Battery storage operators in the UK could be set for a raft of new opportunities after the country’s system operator National Grid called for a review of security standards.

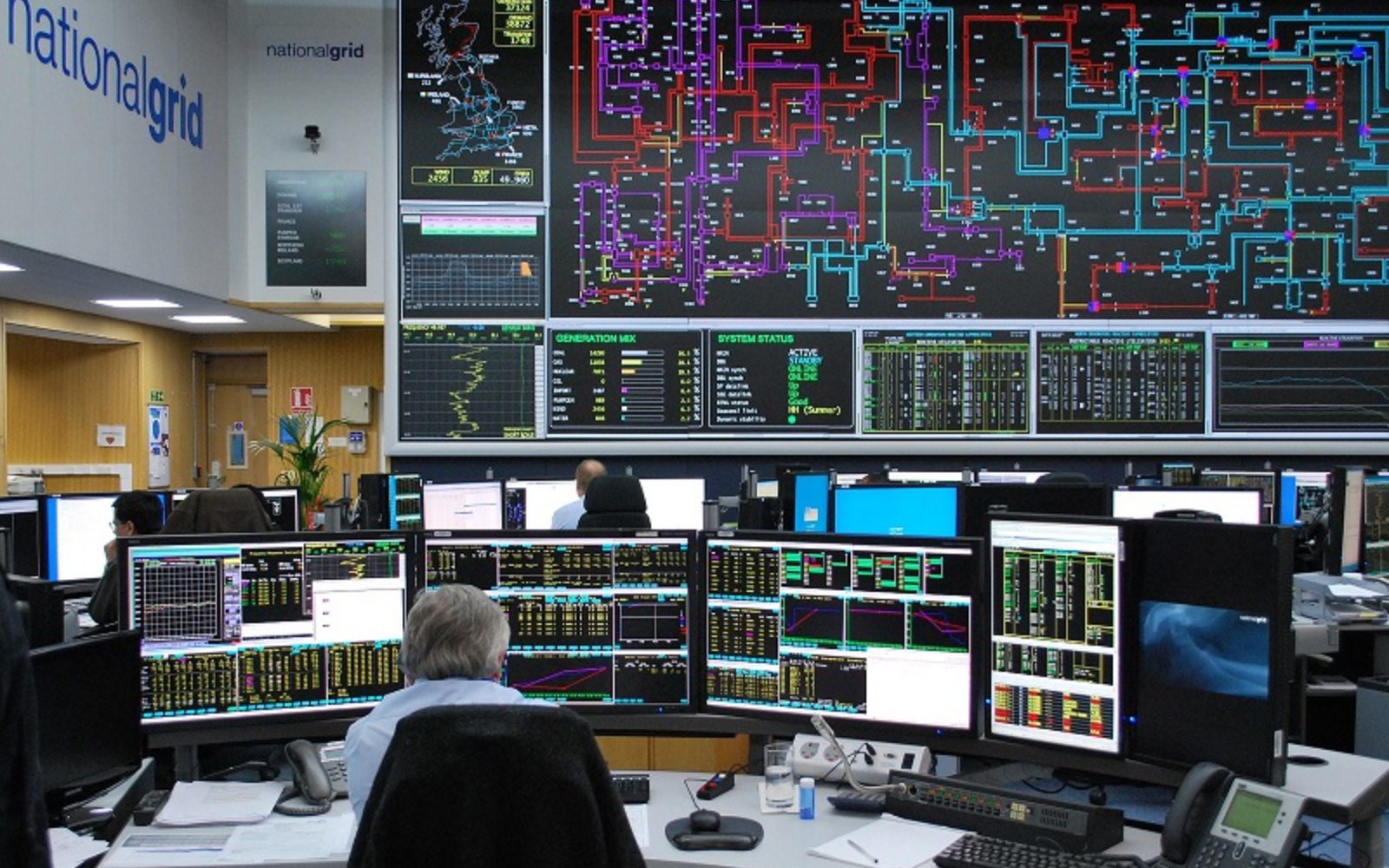

National Grid Electricity System Operator (NGESO), the company tasked with operating the UK’s electricity system, this week published its final technical report into a nationwide blackout that affected some 1.1 million customers in early August.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

That incident, recently discussed by our team on the Solar Media podcast, triggered by a lightning strike and two subsequent failures at large-scale power plants, was alleviated by around 1GW of flexible reserve capacity that is held by NGESO should the grid suffer a frequency excursion.

Around 475MW of operational battery storage capacity was utilised by NGESO to help restore grid frequency to normal levels within four minutes of the event, and now National Grid has questioned in its final report whether or not more reserve could be needed in the future.

The 1GW of reserve capacity the system operator maintains is the minimum limit mandated by industry regulator Ofgem within its Security and Quality of Supply Standard (SQSS).

Among the recommendations within NGESO’s report to Ofgem is a review of that standard, to determine whether or not the minimum level of reserve needs to be increased to help respond to more extreme frequency excursions brought about by “rare and extreme events”.

The system operator has said that any review would need to be conducted in a “structured” way to ensure there remains a balance between risk and cost. Estimates as to how much procuring additional reserve capacity have varied, with the UK power sector placing those added costs at anywhere between £50 million (US$61.7 million) and £250 million per year, which would be redistributed to consumers on their household energy bills.

But battery storage developers and operators in the UK have been unequivocal in their support for expanding upon the reserve,

Steve Shine, chairman at utility-scale battery storage developer Anesco, said that while his company welcomed National Grid ESO’s recommendation of reviews of infrastructure, resilience and embedded generation, it stressed that such reviews were “urgently needed” and should be expedited.

“The fact remains that our national grid is vulnerable to power cuts and is getting more vulnerable by the year. Any review must take place quickly and have the full involvement of the wider industry and not be taken as an opportunity to kick the issue into the long grass.

“It is still clear that National Grid were aware that frequency would fall outside of limits, and with more fast response battery storage on the network this power cut could have been prevented. For that reason National Grid should urgently take action to encourage the building of more energy storage to support the UK’s energy security,” he said.

Meanwhile Thom Whiffen, product manager at smart energy tech firm geo, said that homes with connected batteries could have saved the system if they were coupled to a smart demand side response network built upon real-time data and connected systems. Failure to implement such systems could lead such incidents to become a more regular event in the future, he warned.