The UK and Ireland’s energy storage pipeline is rapidly growing, with co-located solar PV and storage comprising around 20% of planned capacity, writes Mollie McCorkindale of Solar Media Market Research.

The energy storage market in the UK is currently experiencing substantial growth, as evidenced by the current operational capacity of 4.6GW/5.9GWh, projected to increase to 7.4GW/11.6GWh by the end of 2024.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The installed capacity is consistently rising each year, attributable to a notable upsurge in both submitted and approved planning applications.

Similarly, energy storage that is co-located with solar farms in the UK is following a similar trend, with 312MW/465MWh currently in operation. It is anticipated that this capacity will increase to over 1GWh by the end of 2024.

Planned energy storage co-located with solar PV projects in the UK

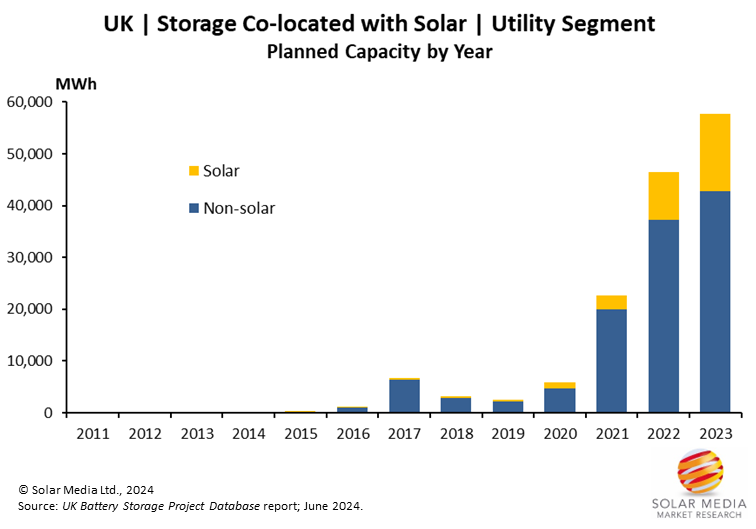

The graphic below displays the total planned capacity (including projects from screening/scoping to under-construction) in MWh of energy storage in the UK by year, with the capacity co-located with solar shown in yellow.

During the initial stages of the planning process, many developers only provide quotes for the megawatt (MW) capacity being developed. Therefore, we have estimated that most of these projects will have a duration of at least 2 hours. However, it’s important to note that as energy storage technology advances, these estimates could end up being higher.

Looking at the graph above, the energy storage market saw initial activity in 2015, followed by a surge of applications in 2017. Subsequently, there was a slowdown for a couple of years; but since 2019, there has been a significant year-on-year increase.

The surge in 2017 can be attributed to the successful EFR (Enhanced Frequency Response) auction in 2016, which encouraged developers to submit applications. The recent growth is driven by the successful approval and completion of previous projects, as well as by the increase in average project size.

The total planned capacity for 2023 is almost 60GWh. This year-on-year increase is expected to continue into 2024, as large-scale projects – including those already in the TEC register – are being submitted into planning.

The total planned capacity for energy storage projects in the UK is 85GW/175GWh, including any submissions to local planning authorities, whether they are full applications or scoping/screening applications.

Of this total, 20% comes from storage capacity co-located with solar sites, with the proportion of this increasing each year. In 2023, over 25% (15GWh) of the total capacity comes from storage co-located with solar sites.

Additionally, in 2023, Innova Renewables submitted a project (co-located with 49.9MWac of solar), with a storage capacity of over 1GW (and likely to have a duration of at least 2 hours). This is the largest co-located storage project submitted so far in the UK.

Submitted, approved, and built UK capacity

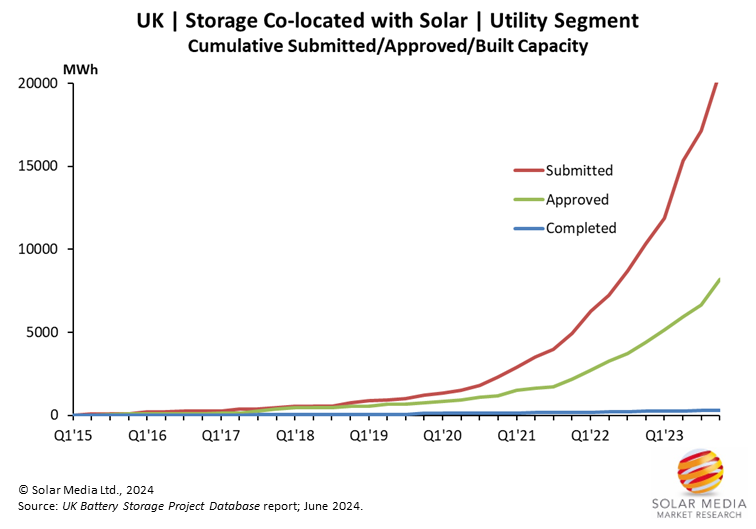

The next graph (below) illustrates the cumulative submitted, approved, and built capacity of energy storage systems co-located with solar. The submitted capacity represents projects that have submitted a full planning application.

Currently, the total operational capacity for energy storage in the UK stands at 4.6GW/5.9GWh, and this is anticipated to double in the next couple of years, with 4.9 GW/10GWh of projects under construction.

Of the operational capacity, 312MW/465 MWh is from storage co-located with solar sites, with 430MW/680MWh currently under construction.

Applications for these types of projects mainly started in 2014, but substantial growth in capacity began in 2016. Significant market activity was observed in 2019 as the capacity started to increase rapidly each quarter.

The submitted capacity for storage co-located with solar has exceeded 20GWh, with the approved capacity now at 11.5GWh, and 3GWh of this capacity approved so far in 2024.

