It took a long time for commercial solar installations to take off. In fact, despite an increasing tendency for big corporations, big box retailers and vast data centres to make high profile, headline-grabbing long-term commitments on rooftop PV, you could see why many businesses, often going from short-term lease to lease on their properties, weren’t as keen to take the plunge.

By contrast, on paper at least, even at this relatively early stage of its market development, energy storage could have instant appeal for a broad range of companies – and is already doing so. Over five years, commercial and industrial (C&I) energy storage in the US is forecast by IHS Markit to grow from 60MW of annual installations in 2017 to 400MW in 2022.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

That would mean the market reaching a total installed base of more than 1,500MW by then. With the cost of this once-expensive and no-longer-so-exotic (at least as far as the finance community is concerned) set of technologies falling, C&I energy storage can enable benefits to the customer, and even when installed behind the meter in this way can offer benefits to utilities and the grid in front of the meter.

Behind-the-meter (BTM) energy storage systems at C&I sites are well positioned to provide benefits to the end customer (e.g., demand charge management and back-up power) and utilities (e.g., meet capacity requirements and provide demand response). As such, they form a crucial part of a more decentralised energy system. From the commercial customer’s point of view, signing a relatively flexible contract for a service-based proposition – where the provider takes care of even the economic modelling of the system throughout the life of the contract simplifies the whole process. And unlike rooftop solar, the customer does not have to effectively take custody of a huge structural addition to their building, batteries are perhaps more like industry equipment that can be deployed – or removed again – fairly easily.

Not to mention that while economics vary hugely from project to project, in some specific cases, a C&I energy storage system in the US could achieve payback in not much longer than a year.

IHS C&I study

The premise

C&I BTM storage is often under-analysed and doesn’t get the attention it deserves based on the opportunity that is in this segment. IHS Markit set out to undertake some analysis of the present-day US market, although globally, C&I BTM storage will be a very crucial segment of the overall market in the long run.

In the US, C&I users of electricity, from retailers to factories are charged premiums for the portion of their power drawn from the grid during peak times on a monthly basis. These so-called demand charges can make up more than 50% of a C&I customer’s total energy bill in specific cases. Storing energy in batteries and discharging them to mitigate those peaks is one way that energy storage companies can earn money. The customer pays a fee to the energy storage provider, who in turn commits to delivering bigger energy savings to the customer via demand charge reduction or management.

Modelling and analysis

In our proprietary economic modelling we took specific customer demand – looking at average load profiles for different customers: medium to large offices, hotels, schools, retailers to give a few examples. We’ve taken hourly data for an entire year, so 24 data points per day, and calculated demand; in other words, the electricity cost for those types of customers in certain states or cities based on local utility tariffs.

What we wanted to do was look at where the best opportunities are, based on demand charge reduction. The modelling really focuses on that rather than other elements, say solar-plus-storage.

Using the different demand charge bands that occur on different days and different seasons, we put those against the customer load profiles and then through the modelling establish what peaks are most effective to cut, what the savings are on an annual basis and then what the payback period and return on investment would be.

