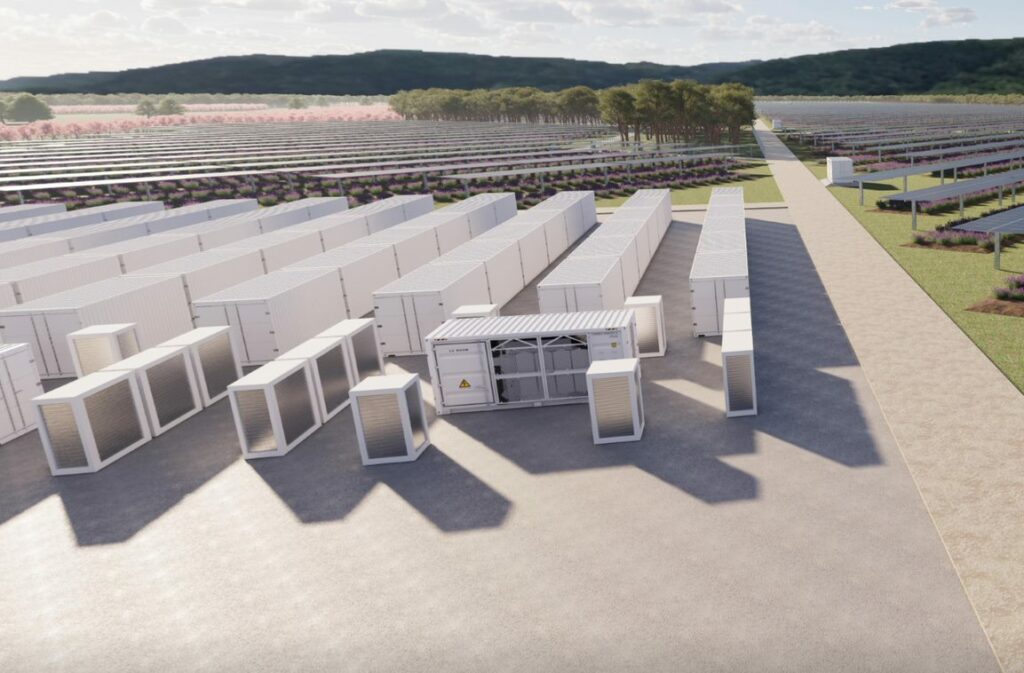

The grid-scale energy storage market in Italy is set to become one of the most active in Europe in the next few years having been close to non-existent until now.

Research firm LCP Delta recently forecast that after annual grid-scale deployments of just 20MW in the last few years, Italy would deploy 800-900MW in 2023/2024, second in scale only to the UK.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In this piece, we interview executives from three developers looking to gain a foothold in the market: Aquila Clean Energy, Field and Innovo Group.

This is an extract of a feature which appeared in Vol.35 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Since it went to press, regulators in Italy approved new auction rules for grid-scale storage and gave the green light to a 200MW/800MWh battery energy storage system (BESS) project from UK developer Aura Power, while Eni Plenitude brought a 15MW BESS online.

Transmission system operator (TSO) Terna says that some 94GWh of new energy storage will be needed to integrate the country’s renewable energy pipeline, although this may include some pumped hydro energy storage (PHES).

“Mainstream, recognised and with more players coming in”

“In 2020, storage was not on the radar of many players but it is now moving mainstream in Italy as it has done in the UK, Germany and elsewhere, because of similar factors to those countries,” says Kilian Leykam, Investment Manager Battery Storage for Aquila Clean Energy. which announced plans to develop battery storage projects in Italy in early 2022.

“There is a recognition that renewables need to be deployed a lot faster and that gas is a bad way to provide flexibility to the grid and manage peak demand.”

With that came a policy recognition from Terna last year that it needed energy storage to achieve that. In February 2022, just before it handed out over 1GW of capacity market contracts to battery storage projects, the TSO called the technology the “indispensable new lungs of our electricity system”.

UK battery storage developer Field has since announced plans to join Aquila in the market, with the setting up of an Italy office and the appointment of Emanuele Taibi as country manager.