There is a clear correlation between the submitted and approved capacity. However, it is anticipated that the built capacity will start to surge soon, similar to the rapid increase in deployment levels witnessed in the total energy storage market.

Build closure status of energy storage projects co-located with solar PV

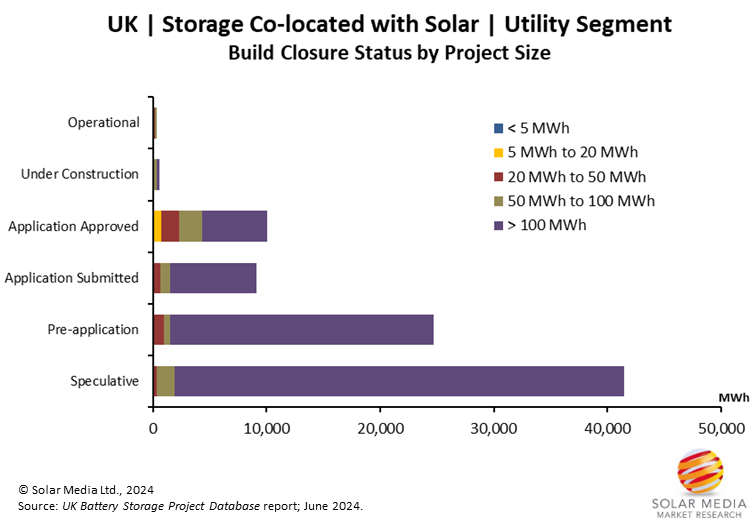

The graphic below illustrates the status of the construction for energy storage facilities located alongside solar projects, based on their capacity in MWh.

Most of the early-stage projects – particularly those in the “Pre-application” stage, and “Speculative” projects – are estimated to have a 2-hour duration, which is likely to increase as technology advances. The “Speculative” projects primarily consist of sites from the Transmission Entry Capacity (TEC) register, and many of these projects have connection dates scheduled for 2030 and beyond. It is uncertain which of these sites will actually proceed to the construction phase.

The total market capacity for storage co-located with solar amounts to 43 GW / 86 GWh. Excluding the “Speculative” projects, the capacity comes to 22 GW / 45 GWh, representing projects that are either in the planning process or construction phase. Until now, most of the operational capacities for storage with solar have been less than 50 MWh, with the majority coming from projects with capacities less than 5 MWh.

Projects in the “Application Approved” phase showcase a variety of sizes, with some ranging from 5 to 20 MWh. However, capacities in the earlier stages of development, including “Application Submitted” projects or “Pre-application” projects, are almost all larger than 100MWh.

At present, 380MW/600MWh is already under construction, with a substantial amount of additional capacity to follow, including 5.2GW/11GWh that has been approved in planning. Given that it takes 2-3 years from application approval to final commissioning, it can be expected that this operational capacity will increase significantly in the future.

Ireland’s co-located energy storage and solar

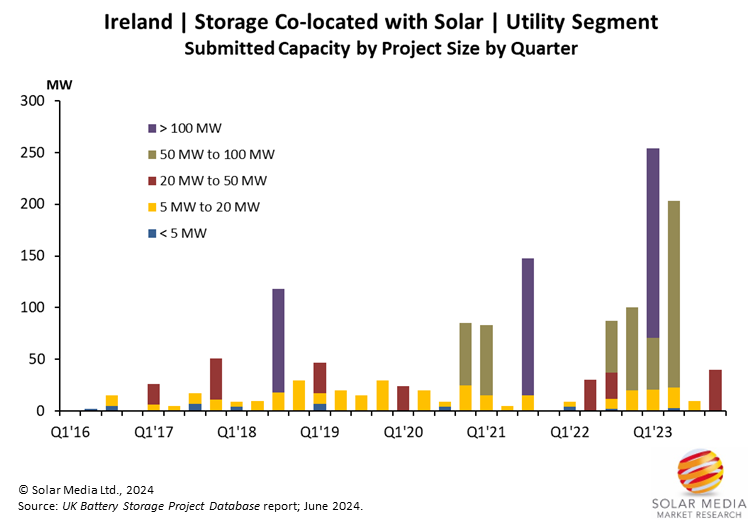

Moving on to Ireland, the next graph shows the capacity of energy storage co-located with solar in the country, segmented by project size and quarter. The submitted capacity in 2023 was the highest since the market began.

In Ireland, the planning process does not require pre-applications; as such, the graph above represents only full applications submitted.

The graph uses MW instead of MWh because it’s still early days for Ireland, making it difficult to estimate the duration of the projects.

Currently, the total operational energy storage capacity in Ireland is over 700MWh, with only 36MWh of that coming from storage capacity co-located with solar PV sites.

The fluctuations and random spikes in the graph are due to larger-than-normal projects being submitted at different times. Despite this, the graph still indicates a trend of increasing yearly submitted capacity, with 2023 showing the largest amount.

Ireland is following a similar trend to the UK in terms of storage co-located with solar, with 20% of the total planned energy storage capacity in Ireland being allocated for sites co-located with solar.

46.4GWh of co-located storage in UK and Ireland’s combined pipeline

In conclusion, the energy storage market in the UK and Ireland is rapidly growing, and this growth is expected to be followed by an increase in energy storage projects co-located with solar energy facilities.

In the UK, the storage co-located with solar market has a pipeline of 22GW/44 GWh (excluding speculative projects), with most of this expected to be operational by 2030. In Ireland, the storage co-located with solar market has a pipeline of 1.5GW/2.4GWh, and this is steadily increasing.

All data and analysis shown in this article comes from our in-house market research at Solar Media Ltd. Full details on how to subscribe to our UK Battery Storage Project Database Report and Republic of Ireland Battery Storage Project Database Report can be found here.