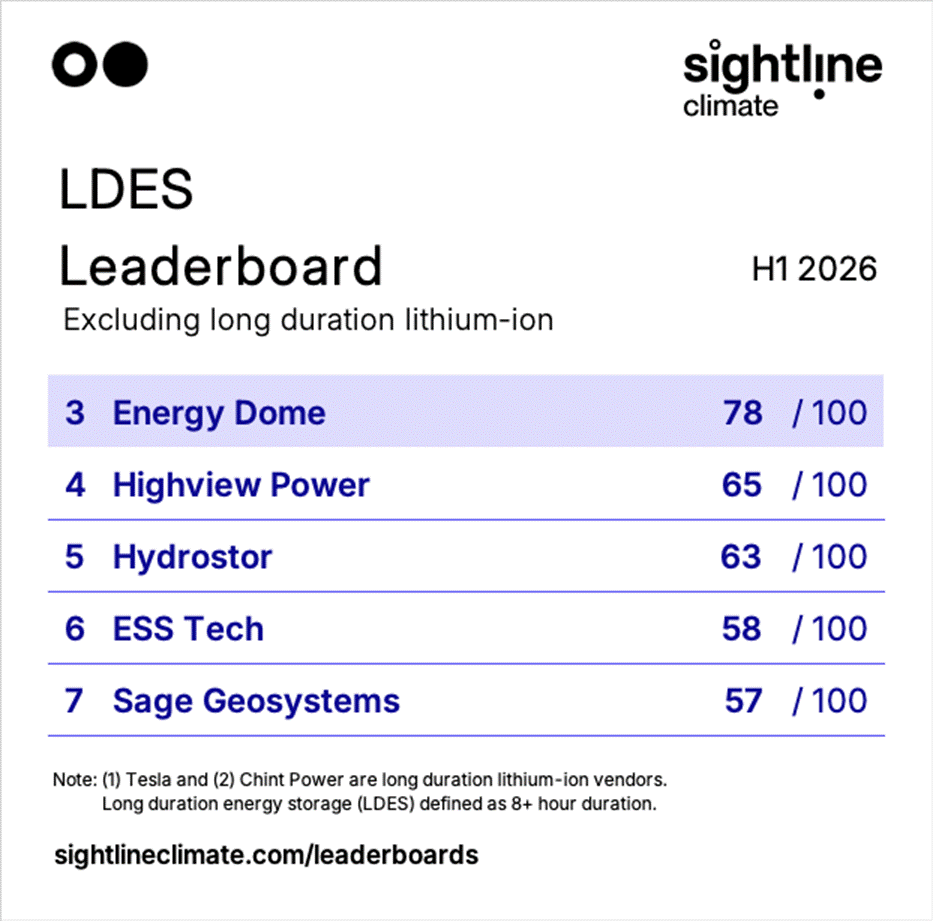

Lithium-ion companies have come out as the top-rated suppliers on a new long-duration energy storage (LDES) leaderboard, while CO2 Battery company Energy Dome is the highest non-lithium company.

The new LDES Leaderboard by research and consultancy firm Sightline Climate ranks suppliers by technology, finance, deployment and economics, research associate Lukas Karapin-Springorum told Energy-Storage.news.

“It shows which companies are competing for and winning LDES tenders, and forms a bridge between crowded market maps and detailed bankability assessments,” said Karapin-Springorum, emphasising it is not a bankability assessment.

As the firm defines LDES as 8-hour duration or more, that means that lithium-ion battery energy storage system (BESS) companies qualify if they’ve deployed projects of that duration. The top two in Sightline’s ranking are Tesla and Chint Power. An 8-hour BESS using Tesla Megapacks went online late last year in Australia.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Mechanical storage-based technology companies best-placed to compete with lithium-ion

Of the non-lithium companies in the Leaderboard, the top five are ‘CO2 Battery’ company Energy Dome, liquid air storage company Highview Power, advanced compressed air energy storage (A-CAES) company Hydrostor, iron hybrid flow battery firm ESS Tech Inc and geothermal player Sage Geosystems. They rank 3-7 in the overall leaderboard including lithium-ion firms.

Karapin-Springorum cited Energy Dome’s two commercial projects post-FID, higher round-trip efficiency than other mechanical storage, and best-in-class capex, in part from low regional costs at its second-of-a-kind project in India, as key factors setting it apart from other firms.

Energy-Storage.news has reported on its large-scale projects in India and Italy, and it has approval for another one in Wisconsin, US.

UK-headquartered firm Highview Power meanwhile has also progressed to large-scale, post-FID projects.

It started building a 50MW/300MWh project in Manchester, UK late last year and has a “strong financing total buoyed by project finance that makes up for its relatively higher capex,” Karapin-Springorum said.

Mechanical storage firms benefit significantly from being able to use off-the-shelf components. This enables them to get to capex levels comparable with lithium-ion.

“This is particularly impressive for first-of-a-kind projects that haven’t realised economies of fleet or learnings from deployment,” he added.

This approach also sidesteps the need for a capital-intensive manufacturing ramp-up. Thus, they score highly in the ranking, despite having raised less money and fewer ‘pipeline’ projects than other technology companies.

The need to finance manufacturing ramp-up has held other companies back in the ranking. Metal-hydrogen battery company Enervenue, iron-air battery firm Form Energy, and vanadium redox flow battery (VRFB) company Invinity Energy Systems rank outside the top seven because of relatively limited front-of-meter deployments and relatively high capex.

That makes the inclusion of iron flow battery company ESS Tech Inc in the top five non-lithium firms perhaps surprising, as the New York Stock Exchange-listed (NYSE) company has warned of its survival being in doubt.

Karapin-Springorum said it scored well because of historical finance (it raised a lot of money when it listed via a SPAC deal) and has a moderate deployment score from utility pilot projects in the US.

Government tenders driving LDES industry & helping to decide winners

A total of up to 9.3GW of LDES tender awards could be announced in the first half of 2026 alone, across the UK, New South Wales in Australia and Ontario, Canada.

“The vendors with successful projects will have a clear path to FID in late 2026 or early 2027 and could pull ahead of their competitors in the leaderboard once they start construction,” Karapin-Springorum said.

“The results of these tenders will show whether any vendors can compete with 8-hour long duration lithium-ion batteries. The vast majority of the projects benefitting from pre-2026 LDES policies in New South Wales and California are long duration lithium-ion batteries because of their maturity and low cost, and the technology makes up 77% of the global capacity scheduled to be operational by 2030.”

“If non-lithium technologies don’t win sizable contracts in 2026, their best option going forward will be to focus on programmes in California and Ontario that exclude long duration lithium-ion.”

The UK cap-and-floor LDES tender in particular could be transformational for Invinity, with gigawatts of projects using its technology currently undergoing project assessments.