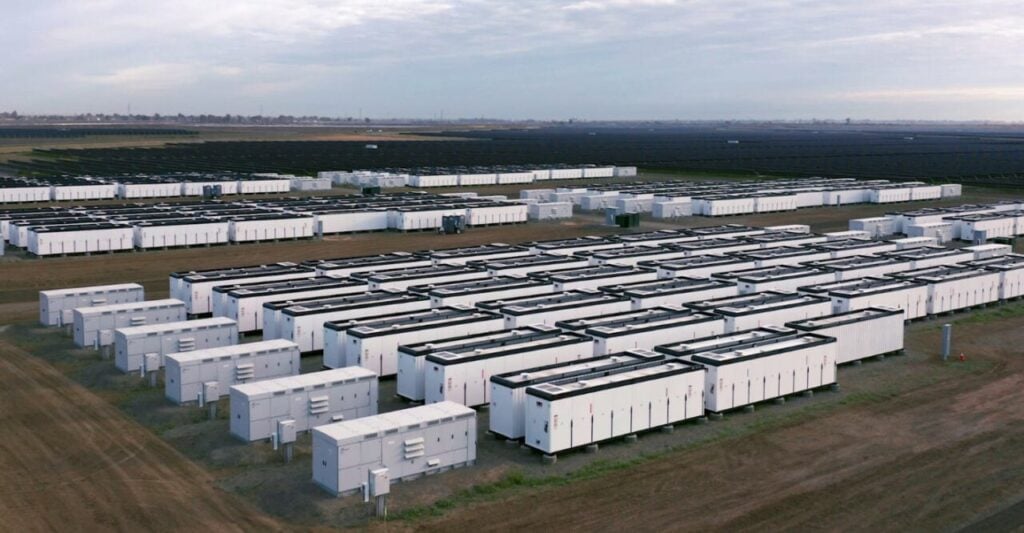

UBS Asset Management has secured financing for a 730MW/1,049MWh battery storage portfolio in Texas via two commercial banks.

Deutsche Bank and First Citizens Bank announced yesterday (4 September) that they served as co-lead arrangers in a US$315.7 million financing for investment manager UBS Asset Management.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The deal is for four battery energy storage system (BESS) projects in the Southwestern US state which is rapidly seeing battery storage deployment grow, due to the rapid growth of wind and solar PV.

This is coupled with the openness of the wholesale electricity market run by system operator Electricity Reliability Council of Texas (ERCOT), which allows battery assets to competitively provide energy and grid-balancing services.

Texas’ ERCOT and California’s CAISO are the two US transmission system areas with the biggest installed capacity of BESS, with CAISO surpassing 10GW and ERCOT expected to go beyond that figure during 2024, making the two states the US’ biggest markets.

Deutsche Bank and First Citizens, have both been involved in other recent financings for grid-scale BESS in ERCOT, as well as in other US and global regions.

In July, Energy-Storage.news reported Deutsche Bank’s partnership with investor HPS to provide construction debt financing and letters of credit for a portfolio of Texas battery projects in development by Intersect Power.

First Citizens closed a US$62.5 million financing agreement with developer Jupiter Power for a 200MW/400MWh ERCOT BESS project in December 2023, which went into operation in Houston a few weeks ago, the city’s first large-scale battery project.

Of the deal, UBS Asset Management’s co-head of energy storage investment strategy Ken-Ichi Hino said the investment group sees “expanding opportunities for battery storage systems, such as these four systems in Texas, to support the reliability and cost-effectiveness of clean energy sources.”

The two banks were joined in the financing by Societe Generale and Siemens, which served as joint lead arrangers, while other finance institutions BankUnited, Mitsubishi HC Capital and Bayern LB were also in the syndicate. Deutsche Bank subsidiary Deutsche Bank Trust Company Americas was the transaction’s administrative agent.

The four projects are all due to go into commercial operation before the end of this year.

UBS Asset Management contracted UK-headquartered BESS optimisation and route-to-market (RTM) provider Habitat Energy to manage the energy market activity of a four-site, 730MW portfolio in Texas, as reported by Energy-Storage.news in May.

The site has reached out to UBS Asset Management for confirmation if, as assumed, the latest transaction refers to the same portfolio and will update this story accordingly on receipt of a response.

Similarly, back in 2022 UBS Asset Management said it had acquired a 700MW portfolio of BESS projects from the pipeline of developer Black Mountain Energy Storage. Energy-Storage.news has asked if this again refers to the same portfolio, and whether Canadian Solar’s integration arm CSI Solar, with which UBS AM signed a 2.6GWh BESS supply deal a few months after that acquisition, is providing the BESS equipment for the four.

IPP Bitech eyes US$80 million sale of tax credits

In other Texas BESS news, today independent power producer (IPP) Bitech Technologies said it has signed a tax credit transfer agreement for a 100MW project.

The project, called Project Redbird, is Bitech’s first, and is in development by its subsidiary Emergen Energy, in Texas’ Fort Bend County. The company hopes to close financing on Redbird and another 100MW Texas project within this year.

Emergen has signed a non-binding term sheet with a ‘renewable energy investor,’ the name of which has not been disclosed, through which the investor will arrange the sale of investment tax credits (ITCs) earned through Project Redbird.

ITCs worth US$80 million will be put up for sale to one or more purchasers. Bitech said it could get ITCs at the 50% rate, and claimed this is anticipated to be worth roughly US$78 million by Q3 2025.

Bitech CEO and chairman Benjamin Tran claimed the investor has “a stellar track record in renewable energy investments,” and that a tax credit transfer agreement would be an important milestone as we advance our flagship BESS project toward monetisation”.

“In tandem with project equity investment or debt financing, we believe the tax credit transfer agreement will enable an initial Commercial Operation Date in the second quarter of 2025,” the CEO said.