We hear from Chris Wickins, technical director at UK-based battery storage developer-operator Field about how the grid interconnection question and market mechanisms are developing in Europe’s most advanced energy storage market.

The company was founded in 2020 by CEO Amit Gudka, previously head of retail utility Bulb which collapsed and was acquired by Octopus Energy in 2022 (it was the largest utility in the UK to tumble in the face of soaring natural gas prices).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

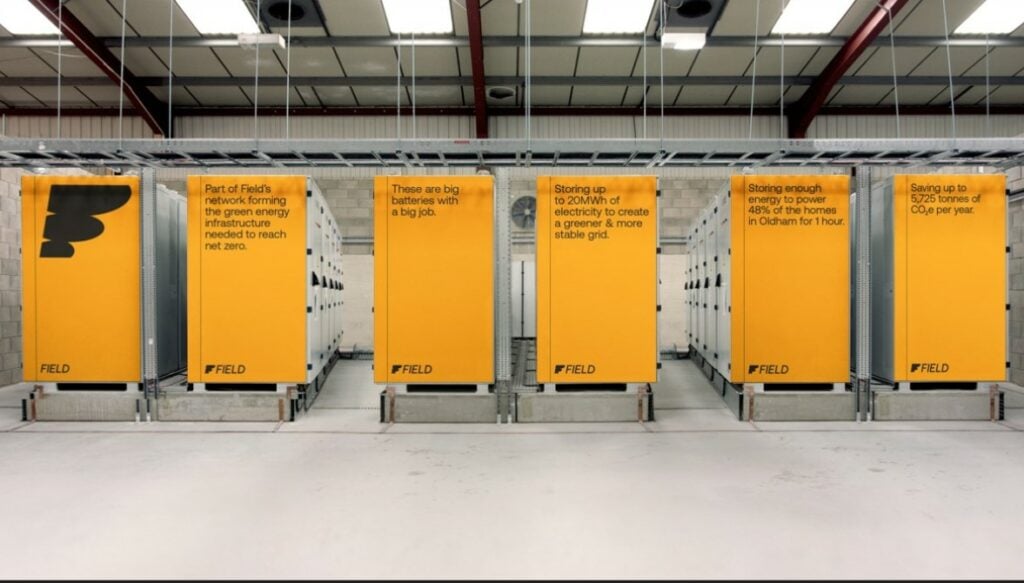

Field primarily operates in the UK where it has a 20MWh battery energy storage system (BESS) project online in Oldham, northern England, and several more under construction across the country. It is also targeting Spain, Germany and Italy, where country head Emanuele Taibi talked to Energy-Storage.news for a special feature on the Italian market for a recent edition of our quarterly journal PV Tech Power.

In this interview, Wickins discusses two important parts of how the UK market and the approach of transmission system operator (TSO) National Grid are developing: grid interconnection and market mechanisms for energy storage.

“There’s lots of appetite in the UK market and the conversation has moved on, rightly so, to how we facilitate getting to our deployment goals as a country. Particularly questions around how can we connect all these new assets to the grid and how can we maximise their usefulness. Across Europe it’s definitely an earlier picture,” Wickins says, with the firm’s experience in Italy so far providing a useful comparison.

Grid: backlogs, queue management and smart planning

As Energy-Storage.news‘ sister site Current has written extensively, one of the big challenges in the UK market is long wait times to connect projects to the electricity grid. There are more BESS projects being developed and put into the queue than grid connections, network capacity or engineers to integrate them, Wickins says.

“This overflowing queue has been borne out of a couple of things. It’s been very cheap to apply to connect to the network, you’ve really had to do nothing in advance of that – the developer approach has been to secure a grid connection then do everything else,” he says.

“In Italy, it’s different – you can’t apply for a grid connection until you have some land secured for your project. That’s more onerous and might take you three to six months to secure that so it turns the development process the other way around, but it slows down the connections being applied for as you won’t get people applying without adequate land.”

