UBS Asset Management has selected data analytics software company ACCURE Battery Intelligence to optimise a four-project portfolio of battery storage assets in Texas, US.

Announced today by Germany-headquartered ACCURE, the deal will see ACCURE’s artificial intelligence (AI) platform deployed to the portfolio of in-development projects in Texas’s ERCOT market, which investment manager UBS Asset Management acquired in 2022.

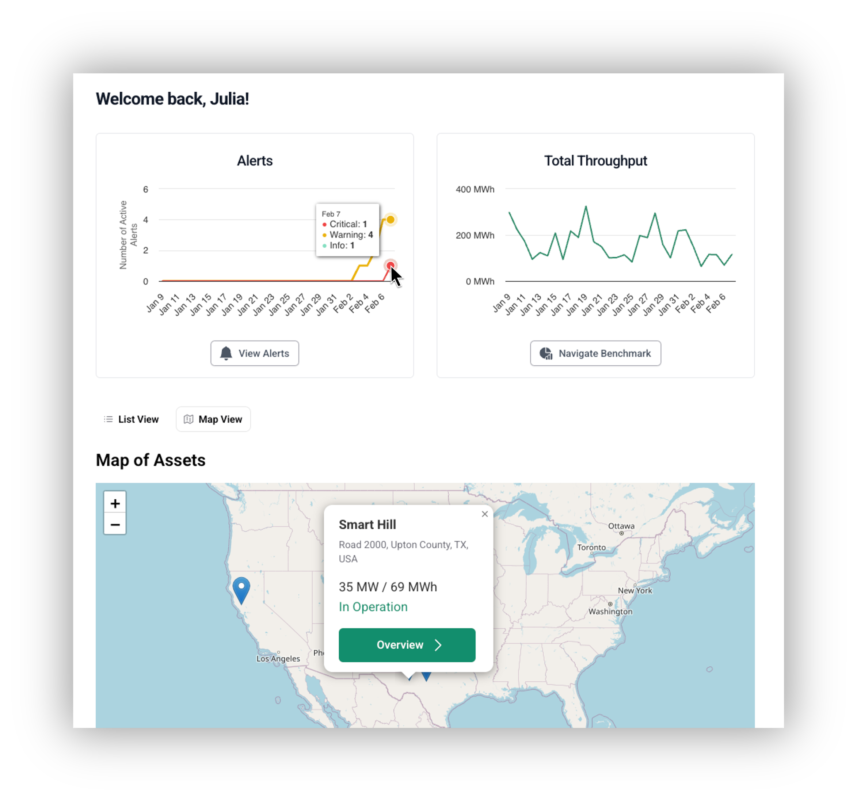

The cloud-based predictive analytics software continuously monitors battery energy storage system (BESS) assets. It offers recommended actions to resolve any issues discovered and supports ongoing operations once maintenance is completed.

It does this by applying AI, machine learning, and operational data built up from monitoring over 6GWh of battery assets. The data is used as an anchoring series of reference points for things like battery cell voltage, operating temperature, state-of-charge, and other key metrics.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The deal refers to UBS’s 730MW/1,049MWh portfolio for which the investor closed financing in Q3 of last year through two commercial banks. It is also thought to be the same portfolio UBS acquired from developer Black Mountain Energy Storage in 2022, although previous requests for confirmation from the investment manager from Energy-Storage.news have not been responded to.

Similarly, back in May 2024, UK-headquartered energy storage route-to-market and energy trading platform company Habitat Energy announced that it had been chosen by UBS to optimise a 730MW Texas portfolio.

What’s important to note is that Habitat Energy will optimise the energy storage systems’ revenues through bidding into the ERCOT wholesale market for ancillary services and energy trading. Conversely, the ACCURE platform will optimise their health and availability.

ACCURE raises US$16 million in oversubscribed funding round

In other news also announced today, the software provider has raised US$16 million through a Series B funding round, led by Incharge Capital Partners, which is a joint venture between Porsche SE and investment firm Digital Transformation Capital Partners (DTCP).

Also taking part were a number of existing investors in ACCURE including French venture capital and equity growth investor BlueBear Capital and HSBC Asset Management.

“We have entered the era of batteries, both for storage as well as propulsion in vehicles. The key to safe, reliable usage of batteries is advanced software that solves highly complex problems,” Incharge Capital Partners partner Michael Schrezenmaier said.

Schrezenmaier called ACCURE’s software “a critical enabler for the safe and efficient proliferation of battery technology.”

Data analytics solutions from ACCURE and an increasingly crowded field of competitors, including TWAICE, Powerup and Volytica Diagnostics, can be applied to a broad range of use cases throughout the BESS project lifecycle—as well as to other battery-led technologies, most prominently electric vehicles (EVs).

In November last year, ACCURE CEO Dr Kai-Philipp Kairies told ESN Premium that data analytics can identify and pinpoint battery anomalies “weeks before they escalate into dangerous situations or costly downtime.”

Those “dangerous situations” could include thermal runaway in cells that could cause fires, while the proactive maintenance that Kairies said analytics enable asset owners and operators to carry out means that systems stay online and available to participate in market opportunities.

That makes such solutions a vital safety product as well as a revenue risk mitigator, Kairies said. Elsewhere, ACCURE and TWAICE have both partnered with BESS insurance providers to offer improved terms for owners and investors, and analytics can also be leveraged to support BESS projects during commissioning. Other use case examples include a recent integration partnership between Volytica Diagnostics and European route-to-market optimiser enspired.