The players

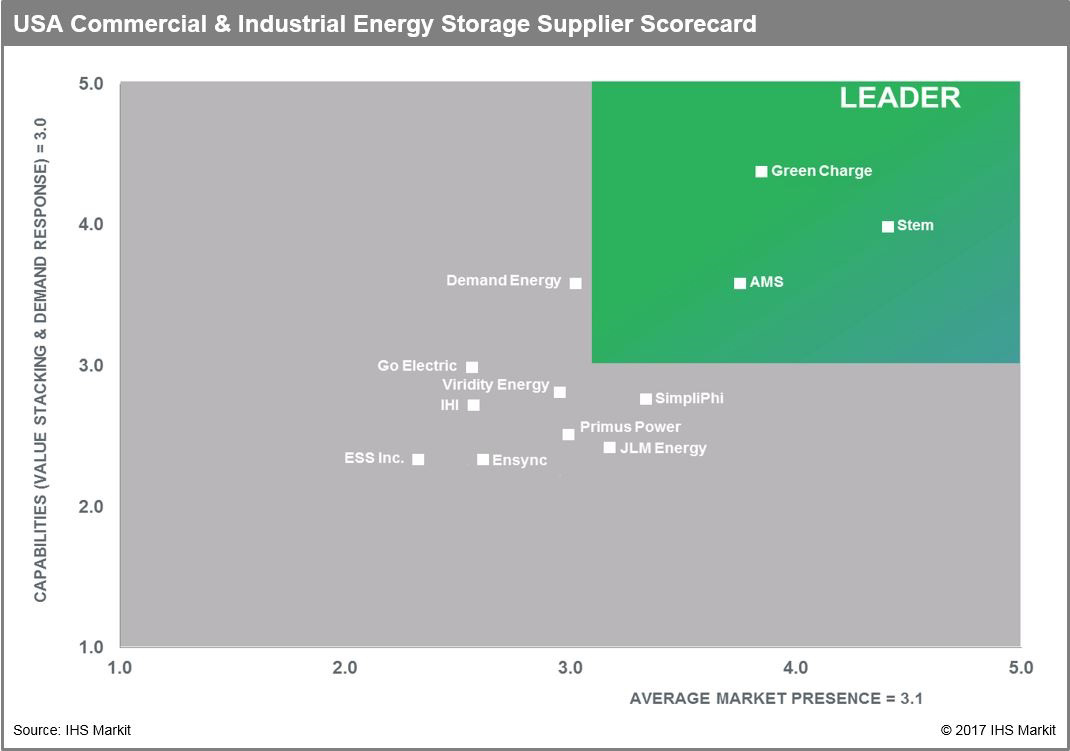

IHS Markit identified what it perceived to be the leaders of the early market, creating a scorecard for its study.

We ranked the players against 11 different metrics to arrive at composite scores around the average market presence and growth potential and basically what we’ve framed as capabilities; but it’s actually capabilities and experience around stacking multiple values and providing demand response with aggregated energy storage assets.

What we focused on was not the hardware manufacturers, so to speak, but really on those suppliers who are exploiting the opportunity on a customer-focused side. So while you might expect to see a lot of Tesla Powerpacks installed in California, including as a supplier to the likes of AMS – one of the leading C&I players themselves – we’ve tried to focus on is those that have an end customer focus rather than those who sell hardware to the likes of Stem, AMS or Green Charge.

Obviously all of these players work with a lot of partners and different channels to get to market. But the leaders we’ve identified are the ones who operate, optimise and deploy storage systems on different levels. Within the C&I space there are a lot of different players along different parts of the value chain. It becomes a difficult exercise to map that because some players go all the way down to actual battery module assembly and then integration, installation, optimisation and the software side of things down to operations and maintenance (O&M), whereas others just focus on very specific aspects of that value chain.

What the three leading companies have in common

‘As-a-service’ is a buzzphrase in the industry right now. For the three leading players, it’s a major part of their business proposition. If you go into a lot of depth they do target slightly different segments in each case and their business models do vary but fundamentally that idea of providing storage ‘as-a-service’ to the customer has been absolutely crucial to building that leading position.

Providing energy storage – and other energy resources – as a service, brings the supplier-customer relationship into something more like a subscription to an app that saves the C&I customer energy and money. It’s a perfect fit for the age of Uber and Airbnb, where you don’t need to own a fleet of cars or expensive hotel real estate to provide that service. Or the age of Netflix and Amazon, where tying a growing customer base in on a reasonably priced contract helps you continue to build scale and confidence to invest back in your own operations. In the case of energy storage, it’s about providing a full service proposition to the customer that the customer doesn’t even have to understand. You save me energy costs and I pay you x and the energy cost goes higher than x, so I win.

What’s absolutely central to their success is significant investment by all three companies in terms of their software, their aggregation capabilities, and really evolving those and learning by doing throughout this continued investment into software, machine learning techniques, data analysis, real-time optimisation and response. They’re all elements that have become crucial for them to actually provide that type of service model in a cost-effective way.

Digging even deeper into that earlier tech analogy, it’s perhaps not surprising that much of the technology being developed and deployed in this segment of energy storage is coming straight out of Silicon Valley.

You’ve probably guessed by now – all three leaders are based in California, giving them immediate access to what appears to be the most attractive regional market. More on that later.

It’s important to note that this is an early market; while we’ve ranked these players, the market is still highly competitive and not a single player there is hugely falling behind. You get quite a big grouping of players that are at a very similar stage in terms of their market presence and then with some variations in terms of software, demand response capabilities and often a big difference in strategy.

For instance, some players are very much targeting technology leadership around solar-plus-storage or resiliency applications. Fundamentally they’re going after different markets than some of the leaders, which makes comparison between them all difficult. Some are targeting a larger number of smaller energy storage systems, to be installed alongside commercial solar. Others, such as Go Electric, have identified specific opportunities. Go Electric develops commercial microgrids and with recent projects has focused on providing UPS to US Military Forces operations, gaining market presence in the process through that focus on the resiliency and backup power capabilities of storage.

You’ve also got the flow battery guys like Primus Power or ESS and we wanted to include them because it’s important to show you need to be technology-agnostic. Especially targeting microgrid applications with longer duration systems, some of these flow battery players are making headway in the C&I segment as well.

It’s a bit more hardware and technology led than the ‘as-a-service’ model, but it’s still creating that end customer relationship.

The stakes in the states

Indeed, California is the market that will lead growth – and we don’t expect to see that contested. To date around 70% of the US’ installed C&I storage is in California. IHS Markit is forecasting 880MW/2,463MWh of BTM C&I battery storage to get deployed in the state from 2017 to 2022. SGIP (Self-Generation Incentive Program, applicable subsidy for solar and solar-plus-storage) has been probably the number one reason for the C&I market to develop as strongly as it has in the past and we do expect it to be the strongest driver in the short term, although this could change going forward. Propositions have been made on the legislative side for the continuation of some form of a support programme in California – but nothing has been decided yet.