“National Grid is now changing the rules and you’ll need a short letter from a landowner saying they are in discussions with you about a project on their land, though we at Field think it should go further. Something like a legally binding option agreement for the land or at least exclusivity terms having been agreed, for example.”

The other aspect of getting projects into the ground more quickly is around queue management; ensuring projects within the interconnection queue are assessed based on how likely they are to be built and not just who joined the queue first.

“There’s been positive movement recently in the direction of queue management too, in terms of telling projects that aren’t moving forward to get out of the queue and to let those behind them that are moving forward to come forward. Queue management is really important and we at Field are very supportive of what’s been done in the last few years.”

A final aspect of the solution is called ‘construction planning assumptions’ which is about not treating energy storage like it is always exporting when modelling its effect on the grid.

“National Grid are changing these assumptions to treat batteries in their analysis more in line with how they will operate, and that should free up the potential to connect batteries earlier.”

“These things mean it’s now a totally different picture to if we had had this conversation around grid a year ago. Lots of good work has been done over 2023 on this,” Wickins adds.

National Grid recently appointed global assurance and risk management provider DNV to assess the potential of taking out energy projects in the interconnection queue it has deemed “high-risk”, totalling 29GW. DNV will assess projects and assess how likely they are to get built which will involve asking developers if they have achieved certain milestones.

Wickins: “It will be interesting to see how that works in practice. You can imagine National Grid liking the idea that someone independent will make the judgement. And if you are a developer trying to cling on to your project you’ll argue tooth and nail that you are nearly there on X, Y and Z. It’s going to be a hard job, but DNV is used to doing this sort of thing.”

Market mechanisms: frequency, reactive power, BM, inertia and Grid Boosters

The discussion moves on to how market mechanisms need to be further developed in the UK to facilitate the deployment of the energy storage the country needs.

“Generally speaking, think we’re in a very good position when it comes to providing frequency services. There’s been a big overhaul of that market and it seems to be working well, National Grid has driven down prices quite successfully,” Wickins says, adding there is good work being done in some areas and work still to do in others.

One area where Wickins says National Grid is leading the world on with BESS is inertia, through its Stability Pathfinders tender.

Other areas need more work. After complaints earlier in 2023 about BESS’ treatment in the Balancing Mechanism, a revenue stream many hoped would make up for falls in frequency service prices, Wickins says there is “good visibility of progress” there as well as the introduction of the Open Balancing Platform.

One current problem is that National Grid doesn’t have a signal telling it the state-of-charge (SOC) of a BESS or how long it can be used for, and if this was rectified the TSO would be using BESS with a lot more confidence.

Reactive power, which means providing power to help manage voltage, is a market which exists at the transmission-level but not at the distribution-level which he calls a “missed opportunity” as there are BESS which could provide that service.

A 100MW, transmission-connected project from developer-operator Zenobe Energy claimed to be the first to do this.

A market mechanism for large-scale BESS seen elsewhere that has caught Wickins’ eye is so-called Grid Boosters in Germany, Lithuania and elsewhere. The basic principle of these is setting up large BESS either side of a high-voltage transmission line to mimic the power flow of the line if it ever goes down, reducing the need for a second, expensive backup line.

“It’s an exciting idea that is not really being talked about in Great Britain (GB). It’s complicated and there’s some really detailed power system engineering that’s gone behind it because things happen on a very short timeframe, and what they are doing in Germany is quite impressive,” Wickins says.

“It may be possible that if we had 2.6GW of batteries in Scotland and 2.6GW in England maybe National Grid wouldn’t be turning off 2.6GW of wind today, which is happening as we speak (Wickin is speaking with the site in early December 2023 – Editor).”

“These wouldn’t even need to be dedicated BESS but they would need to be the right type of very fast-acting batteries.”

Wickins adds that he wouldn’t see a contract for difference (CfD), or other cap-and-floor, or feed-in tariff as appropriate market mechanisms for energy storage.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.