Ofgem, the UK’s energy market regulator, is considering raising the minimum duration of technologies eligible for a long-duration energy storage (LDES) support scheme.

The British government’s energy ministry, the Department for Energy Security and Net Zero (DESNZ) confirmed last October that a cap-and-floor scheme to encourage investment in LDES deployment would be introduced, underwriting revenues to give investors and developers more certainty.

Subsequently, Ofgem, tasked with designing its mechanism, launched a call for stakeholder input over the last few weeks of 2024.

In doing so, the regulator published an open letter hinting that changes could be made to some of DESNZ’s original proposal for the scheme, which was first put out early last year. Ofgem also gave new clarity on requirements and outlined its thinking.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

While DESNZ had suggested a 6-hour minimum discharge duration to be a defining characteristic of LDES, Ofgem said it is considering raising that to an 8-hour or 10-hour threshold.

In a blog for our UK sister site Current± earlier this week (6 January), Energy-Storage.news writer Cameron Murray looked at updates and the latest stakeholder proposals.

‘Short-duration storage fails to meet energy system needs even during this decade’

As of mid-2024, the UK’s operational battery energy storage system (BESS) installations had reached a cumulative 4.6GW/5.9GWh, according to Solar Media Market Research. As the megawatts to megawatt-hour output-to-capacity ratio demonstrates, this installed base is predominantly systems of 1-hour duration or less, although the market is trending toward 2-hour systems as standard.

This is a function of most of the market’s early opportunities in ancillary services, such as frequency regulation, which require relatively short bursts of power injected into the grid. A saturation of those opportunities is leading to an increase in durations as developers and investors instead base their revenue-stacking business models around energy trading.

The cap-and-floor scheme on the other hand aims to promote technologies that help cover much bigger gaps in electricity supply and demand that will likely occur on a grid based on higher shares of variable renewable energy (VRE).

Stephen Crosher, CEO of proprietary ‘high-density pumped hydro’ LDES technology firm Rhe Energise, was among sources spoken to for this week’s Current± blog. Crosher said that a well-designed LDES scheme could correct a potential market imbalance.

Rhe Energise provided input to the Ofgem call, and Crosher told Murray that raising the duration threshold could prevent a “‘land grab’ of capacity (short-term durations) that is financeable today but fails to meet system needs even at the end of this decade.”

Global context

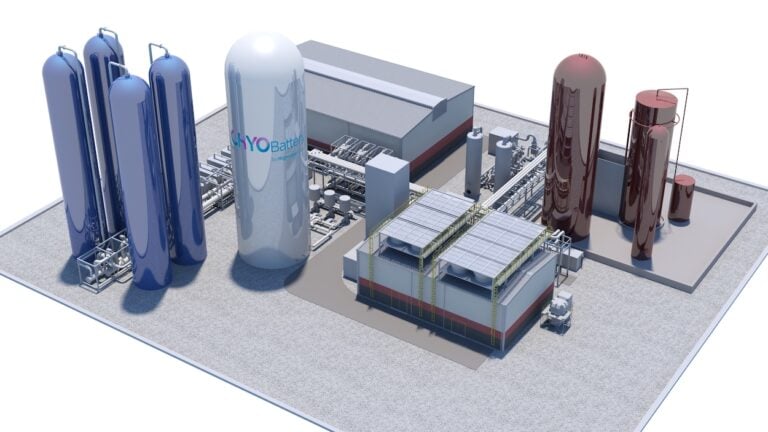

It remains an open question whether lithium-ion (Li-ion) would be explicitly denied eligibility. Still, the raised threshold might be a means to allow other technologies—for which Capex may be higher than lithium but for which storage capacity can be scaled up at a lower levelised cost—from pumped hydro to flow batteries and others like liquid air energy storage (LAES), to compete.

The US Department of Energy (DOE) defines LDES as ‘storage systems capable of delivering electricity for 10 or more hours in duration.’ Meanwhile, its Energy Storage Grand Challenge programme seeks to accelerate cost reductions in storage tech with discharge durations of up to 100 hours.

In some of the early real-world examples of long-duration procurement at scale, run by the California Energy Commission (CEC) in the US, and by the government of New South Wales (NSW) in Australia, the threshold had been set at an 8-hour duration.

So far, the majority of those solicitations have been won by 8-hour duration Li-ion BESS project bids.

Read the Current± blog, ‘Focus on system benefits’: Ofgem call for input on LDES scheme shows evolving requirements