Medium to longer-term drivers include utility capacity procurement and other utility services that are needed, which will be procured under mandates in California. We’re already seeing pretty encouraging signs on that, primarily from Southern California Edison’s local capacity requirement and preferred resource pilot but also recently results were announced on a PG&E request for offers. Only a small proportion of that was BTM energy storage, about 10MW, but it’s still kicking off utility-led procurement in new territories.

Over the coming five years we are expecting other markets to open up, especially NY and Massachusetts because they have a very attractive combination of drivers, which while different (different regulation, market) are kind of mimicking some of the early development in California. Between them we consider that more than 230MW/600MWh of C&I BTM storage will go online in that five-year forecast period. You’ve got strong economics, customers eligible for high demand charges, you have additional propositions around resiliency in those states plus you’ve now got the introduction of energy storage targets in both states.

The economics are looking very strong in specific states and territories and can vary hugely from individual customer to customer – so making sweeping assumptions is very difficult. Nonetheless the best-looking areas for demand charge management for us at the moment are California, including southern and northern but especially southern; also in New York it’s looking very promising and increasingly part of Massachusetts for specific customers as well.

Hawaii is obviously also an attractive market for solar-plus-storage and there you have the Self-supply tariff programme to reward solar self-consumption. So far it’s not had a huge impact but going forward we certainly expect that solar will continue to grow in Hawaii and be a crucial part of the energy system there and storage becomes a natural addition, you have higher prices, more frequent outages and from the utility side there’s an interest in having storage BTM to manage distributed PV. That obviously makes that state interesting.

Other states are so far a bit more behind in terms of actual deployments but certain changes in states like Arizona could make a difference.

The state’s demand response energy storage and load management programme will include C&I customers. Net metering has been eliminated and that could incentivise self-consumption. Obviously it will hit the solar market initially but will increase the attractiveness of self-consumption with storage. The Grand Canyon State also proposed a mammoth 3,000MW energy storage target to be made law later this year, just as this article was going to press.

Nevada is another one to watch – with certain programmes to encourage solar-plus-storage for BTM applications being considered while a reinstated net metering scheme is structured specifically to not punish solar self-consumption.

Changes in the medium-term across important states on the solar front will certainly filter down and create new opportunities for solar-plus-storage – rather than keeping all of the focus on demand charge aspects.

But what does it all mean?

We definitely see a clear trend for commercial energy users to want long-term price security, to have security of supply and they are looking to decarbonise or at least reduce emissions from their energy supply i.e. promoting renewables for their own sustainability goals.

They don’t necessarily want to be in the business of managing their own energy. They are active as a business in their own field, so they’re looking for companies that can provide fully integrated energy services solutions. So far that’s included elements like solar, energy efficiency, like LED lighting etc. (the typical energy service company model). Increasingly, the investments that have been made in energy storage point in this direction: that if required you will manage and provide entire energy solutions to a customer that will include energy storage where it makes sense.

In terms of additional value drivers or business cases that are coming in, we see reliability playing a much stronger part in the proposition for many US customers. That can also be seen in the increasing interest in commercial renewable-plus-storage microgrids, especially for large industrial customers. We see that as being a very good addition to the proposition. There is variation depending on where you are. In some states the reliability element plays a bigger part, in other areas it’s less relevant.

We are also seeing solar-plus-storage potentially increasing in terms of a market base for C&I customers; it’s going to be increasingly attractive to small or medium-sized commercial customers that have PV, and here, again, it’s more around specific pockets.

For the companies identified in the scorecard, there will be some consolidation in the US market and of course the growth that IHS Markit forecasts, but the goal has to be internationalisation for these companies. Green Charge, which recently rebranded as ENGIE Storage Services NA, while Stem just won its first project in Japan and netted investment for a push into Canada. It’s always a question of where to invest and also how you can transport a model that works in one state to a different state, where value drivers might fundamentally be different, or the energy market structure varies. Companies might need to rethink their approach or integrate new assumptions and new data points into their software and data optimisation.

The market’s early leaders obviously have a strong position to build on but the market opportunity is growing quite significantly, allowing new players to come in and potentially move themselves up within that ranking.

Also going back to that observation that state by state, energy storage somewhat follows in the path of solar, while demand charge management and creating that storage ‘as-a-service’ model has been the most attractive economic proposition for the C&I market so far, with those three leading players having benefitted the most, going forward if players are concentrating on the technology element of solar-plus-storage as those markets open up that obviously can put them into a stronger position as well.

This article originally appeared in 'Storage & Smart Power', presented by Energy-Storage.News each quarter in the tech journal PV Tech Power, from our publisher Solar Media. You can also download a PDF of this article from the 'Resources' page on this site.