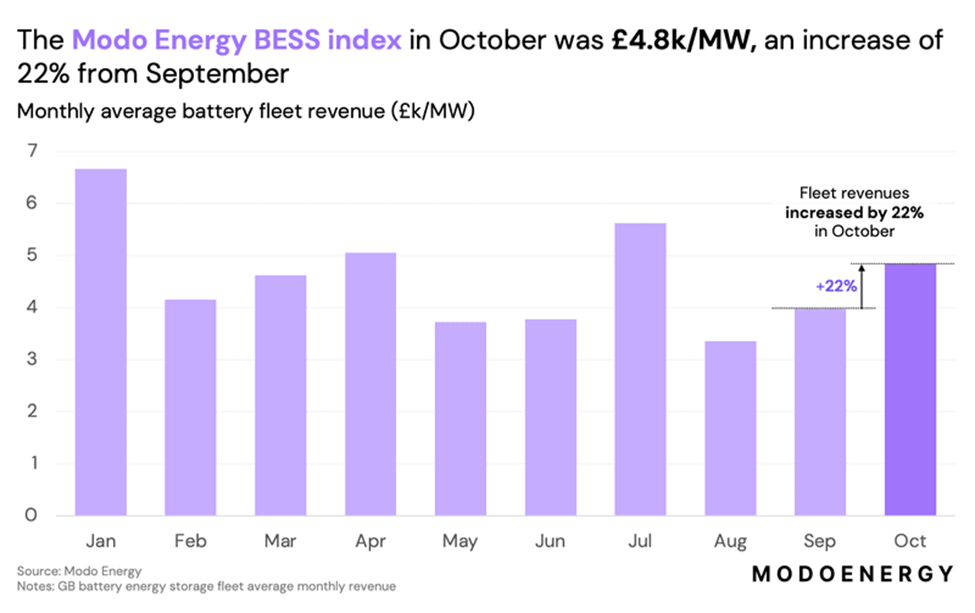

Overall, monthly average battery storage revenue rose by 22% from September to October to £4.8k/MW (US$5.9k/MW). This follows battery revenues increasing by 19% from August to September.

Average revenue for UK batteries under 1.5 hours and over 2.5 hours in duration stood at £4.3k/MW and £6.2k/MW respectively.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Equivalent to £57k/MW/year, the 22% increase saw October deliver the fourth-highest revenues this year so far, added market lead analyst at Modo, Wendel Hortop.

Following a dip in August, these figures show a welcome increase in battery storage revenues following the impressive 53% increase seen between June and July.

The increase in trading revenues followed a 32% rise in trading spreads to £100/MWh on average which, Hortop said, was mostly driven by sustained high wind generation in October. This is the second consecutive increase of 32%.

Gas prices also rose by 17% month-on-month in October, contributing to the rise in trading spreads.

Energy trading starting to make up for UK ancillary service saturation

As Energy-Storage.news has previously written, revenues for UK battery storage projects have crashed year-on-year in 2023 after higher-than-expected performance in 2022 as the saturation of ancillary service markets like FFR (Firm Frequency Response) started to have an impact.

Sources in the market recently said this has led to a fall in the prices that developers are getting for early-stage or ready-to-build (RTB) projects while the share prices of the three listed energy storage funds have fallen substantially over the year, as we recently wrote (Premium access).

See the original version of this article on our sister site Current.