Rodolfo Bigolin is CEO of Innovo Group, which last year formed a 50:50 JV – iCube Renewables – with Spanish utility Iberdrola to deploy solar, wind and also battery storage projects in Italy.

He says the recognition that storage is needed to integrate Italy’s big renewables pipeline has been combined with a capital market which is now more comfortable with and willing to invest in energy storage.

“Last year was the first in a decade where we saw a real, multi-gigawatt renewable energy development market take shape. The regulatory environment has been trending towards a really strong deployment of renewables, and then once you’ve got that of course you need storage,” Bigolin says.

Field’s Taibi dives into the specifics of the regulatory changes. The regulator’s consultation 393 from 2022 outlines a specific mechanism dedicated to energy storage to be procured via auctions run by Terna, the TSO, he says.

With the mechanism’s rules approved, Terna will now consult with the industry, allowing stakeholders and operators to comment on the proposed new auction system. This timeline means the implementation of the new regulation – and the first energy storage auctions carried out by Terna under it – should take place in late 2023/early 2024, Taibi and Bigolin both say.

The revenue opportunities in Italy

The market opportunity in Italy started similarly to the UK, as Aquila’s Leykam explains.

“The market started with the fast reserve auction which gave the initial impetus to start the battery business case, with fixed revenues for the first five years, similar to the first UK FFR auctions which also provided firm revenues over several years,” he says.

The fast reserve auction in Italy took place in late 2020 and saw five-year contracts to provide the service awarded to 250MW of battery systems, for the years 2023-2027. The auction’s biggest winners were Enel and France-headquartered utility Engie.

However, the fast reserve auction does not look set to be repeated, Leykam adds. Most future business cases for energy storage in Italy are now being structured around the capacity market plus energy arbitrage, unlike most of Europe where ancillary services are the main share.

Batteries won substantial contracts in the February 2022 capacity market auctions by Terna, which gave 15-year contracts for 2024 as the delivery year. Enel alone won over 1 GW of battery storage projects through this, 93% of the total storage capacity awarded, which it has started building in Q2 2023 as mentioned previously. Of the total, 500MW is in Sardinia.

Taibi says this quantity of battery storage winning capacity market contracts came as a bit of a surprise to everyone, and was driven by the impressive capex reduction the technology had achieved in the years leading up to it.

The almost immediate upturn in capex costs in the sector afterwards might have caused “a bit of an issue”, he adds, although it did trigger a commitment to deploying a significant amount of energy storage in the country by the government, regulator and the TSO.

Geographical differences and Italy ‘skipping a step’ in storage durations

All interviewed agreed that battery storage projects located in the South, where the bulk of Italy’s solar PV pipeline is located, would focus on time shifting, while the North might be more focused on grid services.

Bigolin says battery storage projects will have five or six different revenue streams and these will depend not only on the region, but the node at which the project is connected.

With a different revenue stack, Italy looks set to move to medium discharge durations of four-eight hours much faster than the UK or German markets did at a comparable point of development.

Terna is envisioning an average discharge duration for energy storage on the grid of eight hours by 2030, weighted between battery energy storage and pumped hydro.

The role of BESS providers, EPCs and optimisers

Despite the quicker move to medium or longer discharge durations, all interviewees say that initial projects would use lithium-ion technology.

Girolami highlights Fluence, the largest battery storage system integrator in the world, as a potential big player in providing BESS technology for projects in Italy. The firm is deploying one of the projects which Enel will use to service its fast reserve auction wins. Girolami also highlights the China-based BESS providers Sungrow, Huawei and CATL.

Last year, competitor Nidec ASI announced orders from Italy of 1.35GW/5.4GWh by an unnamed company. Interestingly, the details and timeline closely match up with the projects being deployed by Enel. Spain-based energy conversion equipment specialist Ingeteam is deploying a 70MW/340MWh project for, again, an unnamed company, set to come online in 2023.

Conclusion

It’s an exciting time for those looking to gain exposure to Italy’s grid-scale market which has, until now, been virtually non-existent as some interviewees say. Battery storage projects have a wealth of opportunities to target, from ancillary services to capacity markets to energy trading, and developers are now positioning projects to best take advantage of these.